- Bitcoin and several altcoins ranking in the top 10 by market capitalization are undervalued, per Santiment data.

- Analysts predict a short-term bounce based on the Market Value to Realized Value of these assets in the last 30 days.

- Crypto market broadly steadies, with market capitalization up by 0.6% in the past 24 hours.

Crypto market steadied in the early hours of Wednesday. The market capitalization of all assets climbed 0.6% to $2.49 trillion, per CoinGecko.

Analysts at on-chain intelligence tracker Santiment have identified signs of a short-term bounce in the top 10 cryptocurrencies.

These assets are undervalued and likely primed for a rally

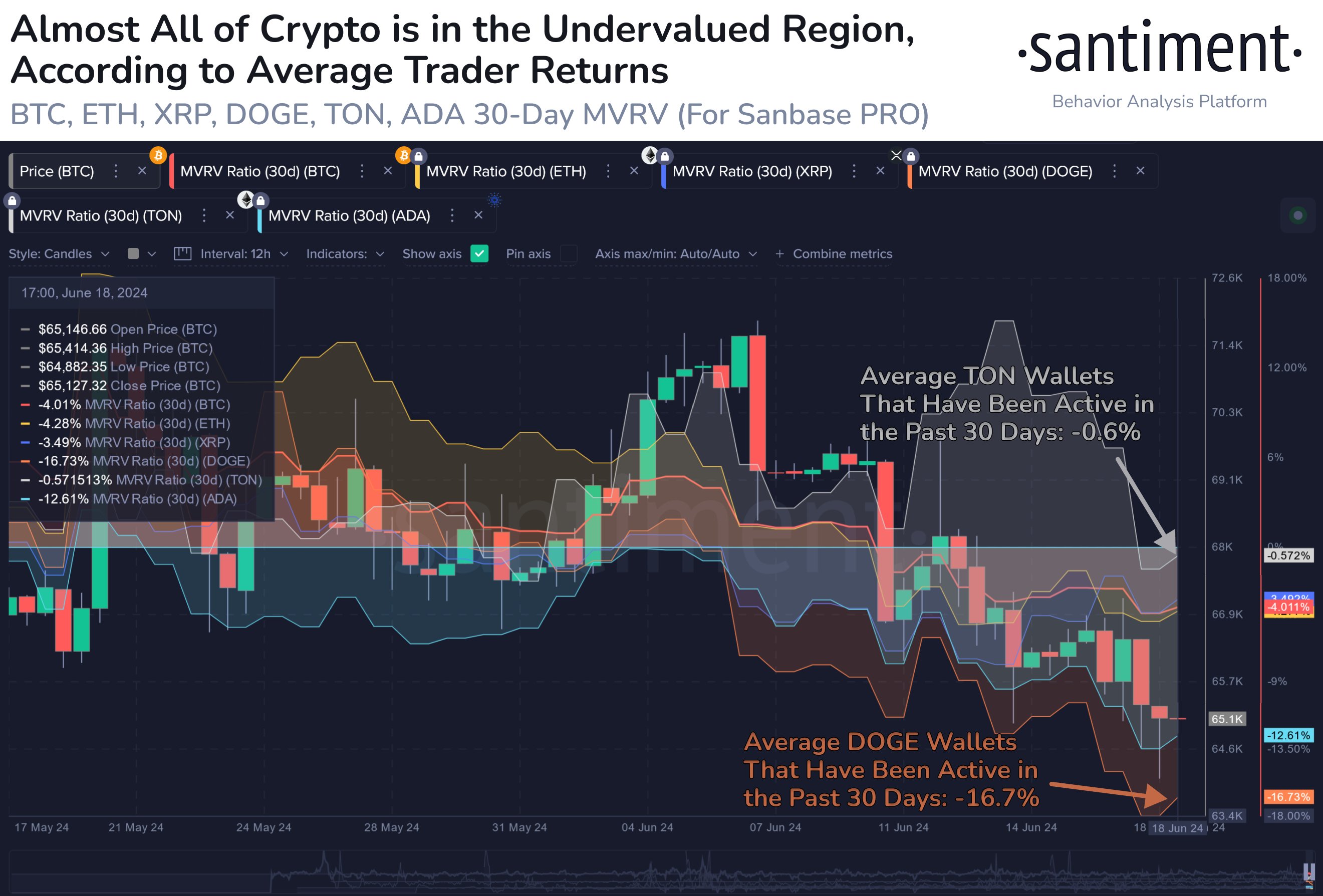

Santiment analysts noted that Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Dogecoin (DOGE), Toncoin (TON) and Cardano (ADA) show signs of being undervalued. The Market Value to Realized Value (MVRV) metric on a 30-day timeframe shows bullish signs for these assets, as seen in the Santiment chart below.

The on-chain indicator MVRV is used to study the aggregate investor behaviors as price moves to/from their cost basis. As MVRV on a given timeframe turns negative, it implies that the asset is undervalued on average.

Analysts note that almost all crypto assets are undervalued when average trader returns are considered.

The chart below shows the 30-day MVRV ratio for the assets and the decline in active wallet addresses in assets like DOGE and TON in the same timeframe. The 30-day MVRV for the assets is:

Bitcoin -4.0% (interpreted as mildly bullish)

Ethereum -4.3% (mildly bullish)

XRP: -3.5% (mildly bullish)

Dogecoin: -16.7% (very bullish)

Toncoin: -0.6% (neutral)

Cardano: -12.6% (very bullish)

Santiment chart on average trader returns, undervalued assets

According to Santiment analysts, lower 30-day MVRV values signal undervalued assets and a potential short-term bounce in prices.

