Odds of a BONK rally amidst the 84B token burn proposal are…

- BONK showed bullish pressure was winning in the lower timeframes.

- The recent structure break and the consistent buying pressure in recent months could sustain a rally.

Bonk [BONK] bulls forced a strong move higher this week after news of a BONK token burn proposal. This 84 billion token burn proposal has not yet been approved but the potential reduction in supply has gotten the bulls giddy, forcing a 23% move from Monday’s open.

The weighted sentiment was positive but trading volume had begun to dip. Is this a sign that the price pump is over?

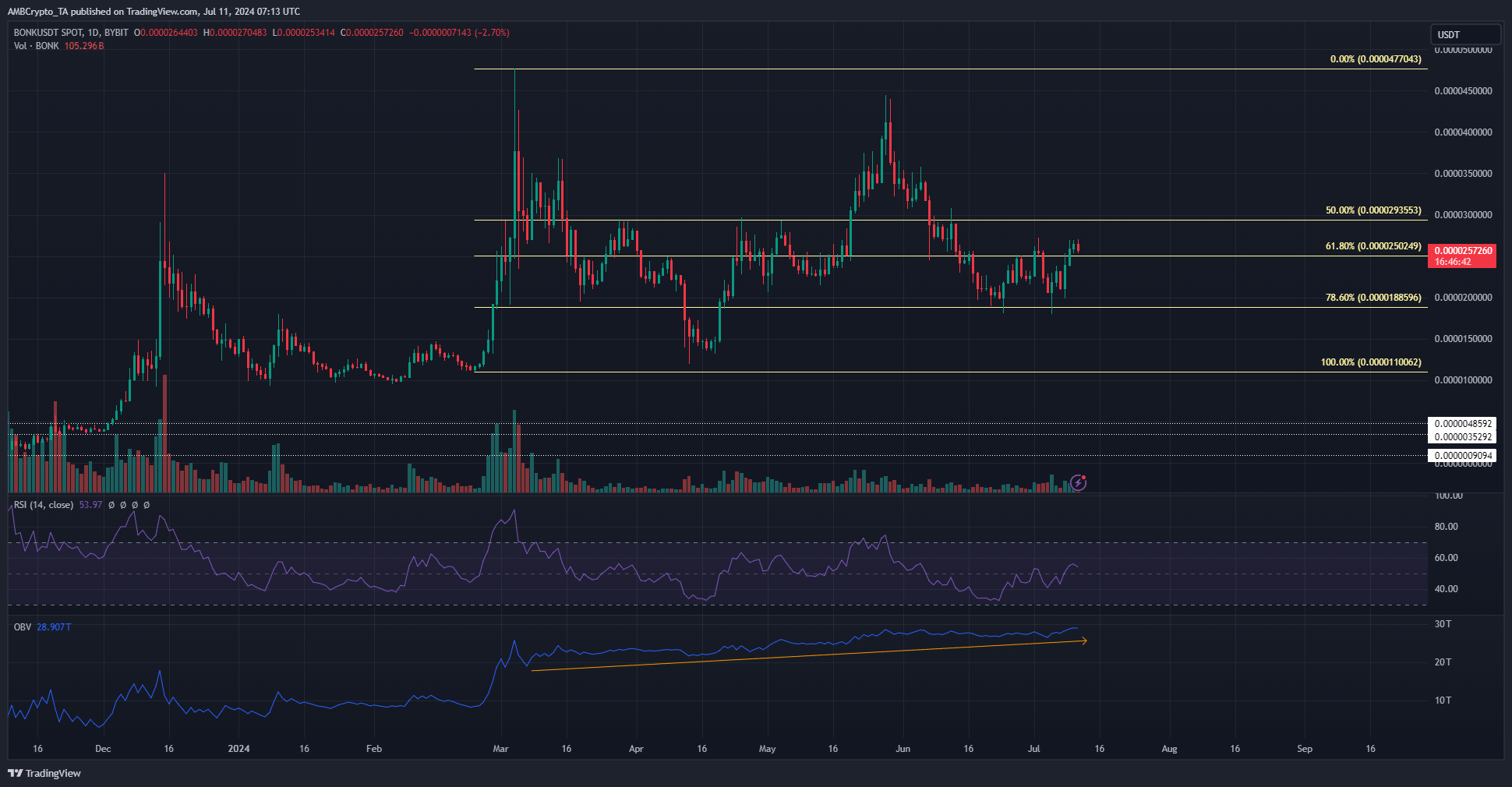

The daily structure is turning bullish

The 1-day price chart showed that the most recent lower high was set in mid-June at $0.00000256. On the 9th of July, the daily trading session closed above this level, flipping the structure bullishly.

The 78.6% retracement level has been a strong support level over the past six weeks. Bulls would be hoping to defend the $0.0000025 and $0.0000023 levels over the coming days.

The RSI broke above neutral 50, another early sign of a bullish trend shift. The OBV has slowly trended upward since March, signaling that another explosive rally is not a question of if but when.

