Toncoin’s price nears key support – A buying opportunity or trap?

- Toncoin’s price action and discouraged investors hinted at a potential buying opportunity

- On-chain metrics did not fully agree with this assessment, with some signs of whale distribution seen too

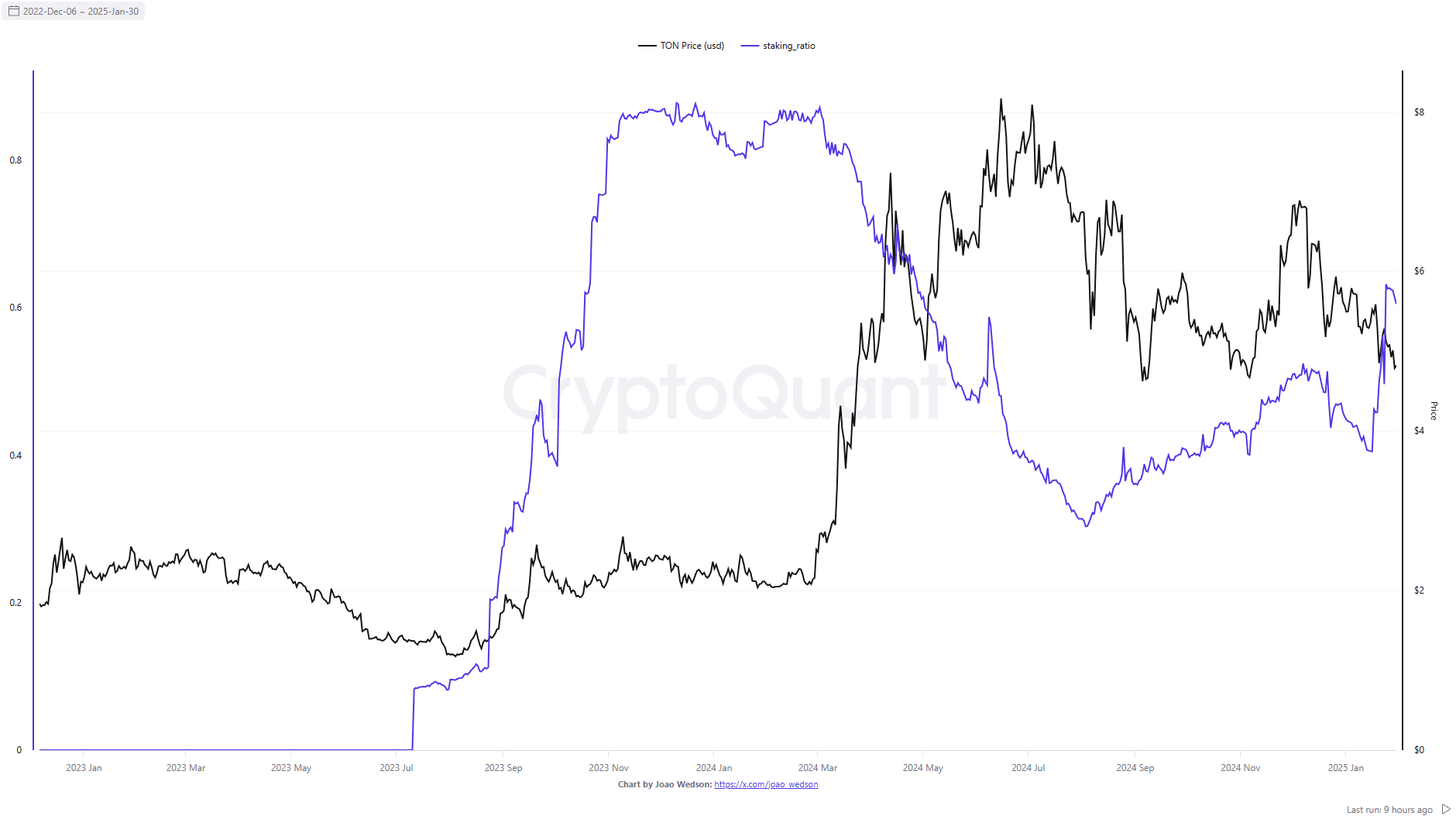

Toncoin [TON] saw a steady decline in its total value locked (TVL) across decentralized and centralized exchanges (DEX and CEX), as well as in derivatives and options. According to CryptoQuant analyst Joao Wedson, this may be a sign of de-leveraging.

