- Dogecoin price reclaims $0.20 after breaking out from an inverse head and shoulders bullish pattern.

- DOGE's rally ignites a string of liquidations, comprising $1.6 million longs and $11.3 million shorts.

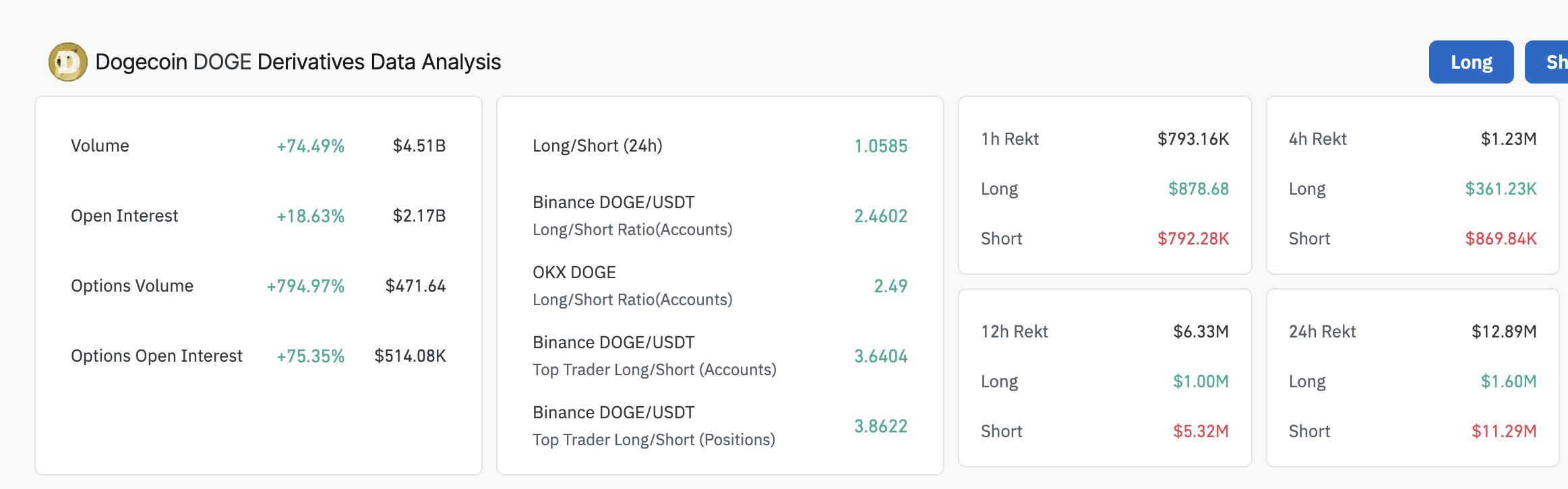

- Open Interest surges 18% to $2.17 billion in 24 hours, signaling trader interest in the leading meme coin.

- Dogecoin's near-overbought conditions could delay or hinder a breakout targeting $0.24.

Dogecoin (DOGE) price edges higher after stepping above $0.20 and climbing to trade around $0.21 at the time of writing on Friday. The leading meme coin's uptrend mirrors a broad-based bullish wave in the market, triggered by the trade agreement between the United States (US) and the United Kingdom (UK) on Thursday.

Dogecoin rally sparks massive liquidation wave

Dogecoin's price climbed in an engulfing bullish candle on Thursday, breaking the brief consolidation phase that followed the recovery from the tariff-triggered crash in early April. The meme coin flipped the 50-day Exponential Moving Average (EMA) around $0.18 into support, accelerating the uptrend above $0.20.

Meanwhile, the rally shook up market dynamics, especially for futures and options traders, with liquidations reaching approximately $13 million over the past 24 hours. Short liquidations dominated at $11.3 billion compared to $1.6 million for longs. This heavy skew toward short liquidations signals a short squeeze, where an increase in price forces short sellers to close positions, thus fueling the rally.

Dogecoin derivatives market data | Source: CoinGlass

The 18% Open Interest (OI) surge to $2.17 billion hints at increasing trader interest in the largest meme coin by market capitalization. In other words, the uptrend in DOGE's price encourages investors to seek exposure, betting on a longer rally.

Additionally, the long-to-short ratio of 2.4602 on Binance shows that long positions primarily drive the OI increase, as traders allocate more capital to bullish bets.

A 74.49% surge in the trading volume to $4.5 billion amplifies the OI and supports the heightened market activity. High volume during an uptrend, like in DOGE, often confirms a strong bullish momentum.

How far can Dogecoin's rally go?

Dogecoin's price displays a strong bullish structure after breaking out and confirming an inverse head and shoulders pattern in the daily chart below. The breakout on Thursday projected an approximately 33% surge to $0.24. The target is determined by measuring the height of the pattern from the neckline to the head and extrapolating above the breakout point.

With DOGE seeking support above the 100-day EMA at $0.20, there's a high probability that the uptrend will continue to tag the inverse head and shoulders patterns' target at $0.24 in upcoming sessions.

The Moving Average Convergence Divergence (MACD) indicator reinforces the bullish structure above the centre line. As the green histograms grow, they indicate a stronger tailwind, pointing to a continued price rise.

DOGE/USD daily chart

However, traders must prepare for different outcomes as Dogecoin's price rallies, including a potential reversal. The Relative Strength Index (RSI) momentum indicator is entering the overbought region at 70.31, implying a robust uptrend.

Notably, overbought conditions often precede drawdowns due to profit-taking and other market dynamics. If DOGE pulls back beyond the 100-day EMA at $0.20, traders would look to the 50-day EMA at $0.18 for support and liquidity before attempting another breakout higher.

(This story was corrected on May 9 at 10:07 GMT to say that overbought conditions often precede drawdowns due to profit-taking, not oversold conditions.)

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRON eyes 40% breakout as Tether mints 1 billion USDT on the network

TRON (TRX) price uptrend remains steady, trading at $0.3227 on Monday. The smart contracts token boasts a 54% rally from its April lows, with gains accrued since the beginning of July totaling 17%.

Crypto Today: Bitcoin, Ethereum, XRP showcase bullish signals after US-EU trade deal

Bitcoin renews bid for record highs, approaches $120,000 after the US-EU tariff deal. Ethereum steals the spotlight, attracting nearly $1.6 billion in inflows last week while edging closer to $4,000.

Bitcoin consolidates amid US-China trade truce extension expectations, US-EU trade deal

Bitcoin price has been consolidating within the $116,000 to $120,000 range for the last 13 days. Macro developments, such as a possible extension of the US-China trade truce and US-EU trade deal, fail to spark immediate momentum in BTC.

Ethena Price Forecast: ENA eyes further gains as the bullish rally hits near six-month high

Ethena edges higher to extend the uptrend for the fifth consecutive day. The Total Value Locked on Ethena hits a record high of $7.71 billion. Ethena’s Open Interest records a new all-time high of $1.35 billion.

Bitcoin: BTC extends correction amid weakening momentum, ETFs outflow

Bitcoin (BTC) is slipping below the lower consolidation band at $116,000, after consolidating for more than ten days. A decisive close below this level would indicate further decline ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.