- The cryptocurrency market trades in the green on Thursday, with Bitcoin breaking above $99,000.

- US President Donald Trump announced a major trade deal with major nations in the Oval Office on his Truth Social post.

- The total crypto market cap reaches $3 trillion, wiping out 71.4% of leverage short positions, according to Coinglass.

The crypto markets trade in green on Thursday, with Bitcoin (BTC) breaking above $99,000. The Asian markets also followed suit, and traded higher. This rally was mostly triggered by US President Donald Trump announcing a major trade deal with major nations in the Oval Office on his Truth Social post. The total crypto market cap reaches $3 trillion, wiping out 71.4% of leverage short positions, according to Coinglass.

Trump announces major trade deal

US President Donald Trump announces on his Truth Social account that a “major trade deal” which would mark the first such agreement to be announced since he imposed tariffs on dozens of America's trading partners.

Trump said on the Truth Social platform that he would hold a news conference at 10:00 in Washington, DC (15:00 BST), to announce an agreement with "representatives of a big, and highly respected, country."

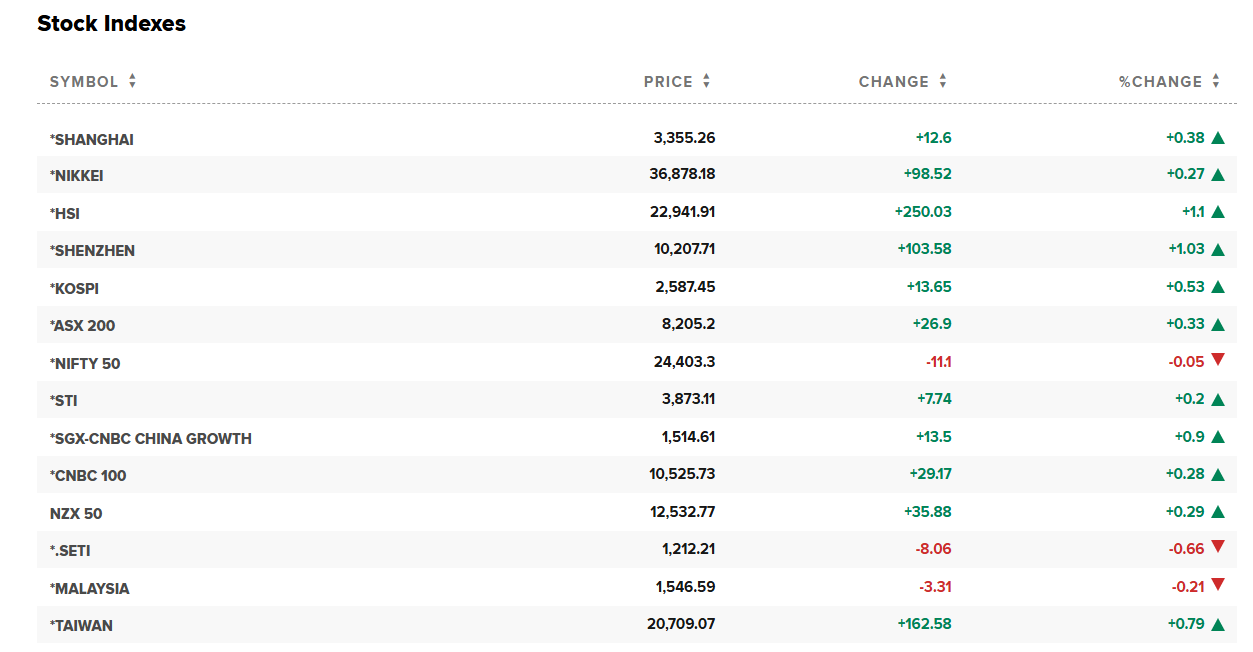

This news announcement had a positive reaction for the Asian equity markets, which traded green on Thursday. The tariff deals with major countries would ease the ongoing uncertainty in the global economy. The crypto market also reacted positively to this news as Bitcoin reached above $99,000 during the early Asian trading session.