Source: CryptoQuant

His analysis suggested that traders and investors have become discouraged with Toncoin and have reduced their exposure to the token. This might explain the steady drop in trading TVL since July 2024.

Bitcoin’s [BTC] volatility in recent weeks, alongside the altcoin market’s weakness, saw the trading TVL drop sharply once again in January. However, is it possible it also presented a buying opportunity?

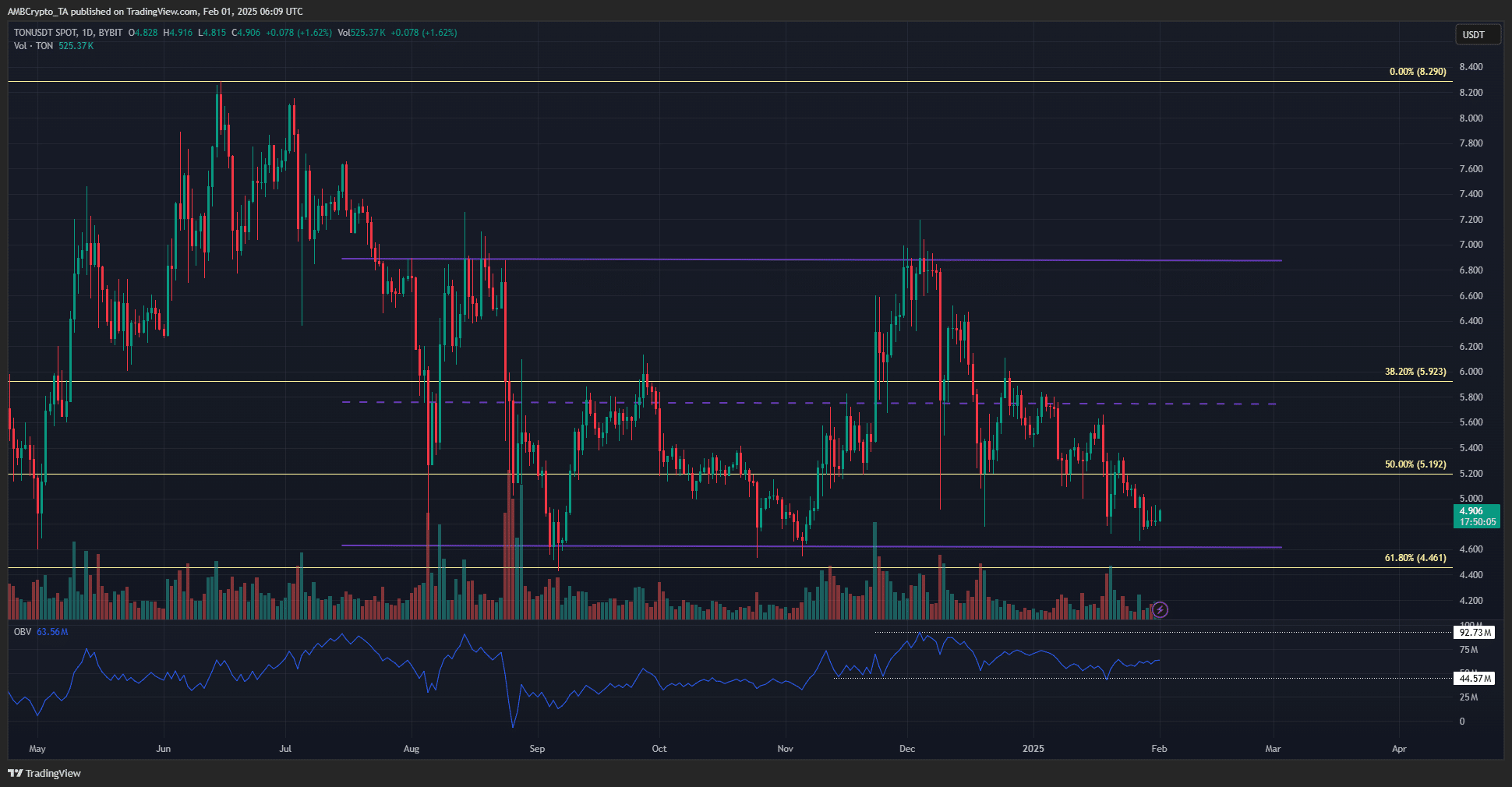

The 1-day price action chart revealed that Toncoin might be near its six-month range lows at $4.62. These lows were just above the 61.8% Fibonacci retracement level, plotted based on the rally that began in March 2024.

