AAVE attempts to break THIS resistance again: Will it reach $200 by year-end?

- AAVE to hit $200 if it breaks key resistance.

- TVL rising, highlighting increasing adoption.

Aave [AAVE] is thriving in the current market environment, outperforming many other crypto assets as the market recovers from the dip on August 5th.

Aave’s price continues to rise steadily, and recent price action saw it trading above $154, a key resistance level.

To confirm a breakout from the 800-day range, the price needs to stay above this level for an extended period. The weekly chart shows Aave approaching this resistance level for the second time, backed by bullish momentum.

The Wave Trend Momentum Oscillator (WTMO) signals strong upward momentum, increasing the likelihood of breaking this resistance.

If Aave continues forming higher highs and higher lows, a break and retest could solidify the $200 target as the next key level in the mid-term.

However, staying above the $154 level is crucial for this upward momentum to continue, supported by the WTMO showing strong momentum to push prices higher.

Aave’s growing adoption driving price higher

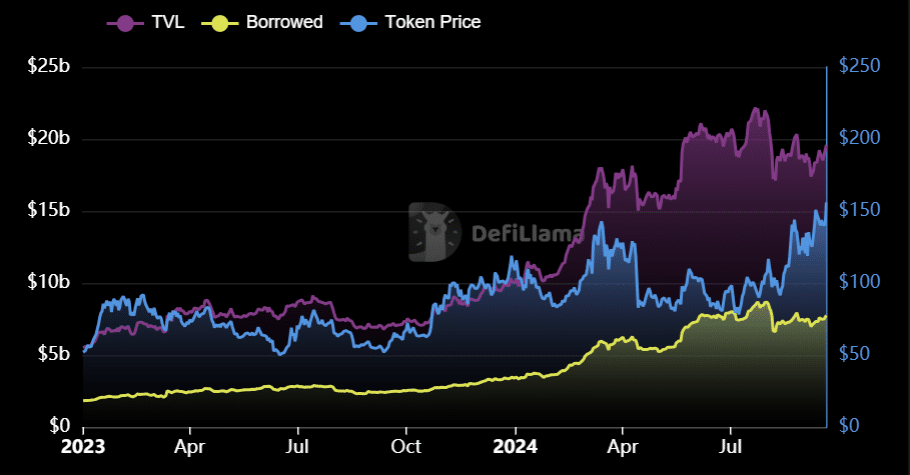

Aave’s success is not just seen in its price action; its Total Value Locked (TVL) has been steadily rising since the beginning of the year.

Although it stagnated between April and July, Aave’s TVL is now rallying again. Currently, the TVL stands at $19.6 billion, while the total amount borrowed through Aave’s protocol has reached $7.748 billion.

This strong growth highlights Aave’s position as a major player in the DeFi space. The rising TVL and borrowed assets reflect increasing adoption and trust in Aave, which adds further confluence to the idea that its price may reach $200 before the year ends.

In addition to strong price action and rising TVL, whales are increasingly buying, adding significant upward pressure on its price. Data from Hyblock Capital shows that the current whale vs. retail delta metric reads 74%, indicating that whales are accumulating Aave at a significant rate.

Furthermore, the net long shorts delta is currently at 84%, further supporting the likelihood that Aave may reach the $200 mark before the end of the year.

The convergence of whale buying activity and strong net longs indicates a bullish sentiment surrounding Aave.

Address activity

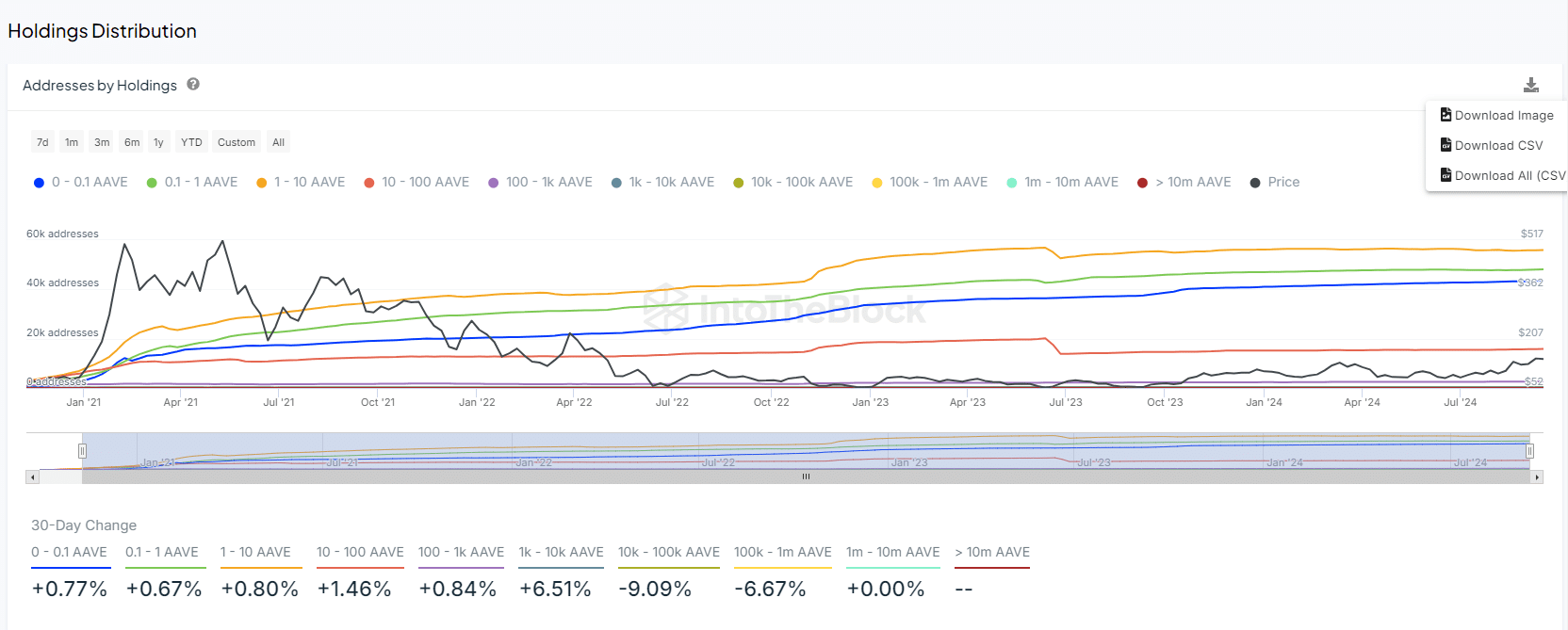

Lastly, Aave has seen a steady increase in the number of addresses holding the token, particularly from retail investors to whales, as well as from long-term to short-term holders.

The monthly change in addresses by holdings shows consistent growth, although there were minor dips for holders of $10K to $100K worth of Aave, as well as those holding between $100K and $1M worth of the token.

Read Aave’s [AAVE] Price Prediction 2024–2025

These categories saw a decrease of 9.09% and 6.67%, respectively.

Source: IntoTheBlock

Despite these dips, the overall trend remains positive, with Aave adoption continuing to rise. This growing adoption, combined with whale buying activity, increasing TVL, and bullish price action, suggests that Aave is well on its way to hitting the $200 milestone.