- Ripple revealed its latest partnership with Chainlink to boost the RLUSD stablecoin utility in DeFi markets.

- Chainlink Price Feeds will allow on-chain developers to integrate RLUSD into their DeFi applications.

- RLUSD could benefit from the latest MiCA laws following the delisting of USDT across major European exchanges.

Ripple (XRP) unveiled in a press release on Tuesday its latest collaboration with decentralized oracle network Chainlink to boost its RLUSD stablecoin utility and adoption across DeFi markets.

Ripple embraces Chainlink standard for wider RLUSD adoption

Ripple announced a partnership with the decentralized oracle network Chainlink to enhance the adoption of its RLUSD stablecoin.

The XRP parent company aims to enhance RLUSD's utility across Ethereum's DeFi markets through Chainlink's secure infrastructure, which has allegedly powered $18 trillion in transactional value.

"By adopting the Chainlink standard for verifiable data on the Ethereum blockchain, Ripple is enhancing the utility of RLUSD across the on-chain economy," Ripple stated.

The company also seeks to maximize Chainlink's price feeds for reliable on-chain market data. This will boost RLUSD's integration across decentralized applications for use cases such as trading and lending.

"By leveraging the Chainlink standard, we bring trusted data on-chain, further strengthening RLUSD's utility across both institutional and decentralized applications," said Jack McDonald, senior vice president of Stablecoin at Ripple.

The Chainlink Effect for stablecoins. https://t.co/BKJIgFZOAk pic.twitter.com/0KwBKraKDx

— Chainlink (@chainlink) January 7, 2025

Meanwhile, RLUSD could be among the largest beneficiaries of the recent Markets in Crypto-Assets (MiCA) laws guiding the use of digital assets in Europe.

Since Tether has not secured MiCA compliance, most European exchanges have delisted USDT from their platforms. Hence, with a chunk of the European stablecoin market volume left open, newer assets like RLUSD could witness wider adoption from institutional and retail investors in the region.

