Abstract

This study examines why Bitcoin consistently traded at a discount in Colombia compared to the US market between April 2020 and July 2023. We introduced the “Bitcoin yield gap,” representing the difference between Bitcoin’s trading price in Colombia and its global price. Using robust ordinary least squares regression, we found a positive relationship between foreign exchange (FX) convenience yields and the yield gap, while Bitcoin convenience yields did not show a significant relationship. Additionally, Bitcoin network demand was significantly associated with the yield gap without affecting other regression parameters. These findings highlight that the yield gap is predominantly driven by dynamics in the domestic FX market, illustrating the interplay between traditional FX markets and the digital cryptocurrency landscape in Colombia.

Similar content being viewed by others

Introduction

The cryptocurrency market, with Bitcoin at its forefront, has captivated researchers and market participants. In Colombia, Bitcoin consistently trades at a discount, unlike the premiums seen in other developing countries. This anomaly challenges existing knowledge and warrants thorough examination.

This study introduces the “Bitcoin yield gap.” a metric measuring the price difference between Bitcoin in Colombia and its global benchmark. Traditional markets have seen price discrepancies investigated, such as deviations from covered interest rate parity as investigated by Du et al. (2018), but cryptocurrency presents new, uncharted factors.

Drawing from Makarov and Schoar (2020) on arbitrage in cryptocurrency markets, we explore why Bitcoin trades at a discount in Colombia and identify sustaining factors. Central to our findings is the role of the foreign exchange convenience yield. While this concept is entrenched in commodity market analysis, it is relevant for cryptocurrencies, influenced by market dynamics and perceived nonmonetary benefits.

Our robust regression methodology integrates traditional foreign exchange metrics with intrinsic Bitcoin network factors, building on work by Jiang et al. (2021). Our key finding is that the FX convenience yield significantly influences the Bitcoin yield gap in Colombia. This result is obtained by analyzing the relationship between the Bitcoin yield gap and various economic indicators, connecting traditional FX markets and the digital currency landscape.

Robust regression analysis was crucial due to potential outliers and heteroskedasticity in financial data. Traditional ordinary least squares (OLS) regression could lead to biased estimates. By employing robust techniques, we ensured resilient and accurate estimates of the relationships between the Bitcoin yield gap, foreign exchange convenience yields, and network activity.

Additionally, this study engaged with literature centered on the role of network activity within the cryptocurrency sphere, which has recently been highlighted as a central force shaping Bitcoin market dynamics. Leveraging the theoretical foundations laid out by Cong et al. (2020) and the empirical results presented by Liu and Tsyvinski (2020), this research delves into the correlation between network activity, as represented by multiple proxies, and the identified yield gap in Colombia. Our analysis reveals a negative association between network activity and the Bitcoin yield gap.

Understanding this Colombian Bitcoin anomaly is vital for policymakers, financial strategists, and investors. Policymakers can use these insights to enhance market stability and regulatory frameworks. Financial strategists may find new avenues for risk management and portfolio diversification. For investors, recognizing the influence of FX convenience yields on Bitcoin prices offers opportunities for informed decision-making. This research not only elucidates the underpinnings of the Colombian Bitcoin market but also contributes to the broader discourse on cryptocurrency dynamics in developing economies.

This paper bridges a critical knowledge gap by integrating traditional financial market theories with emerging cryptocurrency literature. It offers a fresh perspective on the Colombian Bitcoin market, providing a comprehensive understanding of the interplay between cryptocurrencies and traditional financial systems in developing economies.

The structure of this paper is as follows. Section “Background” provides a background on Bitcoin market mechanics, focusing on the Colombian context concerning cryptocurrencies and its foreign exchange markets. Section “Theoretical framework” delves into the theoretical framework, introducing the synthetic Bitcoin yield gap and the concept of convenience yields. Section “Data and estimation technique” delineates the data sources and estimation techniques employed. Our empirical findings are unveiled in the section “Empirical findings”, followed by conclusions in the section “Conclusions”.

Background

Bitcoin and its associated technologies have had a significant impact on the global financial arena, leading to the development of unique markets and trading platforms. In this section, we offer an examination of the mechanics underpinning Bitcoin’s market, its standing in the international financial markets, and its particular implications for Colombia. We also delve into the regulatory nuances surrounding Colombia’s foreign exchange (FX) market. Additionally, we explore the interplay between macroeconomic variables and cryptocurrencies, highlighting how broader economic conditions and policies influence the cryptocurrency landscape.

Macroeconomic variables and cryptocurrencies

Recent studies have increasingly focused on the interplay between macroeconomic variables and cryptocurrencies, shedding light on the complex dynamics that govern these digital assets. Saleem et al. (2024) investigated the relationship between cryptocurrencies and various facets of the financial system, including stock markets and inflation rates. The study reveals a strong positive correlation between cryptocurrency market capitalization and key financial indicators, such as the Dow Jones Industrial Average and the Consumer Price Index. This correlation suggests that macroeconomic conditions significantly impact cryptocurrency markets, aligning with our investigation into how FX convenience yields and broader economic factors influence the Bitcoin yield gap in Colombia.

