- Bitcoin price stabilizes around $84,000 on Thursday after facing multiple rejections around the 200-day EMA.

- Fed’s hawkish remarks on Wednesday weigh on market sentiment for risky assets like Bitcoin.

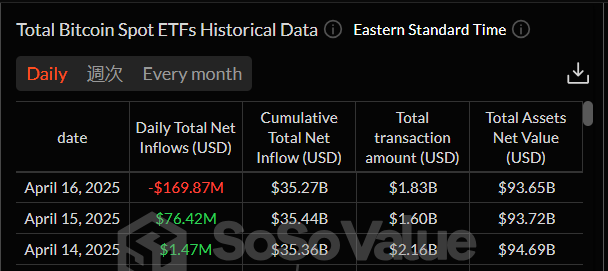

- US Bitcoin spot ETFs recorded an outflow of $169.87 million on Wednesday.

Bitcoin (BTC) is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day Exponential Moving Average (EMA) at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Federal Reserve (Fed) on Wednesday, BTC remains relatively stable. Meanwhile, institutional demand shows weakness, as it recorded nearly $170 million outflow from Bitcoin spot Exchange Traded Funds (ETFs) on Wednesday.

Bitcoin remains resilient despite the Fed’s hawkish stance

Bitcoin holds above $84,000 during Thursday’s European trading session, despite Fed Chair Jerome Powell’s hawkish remarks on Wednesday.

According to Haresh Menghani’s report at FXStreet, the US central bank was not inclined to cut interest rates in the near future, citing the potential inflationary pressure stemming from US President Donald Trump’s aggressive tariff policies.

On Wednesday, the US Census Bureau reported that Retail Sales climbed 1.4% in March, the most in over two years. The reading followed a revised 0.2% increase in the previous month and was better than the market expectation for a 1.3% rise.

Meanwhile, the equity market in Asia-Pacific largely advanced on Thursday. Moreover, traders are still pricing in the possibility that the US central bank will resume its rate-cutting cycle in June. This holds back the US Dollar (USD) bulls from placing aggressive bets while BTC shows signs of resilience.

Traders now look forward to the US economic docket, which will feature the usual Weekly Initial Jobless Claims release, the Philly Fed Manufacturing Index, housing market data, and Fed-speak to grab short-term opportunities.

US Bitcoin Spot ETF demand falls after a slight rise

Institutional flows have continued to weaken so far this week. According to the SoSoValue data, the US spot Bitcoin ETFs recorded a net outflow of $169.87 million on Wednesday after a slight two-day inflow totaling $77.42 million this week. If the net outflow continues and intensifies, Bitcoin’s price could see further correction ahead.

Total Bitcoin Spot ETFS netflow daily chart. Source: SoSoValue

Bitcoin Price Forecast: BTC momentum indicators show indecisiveness

Bitcoin has faced multiple rejections around its 200-day Exponential Moving Average (EMA) at $85,000 since Saturday. On Tuesday, BTC tried breaking above this level but was rejected again and declined by 1.12%. However, BTC stabilized at around $84,000 the next day. At the time of writing on Thursday, it continues to hover around this level.

If BTC closes above $85,000 on a daily basis, it could extend the rally to the key psychological level of $90,000. A successful close above this level could extend an additional rally to test its March 2 high of $95,000.

The Relative Strength Index (RSI) on the daily chart flattens around its neutral level of 50, indicating indecisiveness among traders. The RSI must move above its neutral level for the bullish momentum to be sustained.

BTC/USDT daily chart

However, if BTC continues its downward trend, it could extend the decline to retest its next daily support level at $78,258.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: BTC price reaches 70-day peak, propelled by Michael Saylor and 21Shares

The cryptocurrency aggregate market cap dips by 1.4% in the early hours of Friday despite BTC price rallying above $97,000 for the first time in 70 days. Lagging altcoin performance signals a cooling risk appetite.

Dogecoin spot ETF hype sparks breakout hopes as supply in profit rises

Dogecoin price is consolidating, hovering around the 50-day EMA, as optimism for spot ETF approvals surges. Dogecoin on-chain metrics signal bullish potential as derivatives open interest rises 2.17% to $1.85 billion amid rising shorts liquidation.

Bitcoin Weekly Forecast: BTC looks set to head back to $100K after logging fourth straight week of gains

Bitcoin price is hovering around $97,000 at the time of writing on Friday, following a decisive breakout above its key resistance level the previous day, and looks set to post a fourth consecutive week of gains.

Bitcoin holds gains close to $97,000 as Strategy doubles bet on BTC

Bitcoin steadies close to the $97,000 level even as traders continue to digest tariff-related economic uncertainty on Friday. Most of the top 10 cryptocurrencies gain on Friday and crypto trader’s sentiment improves.

Bitcoin Weekly Forecast: BTC looks set to head back to $100K after logging fourth straight week of gains

Bitcoin (BTC) price is hovering around $97,000 at the time of writing on Friday, following a decisive breakout above its key resistance level the previous day, and looks set to post a fourth consecutive week of gains.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.