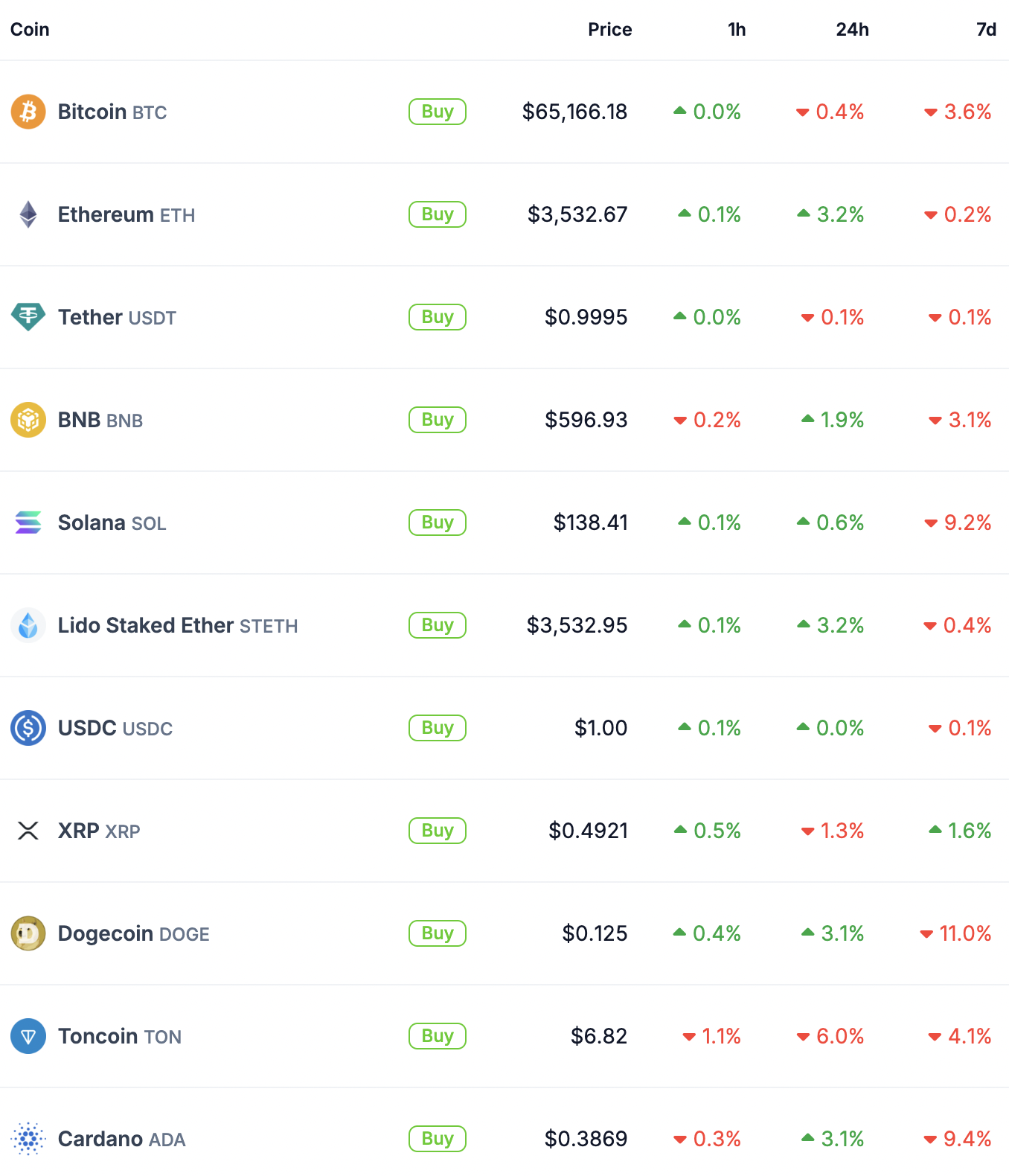

Bitcoin is trading above key support at $65,000 and Ethereum sustained above $3,500 on Wednesday, per CoinGecko data. Other cryptocurrencies in the top 10 have attempted a recovery in the past hour and 24 hours, while returns are largely negative in the seven-day timeframe.

Crypto top 10 prices as seen on CoinGecko

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto markets tumble amid Middle East tensions, wiping $1.15 billion in liquidation

Rising geopolitical tensions in the Middle East have triggered a sharp decline in risk assets, with cryptocurrency markets facing significant losses. The Kobesissi Letter reports suggesting Iran says it will respond "harshly" against Israel.

Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP dips as Israel-Iran conflicts escalate

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) prices have dipped as escalating geopolitical tension between Israel and Iran has triggered a risk-off sentiment in the cryptocurrency markets.

Bitcoin’s slump under $103,000 crashes altcoins: FARTCOIN, ENA, LDO in freefall

The broader cryptocurrency market risk-off sentiment, as Israel confirms attacks on Iran’s nuclear sites, triggers a wave of profit booking among top coins, leading to Bitcoin (BTC) edging lower by nearly 2% at press time on Friday.

Solana dips 10% despite DeFi Development Corp's plan to raise $5 billion to boost SOL treasury

Solana (SOL) is down 10% on Thursday after DeFi Development Corporation (DFDV) announced an equity line of credit agreement with RK Capital Management to raise $5 billion in sales of its shares to stack additional SOL.

Bitcoin: BTC could slump to $100K amid Trump-Musk tussle

Bitcoin (BTC) tumbled to a low of $101,095 on Friday amid volatility in the market. The effect of the tussle between United States (US) President Donald Trump and Tesla Chief Elon Musk negatively influenced the NASDAQ and Tesla's stock price on Thursday, although both are recovering on Friday.