Moreover, Alam et al. (2024) examined the relationship between cryptocurrencies and monetary policy using a Structural Break GARCH-MIDAS approach. The research highlights that the long-term volatility of cryptocurrencies is sensitive to structural breaks in monetary policy, emphasizing the importance of considering macroeconomic policies when assessing cryptocurrency markets. While our study does not directly explore monetary policy, it documents how exchange rate dynamics, which can be influenced by various macroeconomic factors, including but not limited to monetary policy, affect how Bitcoin is priced in Colombia. This connection helps contextualize our findings within the broader scope of macroeconomic influences on cryptocurrency markets.

Additionally, Nakagawa and Sakemoto (2022) explored the macroeconomic factors affecting cryptocurrency returns through long-horizon predictive regressions. The findings suggest that macroeconomic variables such as interest rates and inflation significantly impact cryptocurrency returns. Our study builds on these insights by specifically investigating how FX convenience yields and Bitcoin network activity correlate with the Bitcoin yield gap in Colombia, focusing on the regional dynamics and contributing to the understanding of how these factors influence cryptocurrency pricing.

These studies collectively contribute to a more comprehensive understanding of the relationship between macroeconomic variables and cryptocurrencies, providing a robust framework for analyzing the impact of economic policies on the digital currency market. Our research builds on these insights by specifically investigating how FX convenience yields and Bitcoin network activity correlate with the Bitcoin yield gap in Colombia, adding a regional perspective to the existing body of literature.

Bitcoin market mechanics

In traditional payment systems, a centralized operator, such as a bank or payment processor, validates transactions. They ensure the spender has adequate funds, and they can verify a transaction within seconds. Cryptocurrencies, however, diverge from this centralized model. They rely on cryptographic techniques and decentralized networks, making them free from any single point of control, such as governmental oversight. Introduced by Nakamoto (2009), Bitcoin was the pioneering cryptocurrency, setting the stage for a wave of similar digital assets.

Cryptocurrencies operate on a unique premise: when two parties want to transact, they broadcast this intent to a network of nodes that validate it. Upon acceptance, the transaction is enshrined in the blockchain, a distributed ledger recording all such exchanges. This blockchain is stewarded by a decentralized network of nodes working in tandem to validate and chronicle transactions. Validation hinges on consensus mechanisms, with proof of work (PoW) being a prime example. Here, nodes solve intricate mathematical problems, with successful solvers rewarded with new coins. There are alternative mechanisms, too, such as proof of stake (PoS), where validators are chosen based on the cryptocurrency amount they hold and are willing to stake as collateral.

Bitcoin, for instance, uses a PoW consensus mechanism that takes roughly an hour to fully validate a transaction, with a new block added to its blockchain every ten minutes. Transaction validation duration, however, is not uniform across cryptocurrencies; it varies depending on the consensus mechanism they employ.

Cryptocurrencies can be exchanged for fiat money either through peer-to-peer arrangements or via exchanges. In peer-to-peer setups, parties might know each other’s full legal identity or merely recognize a forum username. Such transactions involve negotiating terms, such as cryptocurrency volume, pricing, and payment method. There are also platforms—for example, Kraken and LocalBitcoins—connecting cryptocurrency buyers and sellers.

In contrast, exchange-based transactions are facilitated by a centralized entity, employing an order book design where traders place buy or sell orders. These orders are ranked, and a trade occurs when a buy matches a sell order. Unlike peer-to-peer trades, exchange-based transactions are more anonymous, as the buyer and seller remain unknown to each other. Exchange operators temporarily hold funds during trades. Yet, while providing some level of security and oversight, exchanges can pose risks if they are mismanaged or inadequately regulated.

Exchanges can be broadly segmented into custodial and noncustodial. Custodial exchanges, operating off-chain, do not record transactions on the blockchain. Rather, akin to conventional banks, they manage users’ assets and maintain balance records. This allows for near-instantaneous transactions but introduces counterparty risk. The collapse of Mt. Gox, a once-renowned Japanese custodial exchange, underscores such risks, as detailed by McLannahan (2015).

Conversely, noncustodial exchanges empower users to retain asset control. These on-chain transactions, chronicled on the blockchain, operate without central oversight. Some noncustodial exchanges even permit fiat—cryptocurrency trades via credit cards, though reverse transactions are often restricted. Noncustodial exchanges provide heightened security by decentralizing asset control but demand greater user vigilance.

Fang et al. (2022) offer a comprehensive survey on cryptocurrency trading, shedding light on the diverse platforms, strategies, and algorithms currently in play, including Bitcoin.

Buda.com: a Latin American cryptocurrency exchange

Buda.com is a centralized, custodial cryptocurrency exchange based in Chile. Founded in 2015, it serves multiple Latin American countries, including Argentina, Chile, Colombia, and Peru. The platform supports various cryptocurrencies, such as Bitcoin, Ether, Litecoin, Bitcoin Cash, and recently USDC. Users can trade within each fiat–crypto pair and also engage in crypto–crypto pair trading.

In 2022, the distribution of Bitcoin trading volume on Buda.com was notably concentrated in Chile, which accounted for 80.4% of the total volume. Colombia followed with 11.4%, Peru with 8.1%, and Argentina with a minimal 0.1%.

