Blockchain analytics firm Santiment has identified significant changes in the asset holdings of Bitcoin (BTC)  $96,106 and Ethereum (ETH)

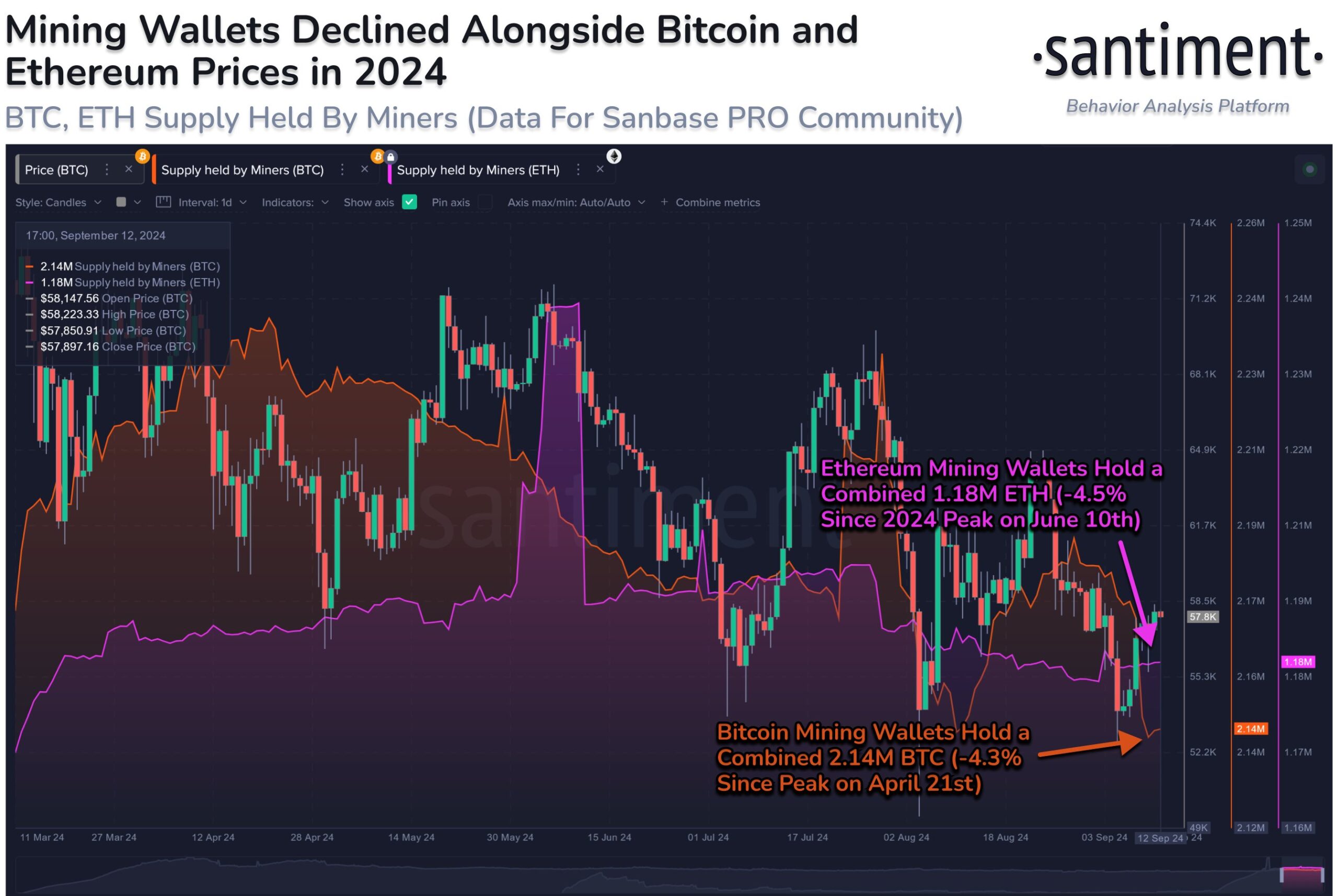

$96,106 and Ethereum (ETH)  $2,752 mining wallets, suggesting a potential upward trend. Since the beginning of this year, the supply held by mining wallets has consistently decreased. However, alongside a recent slight recovery in cryptocurrency prices, Santiment indicates that miners might be preparing for an increase in their collective assets. The firm views this development as a “strong signal” that a new bull run may be on the horizon.

$2,752 mining wallets, suggesting a potential upward trend. Since the beginning of this year, the supply held by mining wallets has consistently decreased. However, alongside a recent slight recovery in cryptocurrency prices, Santiment indicates that miners might be preparing for an increase in their collective assets. The firm views this development as a “strong signal” that a new bull run may be on the horizon.

Miners Send “Confidence” Signals Again

The decline in the supply within miners’ wallets since the start of 2024 has raised concerns among investors and market analysts. Miners typically retain a portion of the coins they mine, and a reduction in this amount can indicate increased selling pressure or a lack of confidence in future price increases. Santiment’s latest findings suggest a reversal of this trend, signaling a renewed optimism among these groups closely aligned with Blockchain networks.

Santiment stated, “Historically, miners’ accumulation is linked to upcoming price increases,” adding that “miners preferring to hold rather than sell their assets reflects confidence in the market’s upward potential and reduces sudden selling pressure.”

Recent Price Rally Reignites Discussions

The cryptocurrency market has experienced significant volatility in recent months due to regulatory uncertainties and macroeconomic factors affecting price fluctuations. However, the recent price rise of Bitcoin and Ethereum has rekindled discussions about market cycles and catalysts for the next significant rally. Miners’ behaviors are often seen as a leading indicator due to their integral roles in the ecosystem.

Industry experts have expressed cautious optimism regarding Santiment’s report. Blockchain analyst James Carter noted that while the increase in miners’ assets could signal a bull market, other factors such as institutional adoption, regulatory developments, and overall market sentiment should also be considered.

Currently, the overall outlook shows signs of maturity for the market. Institutional interest in cryptocurrencies continues to grow as major financial firms explore Blockchain technologies and offer various crypto services. Additionally, ongoing upgrades to Ethereum may attract more users and investors by aiming to improve scalability and efficiency.

However, potential hurdles remain. Regulatory bodies worldwide are still contemplating how to oversee the rapidly evolving cryptocurrency market. Any adverse regulations could dampen market enthusiasm. Furthermore, global economic uncertainties, including inflation, recession fears, and geopolitical tensions, continue to influence investor behavior across all asset classes, including cryptocurrencies.

Türkçe

Türkçe Español

Español