Most top cryptocurrencies have seen significant growth in the past 24 hours, indicating a bullish market sentiment.

The Crypto Fear & Greed Index is currently at 61, indicating investor optimism about the future of the crypto market.

The previous time the index crossed 60 was in late July, when the top cryptos like Bitcoin and Ethereum experienced significant price increases.

The cryptocurrency market is heating up! In the last 24 hours, almost all of the top cryptocurrencies have seen significant price increases, signaling a strong bullish trend. Bitcoin and Ethereum, the market leaders, have gained 3.3% and 2.0%, respectively. But that’s not all – BNB, Solana, XRP, and Dogecoin have recorded increases of 2.3%, 5.4%, 0.6% and 9.4%, respectively.

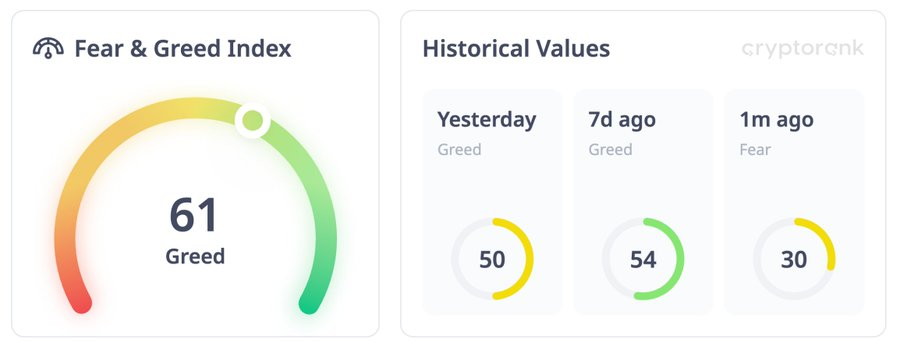

This is the right time to ask: how confident are investors about the future of the crypto market? One effective way to do this is by analyzing the Crypto Fear & Greed Index. Let’s take a closer look at what this indicator reveals about market sentiment.

Crypto Fear & Greed Index: What Does It Show

Before we dive into the current index value, let’s briefly explain what the Crypto Fear & Greed Index indicates. This tool helps us understand the current emotional state of the market, showing whether fear or greed is prevailing. A reading of fear indicates a lack of confidence among investors, while a reading of greed signals optimism.

Currently, the Crypto Fear & Greed Index stands at 61, placing the crypto market firmly in the ‘Greed’ zone. This suggests that investors are feeling quite optimistic about the growth potential of the cryptocurrency sector.

A Month of Shifting Sentiment

This is the first time this month that the index has reached such a high value. The average Crypto Fear & Greed Index for September is 30, starting at just 26. It dipped to a low of 22 on September 6 before showing signs of recovery. By September 14, the index peaked at 50, and on September 25, it reached 59. This week, the average stands at 54.

Understanding from History

An X post by CryptoRank states that the last time the index crossed the 60 mark was in late July.

On July 18, the value was 61, and on July 21, it reached 74. During this period, the price of Bitcoin climbed sharply from $64,127 to $67,188. Throughout late July, the index mostly remained at about 60. Interestingly, during that time, the top cryptos like Bitcoin and Ethereum were largely bullish. The Bitcoin market fluctuated between $64,816 and $68,157, while the Ethereum market between $3,174 and $3,535.

Looking Ahead: Is the Market Headed Up?

Similar to the situation in late July, there is potential for the current positive market sentiment to push the prices of leading cryptocurrencies higher. As mentioned earlier, the top cryptos are already showing initial signs of growth.

In summary, the Crypto Fear & Greed Index highlights the positive sentiment that investors currently hold regarding the future of the cryptocurrency market. However, it’s essential to stay cautious, as too much optimism or overconfidence can sometimes lead to unexpected market downturns.

Is the rise in investor confidence justified? Are you ready to jump back into the crypto market, or are you taking a more cautious approach?