To contextualize the significance of Buda.com in our study, we observed its trading volumes in comparison to other exchanges. Between 2018 and mid-2022, the weekly average trading volume for BTC/PEN on Buda.com was 2.9 Bitcoins, whereas for BTC/COP, it stood at 4.9 Bitcoins from 2020 to mid-2022. In stark contrast, LocalBitcoins, a peer-to-peer platform, recorded substantially higher weekly volumes: 39.8 Bitcoins for BTC/PEN and 139.7 Bitcoins for BTC/COP in the same time frame.

The Colombian market: FX and cryptocurrency landscape

The “Crypto on the Rise 2022” report by Thomson Reuters indicates that cryptocurrency activities in Colombia are largely viewed as illegal. In 2014, the Superintendencia Financiera de Colombia (SFC), the governmental body responsible for financial market oversight, clarified that the government did not oversee cryptocurrency marketsFootnote 1. However, by 2017, the SFC had taken a more restrictive stance, barring any financial institution in the country from participating in cryptocurrency activitiesFootnote 2. As a consequence of this directive, Buda.com temporarily halted its operations in Colombia from August 2018 to June 2019, unable to offer users fiat currency transactions. In 2021, the SFC greenlit select fintech pilot projects related to cryptocurrencyFootnote 3.

From the perspective of the Colombian central bank (Banco de la Republica de Colombia), cryptocurrencies are not acknowledged as legal tender, as reiterated in a 2016 directiveFootnote 4. On the taxation front, the government’s tax and customs agency, DIAN, emphasized that cryptocurrency transactions are taxableFootnote 5. Moreover, the government’s financial information agency, UIAF, mandates that all cryptocurrency exchange platforms report their activitiesFootnote 6. Currently, the Colombian Congress is deliberating on a legislative proposal focused on supervising and regulating cryptocurrency exchanges, with the overarching goal of fortifying security and safeguarding user interests.

Regarding foreign exchange in Colombia, regulations stipulate that transactions connected to imports and exports, investments, and derivative dealings be channeled through the exchange rate market. Set-FX dominates this space, facilitating the negotiation and registration of OTC spot and derivative operations in foreign currency. It is also the origin of the TRM (representative market rate), the weighted average of daily exchange rate prices. The rates tabulated by the Set-FX system are recognized as the official exchange rate.

Colombia’s macro-prudential measures, as determined by the Colombian central bank, impose limitations on foreign exchange balances held by Financial Market Intermediaries (abbreviated as IMC in Spanish). These restrictions specify both minimum and maximum thresholds for assets and liabilities held in foreign currencyFootnote 7. These thresholds are articulated in terms of “proprietary positions” (PP) and “spot proprietary positions” (PPC) involving foreign currency. Castellanos et al. (2011) explored the implications of these constraints on foreign exchange balances, contending that such limitations curb the IMCs’ unrestricted participation in spot and foreign exchange markets, subsequently skewing the price dynamics, because when an IMC enters into a forward contract with a client and simultaneously hedges it by trading foreign currency, it does not affect the PP but does affect the PPC. This dynamic mirrors the consequences observed in the US foreign exchange market, as documented by Du et al. (2018).

Theoretical framework

Literature review

The study of arbitrage in cryptocurrency markets has garnered significant attention in recent years. Makarov and Schoar (2020) explored this domain and found substantial and repeated price deviations across cryptocurrency exchanges between 2017 and 2018. Their observation revealed that these deviations were more pronounced across regions, with a few noticeable exceptions in Brazil and Mexico. It is noteworthy that while Bitcoin seldom traded at a discount outside of US and European exchanges, our study demonstrates that in the context of Colombia, Bitcoin consistently trades at a discount close to the official exchange rate. This highlights that the dynamics of cryptocurrency and fiat currency pricing may vary considerably across Latin American markets.

Building on this, Crépellière et al. (2023) illustrated a decreasing magnitude of arbitrage opportunities in crypto markets since 2018, attributing this to informed trading. Shynkevich (2021) also noted that price deviations among the exchanges contributing to the calculation of the index underlying Bitcoin futures are diminishing. Furthermore, Daian et al. (2019) described the token ecosystem within decentralized exchanges (DEX), shedding light on arbitrage bots contending over transaction fee hikes and order prioritization.

This research aligns closely with literature examining price deviations through no-arbitrage theories. A notable deviation in recent years has been the covered interest rate parity (CIP). Historically, deviations from CIP were rare and often linked to transactional costs or credit risk, as argued by Tuckman and Porfilio (2003). However, the 2008 financial crisis witnessed exacerbated CIP deviations, reflecting the challenges financial entities faced in leveraging arbitrage opportunities during the crisis (Baba et al., 2008; Coffey et al., 2009; Ivashina et al., 2015). In a more contemporary study, Du et al. (2018) postulated that the persisting post-crisis deviations are consequent to new financial regulations. Additionally, the magnitude of such deviations exhibited a connection to interest rates and monetary policy directives.

