‘Fight isn’t over,’ despite SEC closing Ethereum 2.0 probe – Exec

- SEC concluded its 14-month Ethereum 2.0 probe without charging Consensys

- Consensys asserts that the fight continues, with two more SEC probes being contested

The long-standing legal battle between the United States Securities and Exchange Commission (SEC) and Consensys, the firm behind the MetaMask wallet, appears to have finally come to an end.

For nearly 14 months, the SEC had been investigating Ethereum [ETH] 2.0 and Consensys.

For context, Ethereum 2.0 refers to the post-Merge era when the network transitioned from Proof of Work (PoW) to Proof of Stake (PoS). However, according to Consensys, the battle is far from over.

Impact of SEC ending the investigation into ETH 2.0

This development has sent ripples through the entire crypto community, raising the crucial question – What impact will this have on the broader industry?

Commenting on the issue, Laura Brookover, Head of Litigation & Investigations at Consensys, told CNBC,

“Well, we were very pleased, to receive the letter noting that the investigation into Ethereum 2.0 has been concluded, and that it was concluded without charges against Consensys.”

She added,

“It’s the right result, it’s the result that should have happened, a year ago. But of course, the fight isn’t over yet.”

Brookover also emphasized that the Ethereum investigation is just one of three separate probes that Consensys is currently challenging in its lawsuit in Texas.

She pointed out that these investigations are a significant part of the legal action they have undertaken to protect their operations and the broader Ethereum ecosystem.

The story so far…

This all started way back in 2018 when the SEC alluded that Ether was not a security. However, in 2023, the SEC quietly changed its position, asserting authority over Ether as a security and launching an investigation into Ethereum.

This prompted Consensys to file a lawsuit against the SEC on 25 April 2024, with an aim to protect the Ethereum ecosystem. The plaintiffs sought a court order to halt the investigation, arguing that Ether is a commodity and thus outside the SEC’s jurisdiction.

This legal action spurred significant concern from policymakers, including members of Congress and the general public about the SEC’s investigation into Ethereum 2.0.

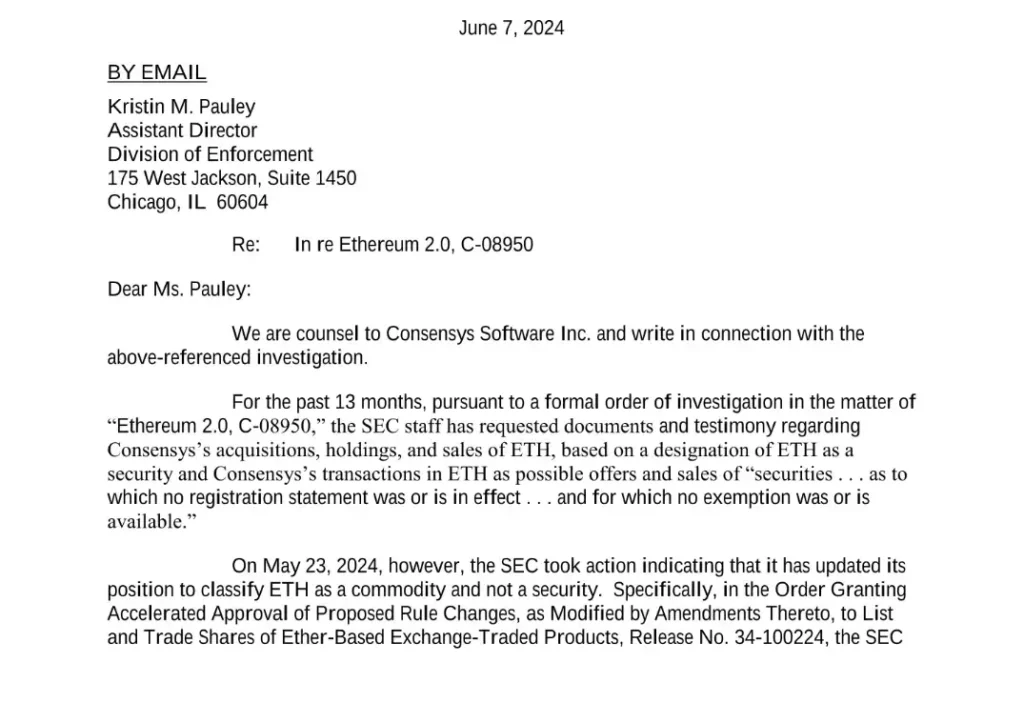

In fact, on 7 June, Consensys sent a letter to the SEC asking for confirmation that May’s ETH ETF approvals, which classified Ether as a commodity, would end the Ethereum 2.0 investigation.