Therefore, the $4.46-$4.6 region is a strong demand zone that would likely be defended upon a retest. Additionally, the OBV has not sunk below its local lows. This meant that selling pressure was not overwhelmingly strong.

Supply distribution and netflows showed conflicting signs

Source: Santiment

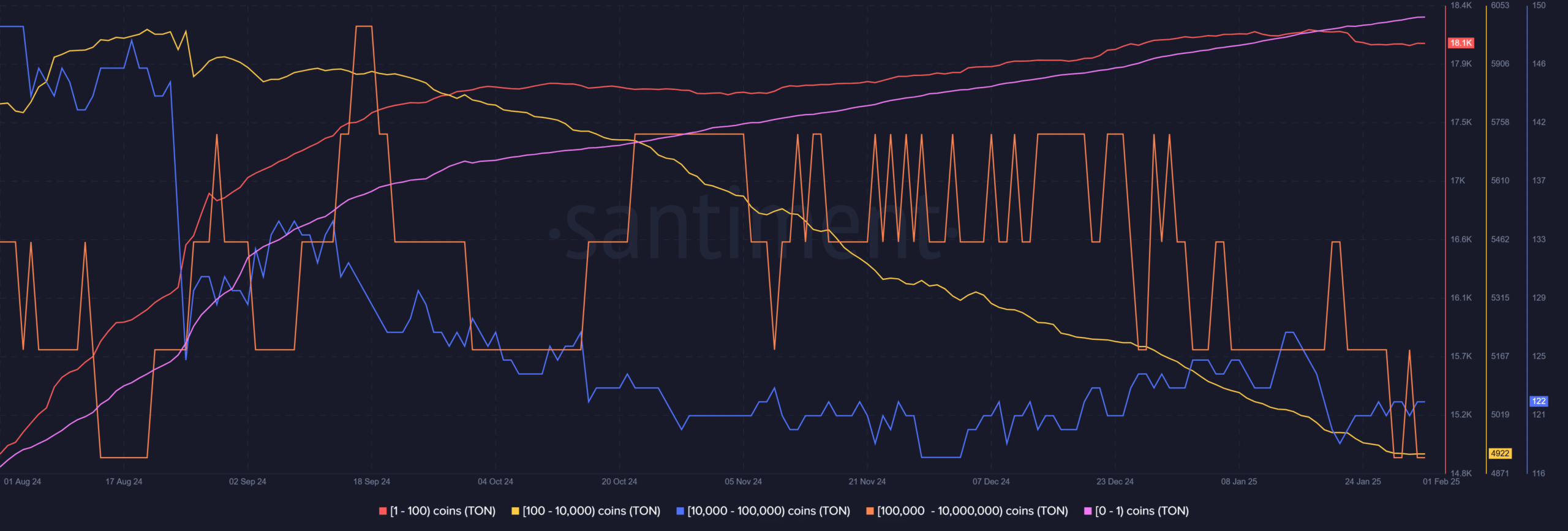

Addresses with less than 100 TON have grown steadily in number in recent months. This was an encouraging sign and hinted that more participants have been entering the ecosystem and buying Toncoin. However, these participants do not move the markets for the most part.

The heavy lifting is done by the whales, and their numbers have dwindled. Shark and whale addresses with more than 100 TON and up to 100k TON have reduced in number since August 2024 – A sign of distribution. The recent transfer of TON to exchanges increased the chances of selling pressure too.

Source: CryptoQuant

The recent drop in the altcoin’s price has also contributed to increased staking TVL ratio. This ratio measures the percentage of total TVL allocated to staking. Its growth underlined some conviction among long-term holders.

Is your portfolio green? Check the Toncoin Profit Calculator

The steady hike in recent months revealed that participants have not been withdrawing their assets from staking to use them more actively for trading purposes, due to the range formation and lack of long-term uptrend.

Combined with the drop in trading TVL, these conditions could present a long-term buying opportunity for investors.