One intriguing hypothesis to explain the observed price deviations is the convenience yield associated with cryptocurrency investments. The FX convenience yield represents the non-monetary benefits of holding a foreign currency over a domestic one, influencing exchange rates and market dynamics.

Jiang et al. (2021) ventured into understanding how fluctuations in the convenience yield of American treasuries impact exchange rates, concluding that foreign investor-driven demand surges for American risk-free assets lead to short-term exchange rate appreciation. Drawing a parallel, it is conceivable that similar forces might influence the relationship between cryptocurrencies and Latin American fiat currencies, which in turn affects the Bitcoin yield gap.

In the realm of cryptocurrency, network activity has emerged as a pivotal factor. Cong et al. (2020) developed a dynamic asset pricing model for cryptocurrencies and established an inverse relationship between network activity and the crypto convenience yield. This inverse association is rooted in the idea that a larger and more vibrant network simplifies the process of identifying transactional counterparts. Complementing this, Arkorful et al. (2023) delved into the Bitcoin convenience yield during the COVID-19 pandemic, underscoring the aforementioned inverse link. However, it is essential to recognize that the advent of innovations like the Lightning Network, a second-layer payment protocol atop the Bitcoin blockchain, has seemingly mitigated Bitcoin network congestion, as posited by Divakaruni and Zimmerman (2023). Such advancements introduce nuances in accurately gauging network activity.

Our findings drew inspiration from Liu and Tsyvinski (2020), who identified key factors influencing cryptocurrency performance. While they delineated that current returns on cryptocurrencies reflect the anticipated use of crypto platforms and observed that FX factors seldom elucidate cryptocurrency returns, our study contends that certain FX-related variables significantly influence the Bitcoin yield gap.

In summary, the literature presents a multifaceted view of the factors driving price deviations in cryptocurrency markets. By introducing the concept of the Bitcoin yield gap and examining its relationship with both FX convenience yields and Bitcoin network activity, this study seeks to contribute to the existing body of knowledge and provide insights into the intricate dynamics at play.

The synthetic exchange rate and the Bitcoin yield gap

Consider \({S}_{t}^{l}\) as the price of a cryptocurrency at time t, denominated in the fiat currency of country l. Similarly, let \({S}_{t}^{x}\) represent the price of the same cryptocurrency but denominated in the fiat currency of country x. Without transaction costs, an investor can potentially convert local currency into a foreign one by purchasing the cryptocurrency with domestic fiat currency and subsequently selling it for foreign fiat currency. This allows us to define the synthetic exchange rate, as inferred from cryptocurrency markets, as

Moreover, \({Q}_{t}^{l,x}\) is designated as the official exchange rate between countries l and x. This rate signifies the number of currency units from country l needed to obtain a single unit of currency from country x. We assume \({Q}_{t}^{l,x}\) is established in the spot foreign exchange market, where fiat currencies are exchanged directly.

Under the premise that investors can freely and instantly trade both cryptocurrencies and fiat currencies and assuming no arbitrage opportunities exist, the relationship \({\hat{Q}}_{t}^{l,x}={Q}_{t}^{l,x}\) should hold true. However, instantaneous buying and selling of cryptocurrencies using fiat might not always be feasible due to factors related to the specific cryptocurrency, its trading platform, and the required confirmations for transaction validation, as discussed in the section “Bitcoin market mechanics”.

We denote \({G}_{t}^{l,x}\) as the gross return obtained from buying foreign currency in the official market, procuring cryptocurrency in the foreign market, and subsequently selling it domestically. Essentially, \({G}_{t}^{l,x}\) characterizes the disparity between the official and the synthetic exchange rates. This can be expressed as

with lowercase letters indicating logs. This difference, \({g}_{t}^{l,x}\), is termed the Bitcoin yield gap. A negative Bitcoin yield gap suggests that the cryptocurrency is trading at a relative discount in the domestic country’s fiat currency compared to that of the foreign country. As documented by Makarov and Schoar (2020), outside of the US and European Union, cryptocurrencies seldom trade at such a discount.

Bitcoin and FX convenience yields

Given that an investor can achieve identical cash flows through trading either at the official exchange rate or via synthetic exchange rates, the Bitcoin yield gap should be intrinsic to the assets comprising the portfolio strategy. Convenience yields represent the advantages derived from possessing the asset directly, as opposed to having a commitment that assures access to the asset, such as maintaining a long position in a forward contract. While convenience yields are not immediately visible, they can be discerned as the difference between a forward position and a self-financed portfolio that retains the asset. In the context of exchange rates

where yQ denotes the FX convenience yield. fQ represents the logarithm of the forward exchange rate at t = 0 for exchanging Colombian pesos for one US dollar at t = T. \({q}_{0}^{l,x}\) is the logarithm of the spot exchange rate, rl is the continuously compounded domestic interest rate, while rx is the analogous foreign interest rate. The initial term on the equation’s right side embodies the cost of carry, which mirrors the opportunity cost of retaining the asset within the interval [0, T]. Specifically for currencies, this cost of carry indicates the net result of the forgone interest in the domestic market and the interest accrued in the foreign market. When the foreign exchange convenience yield is positive, the differential between the forward and spot exchange rates falls below the cost of carry. This differential exemplifies the opportunity cost that agents incur due to their preference for directly holding the foreign currency rather than possessing a commitment to it.