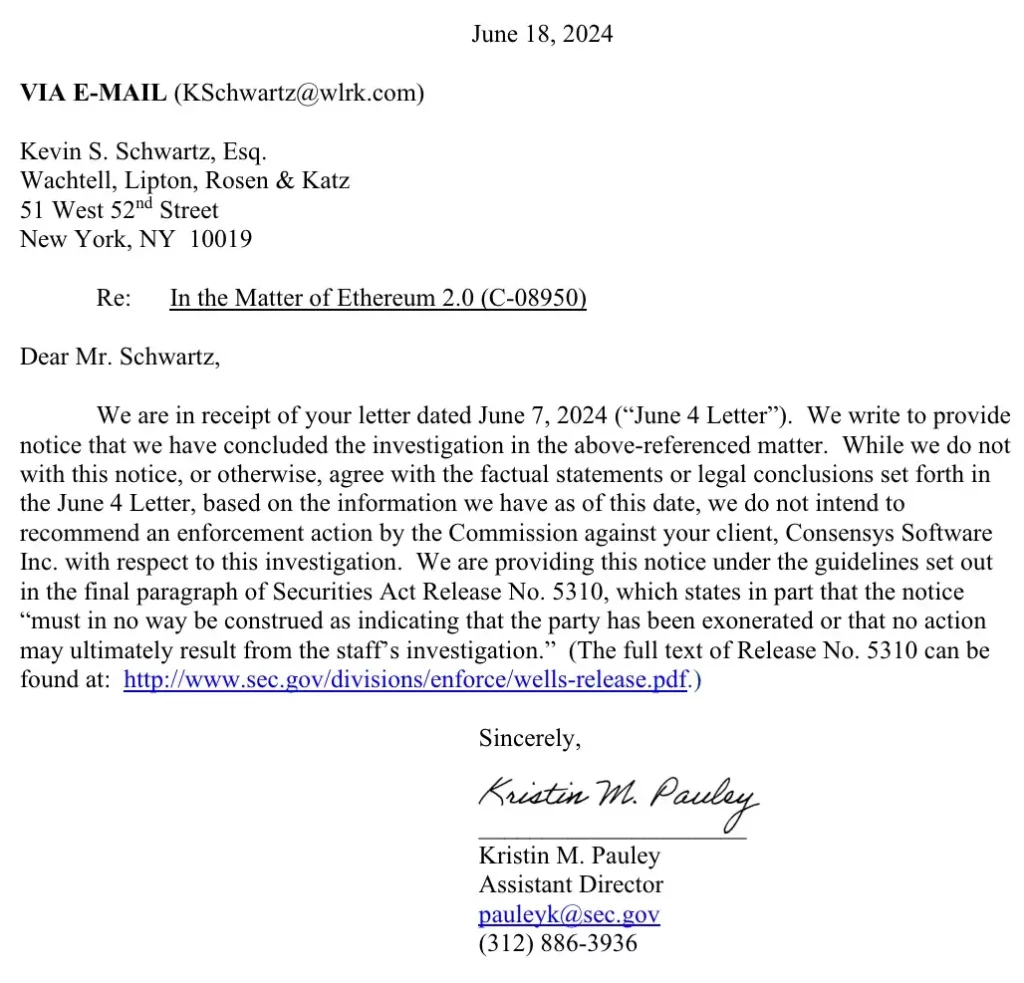

Responding to the same, the SEC in an 18 June letter claimed,

“We do not intend to recommend an enforcement action by the Commission against your client, Consensys Software Inc., with respect to this investigation.”

The fight isn’t over yet

Despite the SEC’s decision to close the investigation, however, the letter lacks the transparency the industry needs. It fails to explain why the SEC closed the investigation and how this decision impacts other ongoing investigations and enforcement actions.

This leaves many questions unanswered and underscores the need for clearer regulatory guidelines in the rapidly evolving cryptocurrency landscape. Expanding on the same, Brookover concluded,

“Until we get defended of answers and a judicial ruling that we have not isolated the security lawsuit we’re gonna keep fighting.”