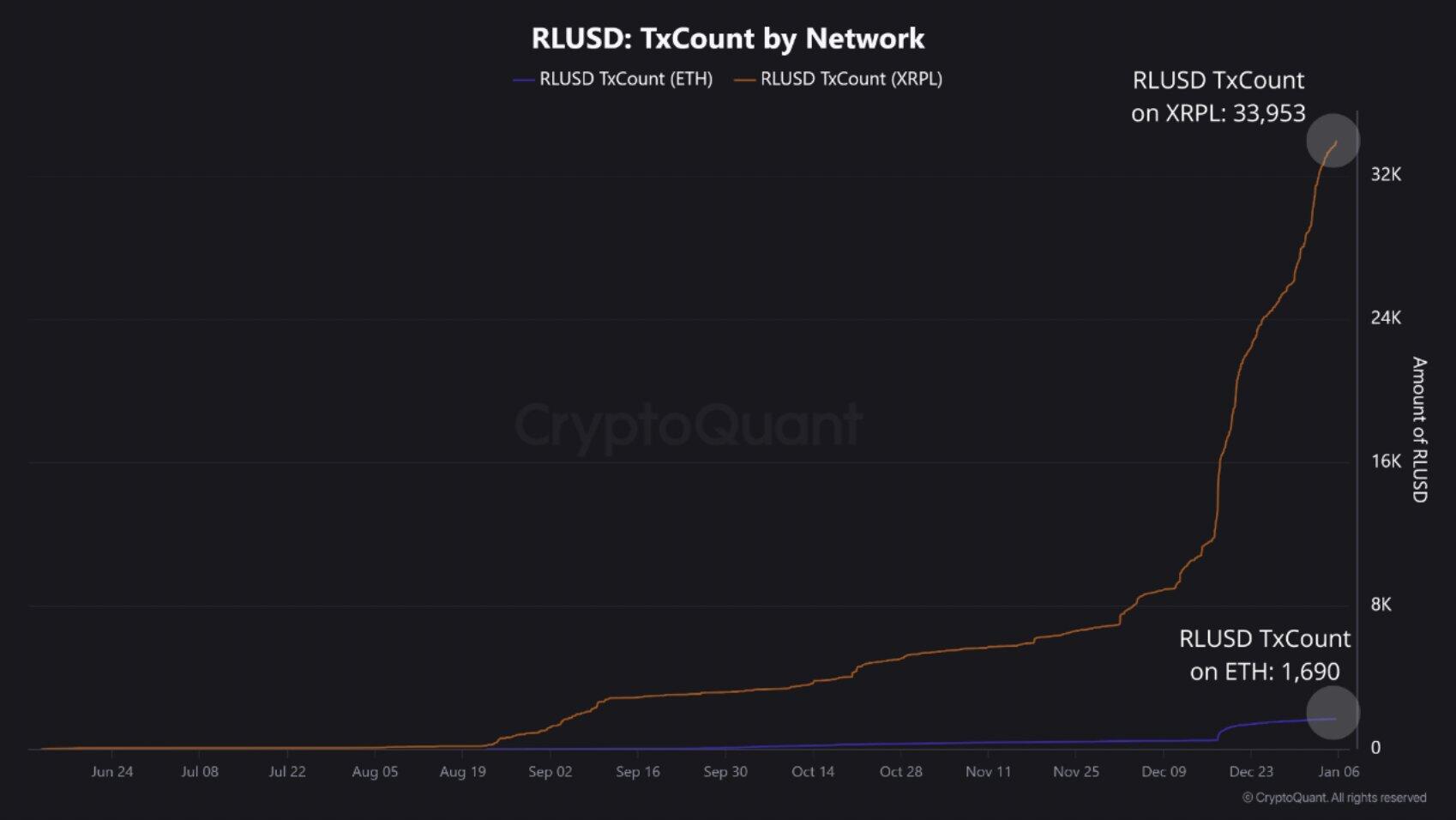

Furthermore, CryptoQuant data revealed a surge in RLUSD's transaction count since Ripple announced its launch in December. The stablecoin has since witnessed 33,953 transactions on the XRP Ledger and 1,690 on Ethereum. This indicates a growing preference for RLUSD among investors.

RLUSD Transaction Count by Network. Source: CryptoQuant

If RLUSD adoption continues its uptrend, it could boost demand for XRP, which serves as an auto-bridge asset for converting the stablecoin to other currencies.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

BNB down 5% from peak as Windtree Therapeutics plans $520 million treasury

BNB price is down slightly to trade at $771 on Friday, after correcting from its new record high of $809, reached on Wednesday. The Binance exchange native token is up nearly 20% in July, amid relatively overheated market conditions and institutional adoption.

Crypto Today: Bitcoin declines amid de-risking sentiment, Ethereum and XRP hold key support

Bitcoin sweeps through liquidity around $115,000 level, amid profit-taking and risk-off sentiment. Ethereum rebounds from range low support above $3,500 amid steady ETF inflow.

Ethena eyes 20% gains amid Arthur Hayes 2 million ENA grab, Anchorage Digital deal, new apps

Ethena edges higher by over 20% on Friday as it bounces off a crucial support floor to extend the prevailing bullish run. Arthur Hayes acquires 2.16 million ENA tokens amid Ethena’s partnership with Anchorage Digital to achieve GENIUS Act compliance.

Bitcoin Weekly Forecast: BTC extends correction amid weakening momentum, ETFs outflow

Bitcoin price is slipping below the lower consolidation band at $116,000, a decisive close below to indicate further decline ahead. US-listed spot Bitcoin ETFs show early signs of investor pullback, recording a mild weekly outflow of $58.64 million by Thursday.

Bitcoin: BTC extends correction amid weakening momentum, ETFs outflow

Bitcoin (BTC) is slipping below the lower consolidation band at $116,000, after consolidating for more than ten days. A decisive close below this level would indicate further decline ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.