We estimate the Bitcoin convenience yield following Arkorful et al. (2023). An agent retaining Bitcoins over the duration [0, T] incurs costs equivalent to the forgone interest from purchasing Bitcoins, as well as the associated transaction costs, denoted by Ct. These transaction costs stem from the fees agents pay to miners to ensure the transaction is registered on the Bitcoin blockchain, compensating them for the computational resources utilized in validating and recording the transaction. In the foreign market, the Bitcoin convenience yield, represented as yS is

where fQ is the logarithm of the Bitcoin forward price, while \({\hat{s}}_{0}^{x}\) symbolizes the natural logarithm of the Bitcoin price in foreign currency adjusted for transaction costsFootnote 8.

Data and estimation technique

Sources

We gathered our dataFootnote 9 from four primary sources. First, Bloomberg supplied daily data on Bitcoin one-month futures and spot closing prices, daily one-month forward and spot foreign exchange closing prices for the COP/USD currency pair, and daily one-month LIBOR rates. Second, Buda.com provided daily Bitcoin prices and information on the volume of Bitcoins traded in Colombian pesos. Third, we sourced daily one-month IBR rates from the Colombian central bank; these rates represent the interbank rates utilized in derivative pricing. Finally, from the BigQuery Bitcoin Public Dataset by Google—a comprehensive account of Bitcoin’s blockchain transaction history—we extracted daily Bitcoin transaction details on the number of Bitcoins traded, the number of unique input and output addresses, the total fees paid in Bitcoins, the size of each transaction, and the total number of transactions.

Our sample begins on April 1, 2020, ten months following the resumption of Buda.com’s operations in Colombia. This restart came after the restrictions set by the SFC in 2018. It was only after this date that the weekly trading volume reached the equivalent of $500,000 US dollars, close to the levels before the ban. The sample ends in July 2023.

Bitcoin yield gap and convenience yields

We derived the synthetic foreign exchange rate from Bitcoin prices in Colombian pesos, sourced from Buda.com, and Bitcoin prices in US dollars obtained from Bloomberg using Eq. (1). Subsequently, we determined the Bitcoin yield gap with data on the USD/COP pair using Eq. (2). Given that Bitcoin markets operate continuously throughout the day and week, unlike traditional foreign exchange markets, we have aggregated the data to provide average weekly observations.

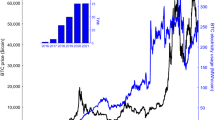

Figure 1 illustrates the Bitcoin yield gap. The series is predominantly negative, indicating that the synthetic exchange rate is typically lower than the official exchange rate. On average, the synthetic exchange rate is 3.2% lower than the official rate. The most significant gap observed was—9.8% in October 2020. The series has a standard deviation of 2.6%. During this time frame, Bitcoin prices in USD surged by 42%, while the exchange rates saw a modest ascent at a rate of 1% annually.

The Bitcoin yield gap series appears to be stationary, as suggested by the augmented Dickey–Fuller statistic of—3.36 and an associated p-value of 0.012. The series displays autocorrelation at the first and fourth lags. Estimation results for various autoregressive models are provided in Table 1. The first column features an AR model with just a one-period lag, the second column presents a model with a four-period lag, and the third encompasses a model with both the first and fourth lags. Across all models, the constants are negative, while the beta coefficients for the lags are positive and sum to less than one. This suggests a positive autoregressive behavior in the series that is mean-reverting.

We computed both the FX and Bitcoin convenience yields using Eqs. (3) and (4), respectively. When determining the FX convenience yields, we converted the one-month LIBOR and one-month IBR rates into continuous compounding rates. This conversion was necessary to accurately determine the cost of carry.

Contrary to the assumption of Arkorful et al. (2023) that the transaction cost of holding Bitcoin is constant and thus included in the convenience yield, we computed the transaction costs embedded in the Bitcoin convenience yield equation. Our initial step was to calculate the average daily cost in Bitcoins for each transaction. This was achieved by dividing the total daily fee, denominated in Bitcoin, by the aggregate number of daily transactions. Subsequently, we converted this fee into US dollars using the daily Bitcoin price in US dollars. Figure 2 illustrates the average weekly transaction fee in US dollars paid to miners for the validation and recording of transactions on the Bitcoin blockchain. The median cost is USD$2.40 per transaction over the sample period. Transaction costs surged during the pandemic, reaching a peak of USD$56.40 in May 2021. Following this peak, costs dramatically declined and have since remained consistently low. Our analysis underscores that the assumption of a constant cost is not tenable.

Figure 3 displays the convenience yields for both Bitcoin (on the left) and the USD/COP pair (on the right). For Bitcoin, the average convenience yield is—0.68%, fluctuating between—86% and 55.7%, with a standard deviation of 11.88%. This negative convenience yield suggests that forward prices surpass the costs linked to holding Bitcoins. While these results are sizable in magnitude, they align with the observations made by Arkorful et al. (2023).