Asian Markets chart

Crypto market cap reaches $3 trillion and wipes out 71% of short positions

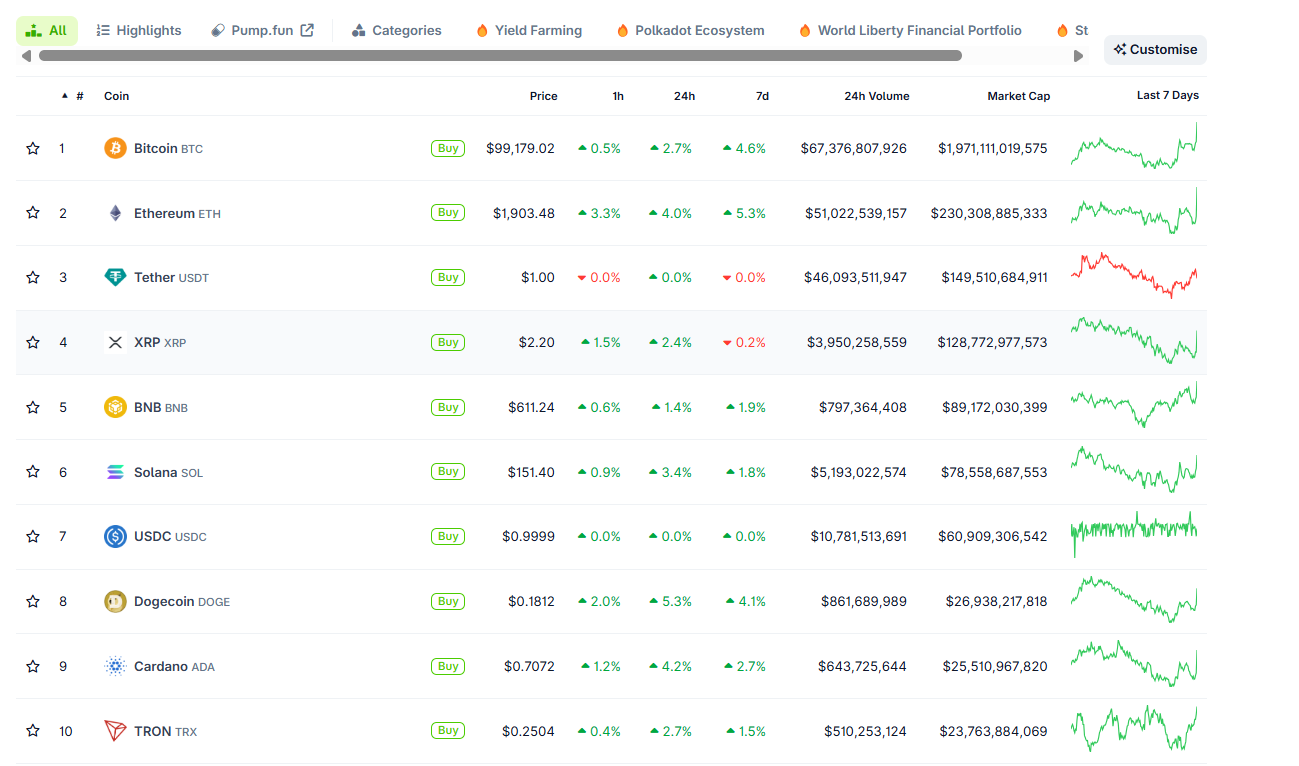

The total cryptocurrency market capitalization reached above $3 trillion on Thursday, as shown in the chart below.

CoinGecko data shows that the top 10 cryptocurrencies trade in green during the early Asian session.

