- Worldcoin announced the extension of WLD token unlocks for team members and investors from three to five years.

- Investors raised concerns about the rising supply of WLD, speculating a possible price manipulation.

- WLD is up more than 36% following the announcement.

Worldcoin (WLD) is up over 36% on Tuesday, following the Worldcoin Foundation's announcement that the lock-up schedule for WLD tokens has been extended from three to five years. This follows concerns from investors over the large amount of WLD supply that has been entering circulation in the past few months.

WLD soars as Worldcoin extends token unlock schedule

Decentralized identity protocol Worldcoin announced in a blog post today that the token lock-up period for early Tools for Humanity contributors and investors has been extended from three to five years.

Tools For Humanity (TFH) is the software company that helped develop the Worldcoin project before transferring its ownership to the Worldcoin Foundation. However, the company still helps develop and operate the World App. As a result, the team behind TFH was actively allocated locked WLD tokens for their efforts.

Before the announcement earlier today, the WLD unlock schedule was set for three years, with approximately 3.3 million tokens entering circulation daily. However, following the schedule change, only 2 million tokens will be unlocked daily for five years.

Interestingly, Worldcoin holds the highest unlock value of its token this month, with roughly 53% of its supply worth over $600 million being released into circulation, according to data from Token Unlocks.

July Token Unlocks

Meanwhile, early investors in the Worldcoin project have reacted to the sudden change in the previous schedule, claiming that the plan alteration will affect their investment strategies. Investors had also previously criticized Worldcoin due to its heavy unlocks in the past months.

Other investors, on the other hand, suggested it may be a plot to manipulate the token's price, as it quickly rallied after the announcement.

WLD token is up over 36% in the past 24 hours and may continue the rally with bullish sentiment prevailing in the wider market. The rise may be due to renewed investor confidence, as fewer unlocks signify a lower downside impact on prices.

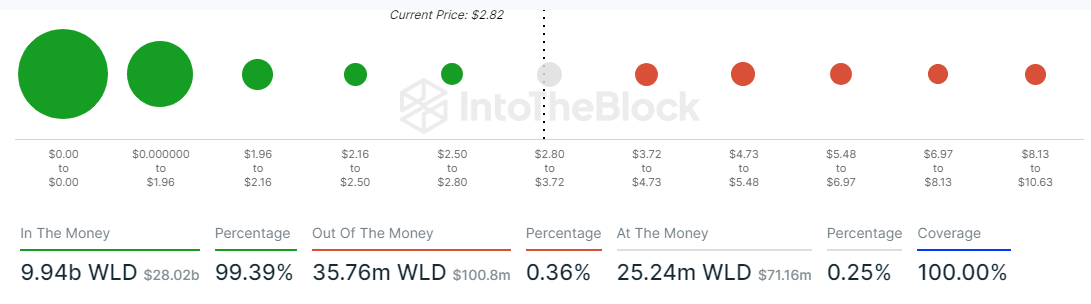

Investors must also exercise caution as a price correction often follows periods of heightened investors’ confidence. With over 99% of WLD tokens in profit, it won’t be a shock if a few investors sell off their tokens to book profits.

WLD Global In/Out of the Money

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin consolidates ahead of MicroStrategy Q1 earnings, strategic Bitcoin reserve deadline

Bitcoin price is extending its consolidation streak, trading around $95,000 on Wednesday, as traders await a decisive breakout. MicroStrategy’s Q1 earnings release and the approaching deadline for the Strategic Bitcoin Reserve have the potential to move BTC price.

Chainlink price offers mixed signals as supply outside of exchanges soars but network activity declines

Chainlink's supply outside exchanges has surged to 803.38 million from 778.87 million in under two months. LINK network activity declines, with new and active addresses falling from a recent peak.

Ripple Price Prediction: XRP price uptrend toward $3 looks steady

Ripple (XRP) price hovers at $2.24 at the time of writing on Wednesday as bulls try to prevent the pullback from its April peak of $2.36 from extending further. If XRP holds above the immediate support at $2.21, a reversal could soon ensue.

THORChain announces integration of XRP stagenet ahead of the mainnet network launch

THORChain announced on Tuesday that its stagenet development of its Ripple (XRP) integration is nearing the final step, with mainnet activation imminent. This integration enhances THORChain’s economic model by increasing swap activity and protocol fees.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.