Conversely, the left side of the figure presents the time series of the FX convenience yield. The average FX convenience yield stands at—0.82%, indicating that the spread between forward and spot prices exceeds the cost of carry. Such a negative value resonates with findings from Du et al. (2018) and Jiang et al. (2021) for most G10 currencies post-financial crisis. However, the magnitude is greater than what’s observed for these developed economiesFootnote 10. The FX convenience yield showcases less volatility compared to its Bitcoin counterpart, with a standard deviation of 3.65% and a range between—29% and 26%. Notably, the series exhibits increased volatility post-mid-2022, marked by a declining trend, coinciding with the government transition.

Econometric model

To empirically analyze the dynamics of the Bitcoin yield gap and its potential determinants, we employed a robust ordinary least squares (OLS) regression approach. This methodological choice was driven by our need to ensure that the estimated relationships were not influenced by issues such as heteroskedasticity and autocorrelation, which can undermine the reliability of regression results. By using robust OLS regression, we addressed both of these issues. The robust standard errors generated provided us with more reliable coefficient estimates that are resilient to these violations.

Our primary focus in this econometric exploration is on two pivotal dependent variables: the Bitcoin convenience yield and the FX convenience yield. These convenience yields represent the benefits or costs that accrue to the holder of the underlying asset over the contract period, adjusted for factors such as storage costs, transaction fees, and other related expenses. Given the temporal characteristics of our data, and in order to grasp both immediate and delayed effects, we investigated both contemporaneous and lagged specifications of the model. This dual approach allows us to understand not only the immediate relationship between the yield gap and the convenience yields but also any delayed repercussions that may materialize over time.

Given the temporal nature of our data and based on our initial time series analysis, we detected evidence of autocorrelation at both one and four lags for the Bitcoin yield gap. This finding suggests that the current value of the Bitcoin yield gap could be influenced by its own values up to four periods prior. Consequently, to capture these dynamic effects, account for potential feedback loops, and ensure that the model is well specified, we incorporated these specific lags of the Bitcoin yield gap into our regression.

In our attempt to capture the nuances influencing the Bitcoin yield gap, we introduced two control variables: log returns on Bitcoin prices and log changes in the foreign exchange rate. These variables were chosen for the following reasons: 1. Log returns on Bitcoin prices capture the inherent volatility and fluctuations in the Bitcoin market. Any significant movement in Bitcoin prices can influence its yield gap, and therefore, controlling for this ensures that our model is not conflating the effects of other predictors with natural fluctuations in the Bitcoin price. 2. Given that our Bitcoin yield gap is essentially derived from a comparison involving foreign exchange rates, it’s necessary to control for changes in these rates. This variable represents the underlying shifts in the traditional foreign exchange market, which can have direct implications on the yield gap.

Both these control variables essentially represent changes in the underlying components of the Bitcoin yield gap. By including them, we aimed to isolate the effect of our primary predictors and ensure that our model is capturing the true relationship without omitted variable bias.

We estimate the following specifications of the model:

where X1t and X2t are the two control variables at time t that represent log returns on Bitcoin prices and log changes in the foreign exchange, respectively. L1t and L4t denote the first and fourth lags of the Bitcoin yield gap. \({y}_{t-j}^{{\rm {S}}}\) and \({y}_{t-j}^{{\rm {Q}}}\) are the variables of interest, which are the Bitcoin convenience yield and the FX convenience yield at time t−j, respectively, and where j represents the number of lags of the dependent variable. ϵt is the error term.

Empirical findings

Main findings

Table 2 offers a comprehensive overview of the robust OLS regression results, focusing on the dynamics surrounding the Bitcoin yield gap. A few significant findings emerge from this analysis.

First and foremost, across all model specifications, the lags of the dependent variable consistently exhibit positive coefficients that are less than one. It demonstrates that the Bitcoin yield gap shows positive autocorrelation and mean-reverting properties, suggesting temporary deviations from its long-term mean.

The log return of Bitcoin and the log change in the USD/COP exchange rate consistently have negative coefficients and are statistically significant. Specifically, a 100 basis points (bp) increase in Bitcoin price decreases the yield gap by 12 bp, and a 100 bp uptick in the exchange rate reduces the gap by 35 bp.

As these results are delved deeper into, they resonate with intuitive economic logic. An appreciation in Bitcoin prices, when denominated in US dollars, effectively narrows the synthetic exchange rate. This, in turn, diminishes the Bitcoin yield gap. Conversely, a surge in the official exchange rate exacerbates the divergence between the synthetic and official rates. This phenomenon subsequently contracts the Bitcoin yield gap.

Regarding the variables of interest—the Bitcoin and FX convenience yields—only the first lag of the FX convenience yield proves to be statistically significant at the 5% level. This coefficient is positive, signifying that an increase in the FX convenience yield amplifies the Bitcoin yield gap. This outcome can be rationalized by recognizing that a heightened convenience yield enhances the attractiveness of holding foreign currency, thereby increasing demand for foreign currency and influencing the Bitcoin yield gap.

The robustness of these coefficients across varying specifications cannot be overstated. This lends further credence to our empirical findings and their implications. Conceptually, the overarching takeaway from this analysis is that the Bitcoin yield gap is predominantly shaped by developments in the FX market rather than intrinsic fluctuations within the Bitcoin market.