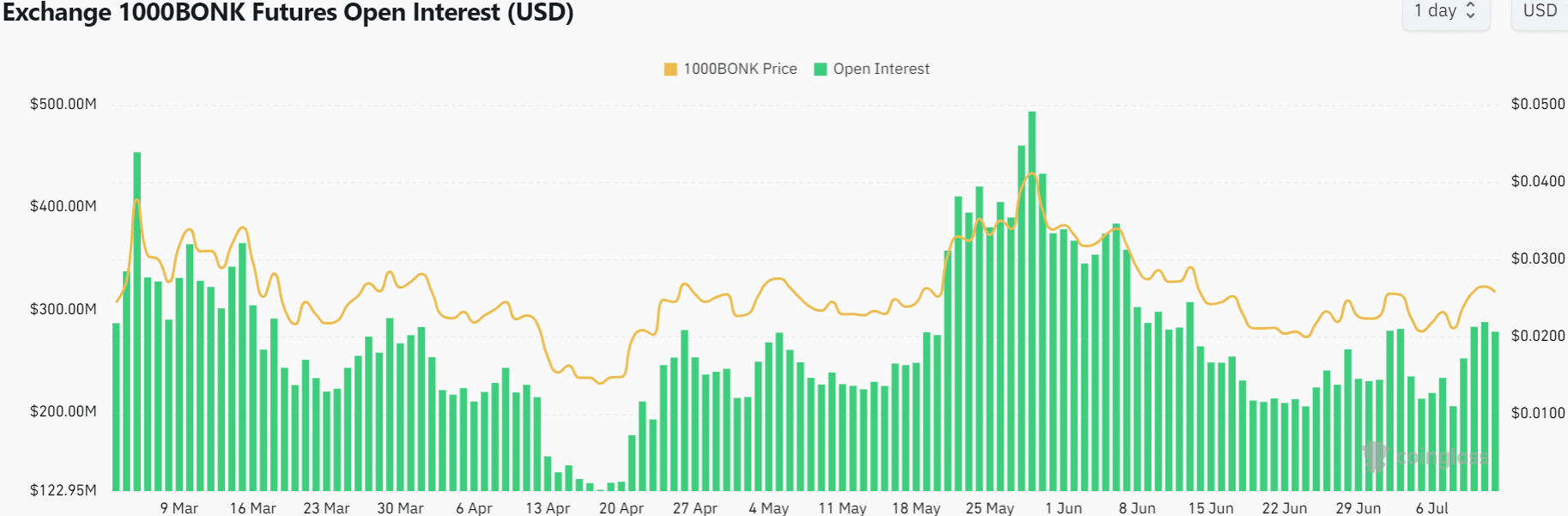

The futures data showed sentiment was positive

Source: Coinglass

The Open Interest increased from $205 million on the 8th of July to $283.3 million on the 10th of July. The quick uptick in OI alongside the price increase meant that speculators were willing to go long on the memecoin.

Over the past 24 hours, it has begun to diminish, but overall the short-term sentiment was bullish.

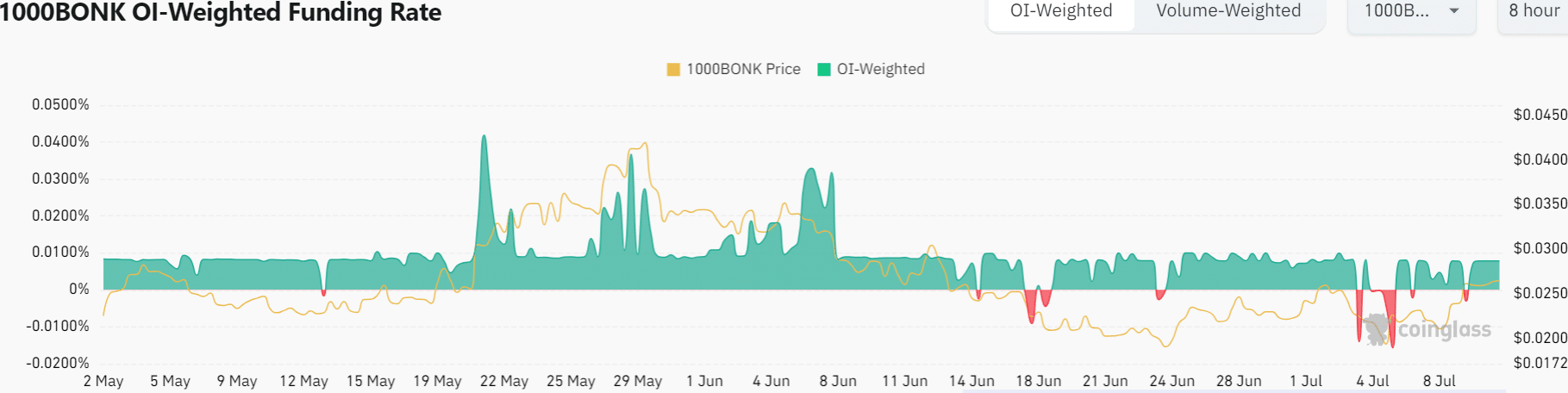

Source: Coinglass

Is your portfolio green? Check the BONK Profit Calculator

The funding rate climbed back into positive territory after dropping on the 5th of July and more recently on the 9th of July.

However, it was not abnormally positive which suggested that the market was not overheated.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.