Top 10 cryptocurrencies chart. Source: CoinGecko

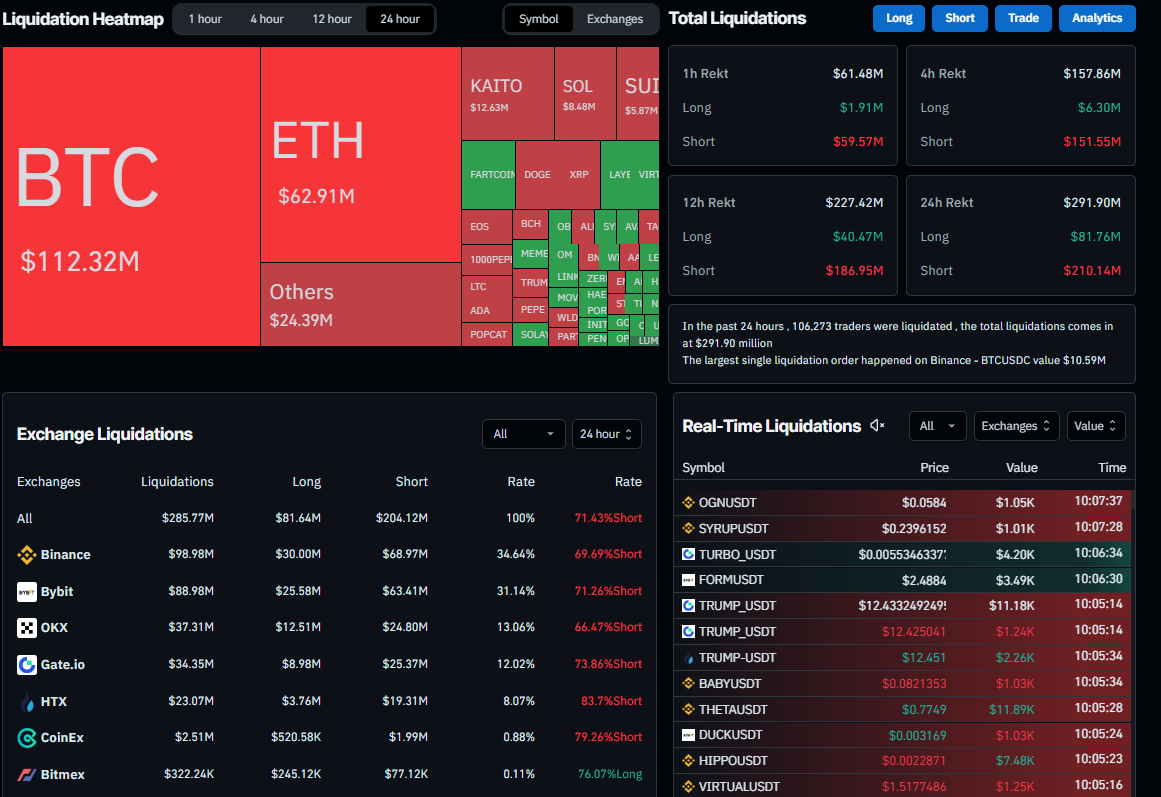

These gains in market value reflect a broader risk-on sentiment due to the ease of tariff uncertainty, which triggered a wave of liquidation. According to the CoinGlass Liquidation Map chart, in the last 24 hours,106,273 traders were liquidated, out of which 71.43% were leveraged short positions. The total liquidations came in at $291.90 million. The largest single liquidation order happened on Binance - BTCUSDC value $10.59 million.

Liquidation Heatmap chart. Source: Coinglass

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto markets tumble amid Middle East tensions, wiping $1.15 billion in liquidation

Rising geopolitical tensions in the Middle East have triggered a sharp decline in risk assets, with cryptocurrency markets facing significant losses. The Kobesissi Letter reports suggesting Iran says it will respond "harshly" against Israel.

Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP dips as Israel-Iran conflicts escalate

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) prices have dipped as escalating geopolitical tension between Israel and Iran has triggered a risk-off sentiment in the cryptocurrency markets.

Bitcoin’s slump under $103,000 crashes altcoins: FARTCOIN, ENA, LDO in freefall

The broader cryptocurrency market risk-off sentiment, as Israel confirms attacks on Iran’s nuclear sites, triggers a wave of profit booking among top coins, leading to Bitcoin (BTC) edging lower by nearly 2% at press time on Friday.

Solana dips 10% despite DeFi Development Corp's plan to raise $5 billion to boost SOL treasury

Solana (SOL) is down 10% on Thursday after DeFi Development Corporation (DFDV) announced an equity line of credit agreement with RK Capital Management to raise $5 billion in sales of its shares to stack additional SOL.

Bitcoin: BTC could slump to $100K amid Trump-Musk tussle

Bitcoin (BTC) tumbled to a low of $101,095 on Friday amid volatility in the market. The effect of the tussle between United States (US) President Donald Trump and Tesla Chief Elon Musk negatively influenced the NASDAQ and Tesla's stock price on Thursday, although both are recovering on Friday.