Bitcoin network effects

The inconclusive role of the Bitcoin convenience yield in explaining the Bitcoin yield gap led us to explore alternative proxies. Network effects, as described by Cong et al. (2020), suggest that as a network’s productivity rises, the convenience yield diminishes. Arkorful et al. (2023) findings using unique active addresses support this inverse relationship between Bitcoin’s convenience yield and network usage.

In light of these findings, our analysis introduces a dimension related to network usage to the regression model. We calculate four distinct proxies, namely: 1. The number of unique input addresses, representing those broadcasting the transaction and owning the Bitcoins being transferred. 2. The number of unique output addresses, signifying the addresses that receive the Bitcoins. 3. The overall number of transactions. 4. Total input in Bitcoins. 5. Total output in Bitcoins.

It is important to note a subtlety: the total input in Bitcoin is not synonymous with total output. This is because newly minted Bitcoins, rewarded to miners, cause a bifurcation of input into output and fees.

All the aforementioned variables are rendered in a logarithmic form based on their weekly averages. Among these proxies, the weekly averages of unique input addresses and the overall number of transactions emerge as the only statistically significant variables (both at the 10% level) when these are incorporated into the regression along with the lag Bitcoin yield gap and control variables. Their coefficients, detailed in Table A.1 in the Appendix, are negative, so an uptick in network activity is associated with a decline in the Bitcoin yield gap.

In our investigation of the potential impacts of network activity on the Bitcoin yield gap, we introduced a variable to account for network activity—specifically, the unique input address. The results of this extended regression are presented in Table 3. A primary observation is the consistent and statistically significant negative relationship between network activity and the Bitcoin yield gap across all model specifications. Specifically, for every 1% increase in network activity, the Bitcoin yield gap declines by ~2.5 basis points. This relationship remains remarkably stable in magnitude throughout the different specifications, underscoring its robustness.

Additionally, when comparing these results to our baseline specification, the coefficients for all other variables demonstrate a persistent behavior, reaffirming their stability. The FX convenience yield retains its explanatory power over the Bitcoin yield gap, emphasizing its consistent relevance. It’s worth noting that results obtained using the number of transactions as a proxy for network activity instead of unique input addresses, yielded similar outcomes and can be provided upon request.

This augmented specification, therefore, elucidates that both the network activity within the Bitcoin market and the variables related to foreign exchange play pivotal roles in explaining variations in the Bitcoin yield gap. In essence, the incorporation of our network activity proxy strengthens our understanding and reinforces the robustness of our findings.

Our empirical analysis confirms that the FX convenience yield is a significant determinant of the Bitcoin yield gap in Colombia. The robust regression results consistently show a positive relationship between the FX convenience yield and the Bitcoin yield gap. This finding underscores the dominance of traditional FX market dynamics in shaping the Bitcoin yield gap, which has important implications for regulatory and strategic decision-making.

Despite the significant findings, this study has limitations. First, the analysis focuses solely on the Colombian market, which may limit the applicability of the results to other contexts. Second, the study uses a specific timeframe, and the results may vary with different periods. Finally, while robust regression methods were employed to mitigate biases, potential unobserved factors could still influence the Bitcoin yield gap. Future research should explore these aspects to provide a more comprehensive understanding.

Conclusions

In this study, we introduced the concept of the Bitcoin yield gap, a novel metric for financial analysis in developing economies. Our findings reveal that this gap is negative, contrasting with prevailing literature that suggests Bitcoin usually trades at a premium in developing economies.

Our empirical estimations provide a clearer understanding of the forces shaping this phenomenon. The FX convenience yield consistently and strongly influences the Bitcoin yield gap, highlighting the interconnectedness of traditional foreign exchange markets with the evolving digital currency landscape. The relationship between Bitcoin network activity and the yield gap suggests that dynamics within the Bitcoin ecosystem impact its valuation in local economies, warranting nuanced interpretation for policymakers and stakeholders.

The effects from foreign exchange markets manifest with greater statistical significance and magnitude compared to those from the Bitcoin market, emphasizing the dominant force of traditional market mechanisms in shaping the Bitcoin yield gap.

The study’s findings have significant implications for various stakeholders. Policymakers need to recognize the influence of foreign exchange markets on the cryptocurrency landscape to formulate regulations that mitigate systemic risks and enhance market efficiency. Financial practitioners can use the Bitcoin yield gap as an indicator for market anomalies, aiding in better risk management and strategic planning. Researchers are encouraged to explore the interplay between traditional and digital financial markets, particularly in developing economies, to build on these foundational insights. These implications highlight the broader relevance and practical applications of our research, contributing to a deeper understanding of the financial ecosystem.

Future research could investigate other Colombian markets where investors obtain US dollars, such as the black market. Investigating the FX convenience yields in these alternative markets could offer insights into its influence across various financial platforms. Such explorations would be invaluable in expanding our understanding of the interplay between traditional and digital financial ecosystems in developing economies.

Data availability

The data supporting the findings of this study are derived from both public and proprietary sources. Some data, such as financial data obtained from Bloomberg, cannot be publicly shared due to licensing restrictions. Calculations based on the data and any derived datasets generated during the study have been deposited at https://doi.org/10.7910/DVN/BEX7I3. Regarding public data, the Bitcoin price in Colombian pesos was directly downloaded using Buda’s open API: https://shorturl.at/o1PeL. Data on Bitcoin network usage were obtained from the Google BigQuery Bitcoin Public Dataset. The one-month IBR rates were sourced from the Colombian central bank at banrep.gov.co.

Notes

Carta circular 29 de 2014.

Carta circular 52 de 2017.

Circular externa 016 de 2021.

Oficio GG2105, September 2016.

Concept 20435, 2017.

Resolucion 314 de 2021.

Circular Reglamentaria Externa DODM 139 from 2016.

\({\hat{s}}_{0}=\ln ({S}_{0}+{C}_{0})\). This cost is a one-time fee incurred during the transaction.

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

The most negative value found by Du et al. (2018) was—0.6% for the Danish krone.

References

Alam MS, Amendola A, Candila V, Jabarabadi SD (2024) Is monetary policy a driver of cryptocurrencies? Evidence from a structural break Garch-Midas approach. Econometrics 12(1):2

Arkorful GB, Chen H, Gu M, Liu X (2023) What can we learn from the convenience yield of bitcoin? Evidence from the covid-19 crisis. Int Rev Econ Financ 88:141–153

Baba N, Packer F, Nagano T (2008) The spillover of money market turbulence to FX swap and cross-currency swap markets. BIS Q Rev 73–86. https://www.bis.org/publ/qtrpdf/r_qt0803.htm

Castellanos D, Lizarazo AM, Castro A (2011) Las implicaciones de los límites a las posiciones en moneda extranjera. Sem Econ 792:1–13

Coffey N, Hrung WB, Sarkar A (2009) Capital constraints, counterparty risk, and deviations from covered interest rate parity. Federal Reserve Bank of New York Staff Report no. 393

Cong LW, Li Y, Wang N (2020) Tokenomics: dynamic adoption and valuation. Rev Financ Stud 34(3):1105–1155

Crépellière T, Pelster M, Zeisberger S (2023) Arbitrage in the market for cryptocurrencies. J Financ Mark 64:100817

Daian P, Goldfeder S, Kell T, Li Y, Zhao X, Bentov I et al. (2019) Flash Boys 2.0: frontrunning, transaction reordering, and consensus instability in decentralized exchanges. Preprint at arXiv:1904.05234

Divakaruni A, Zimmerman P (2023) The lightning network: turning bitcoin into money. Financ Res Lett 52:103480

Du W, Tepper A, Verdelhan A (2018) Deviations from covered interest rate parity. J Financ 73(3):915–957

Fang F, Ventre C, Basios M, Kanthan L, Li L, Martinez-Regoband D et al. (2022) Cryptocurrency trading: a comprehensive survey. Financ Innov 8:13

Ivashina V, Scharfstein DS, Stein JC (2015) Dollar funding and the lending behavior of global banks. Q J Econ 130(3):1241–1282

Jiang Z, Krishnamurthy A, Lustig H (2021) Foreign safe asset demand and the dollar exchange rate. J Financ 76(3):1049–1089

Liu Y, Tsyvinski A (2020) Risks and returns of cryptocurrency. Rev Financ Stud 34(6):2689–2727

Makarov I, Schoar A (2020) Trading and arbitrage in cryptocurrency markets. J Financ Econ 135(2):293–319

McLannahan B (2015) MtGoxMtGox ‘lost coins’ long before collapse. Financial Times. Retrieved from https://www.ft.com/search?q=MtGox+lost+coins+long+before+collapse

Nakagawa K, Sakemoto R (2022) Macro factors in the returns on cryptocurrencies. Appl Finance Lett 11:146–158

Nakamoto S (2009) Bitcoin: A peer-to-peer electronic cash system. Retrieved from https://bitcoin.org/bitcoin.pdf

Saleem MN, Doumenis Y, Katsikas E, Izadi J, Koufopoulos D (2024) Decrypting cryptocurrencies: an exploration of the impact on financial stability. J Risk Financ Manag 17(5):186

Shynkevich A (2021) Bitcoin arbitrage. Financ Res Lett 40:101698

Tuckman B, Porfilio P (2003) Interest rate parity, money market basis swaps, and cross-currency basis swaps. Lehman Brothers Fixed Income Liquid Markets Research

Acknowledgements

Use of artificial intelligence: During the preparation of this work, the authors used ChatGPT in order to review spelling and grammar. After using this tool/service, the authors reviewed and edited the content as needed and take full responsibility for the content of the publication.

Author information

Authors and Affiliations

Contributions

The sole author was responsible for all aspects of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The author declares no competing interests.

Ethical approval

Was not required as this article does not contain any studies with human participants performed by any of the authors.

Informed consent

Was not required as this article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Rendón, J.A. The Bitcoin yield gap in Colombia: unraveling the influence of FX and Bitcoin convenience yields. Humanit Soc Sci Commun 11, 1675 (2024). https://doi.org/10.1057/s41599-024-03872-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-03872-y