Highlights

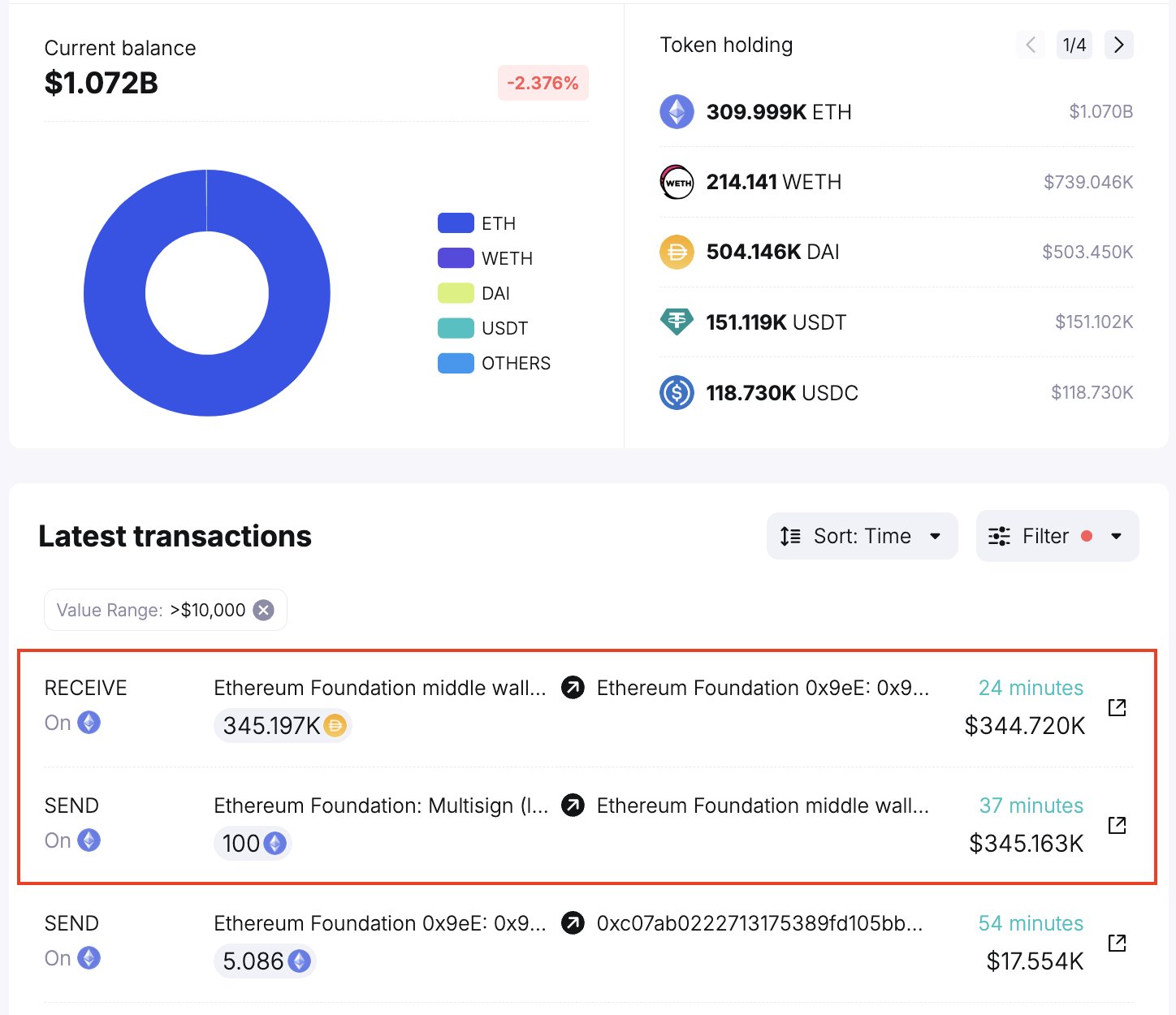

- Ethereum Foundation sold 100 ETH for 345,179 DAI.

- Ethereum Foundation offloading Ethereum ahead spot Ethereum ETF launch raises skepticism.

- ETH price trades higher at $3,505.

Ethereum Foundation has just sold 100 ETH, according to a transaction on Tuesday. The move raises eyebrows in the crypto community as the foundation sold the crypto asset just before the spot Ethereum ETF listing and trading today. Traders didn’t respond immediately to the selloff by the foundation.

Ethereum Foundation Wallets Offloading ETH

It’s a huge week for Ethereum and ETH with the spot Ether ETFs set to go live today. However, Ethereum Foundation-linked wallets are selling the crypto asset ahead of ETF launch.

In a significant development on July 23, Ethereum Foundation sold 100 ETH for 345,179 DAI. Notably, the transaction came just before the start of spot Ethereum ETFs trading today. Traders look out for further cues as institutions continue to send ETH to crypto exchanges or other wallets.

As per on-chain data platform Spot On Chain, Ethereum Foundation has sold 2,366 ETH for 6.9 million DAI stablecoin this year. The last Ether selloff by the foundation was noted on July 2. Investors panicked due to offloading by foundation-linked wallets, but overall sentiment remain positive.

In addition, the wallet address “0xdb3” linked to Ethereum Foundation or Ether ICO moved 3,200 ETH worth $11.2 million to Kraken. Grayscale also transferred $1 billion in Ethereum to Coinbase ahead spot Ethereum ETF debut.

Also Read: OKX To Delist XRP, SHIB, ADA, & 27 Crypto In BTC and ETH Pairs

US SEC Issues Effectiveness Notice For Ether ETFs

U.S. SEC has issued the S-1 application effectiveness notice for all spot Ethereum ETFs. Issuers including BlackRock’s iShares, Fidelity, Franklin Templeton, Bitwise, VanEck, 21Shares, Invesco Galaxy, and Grayscale are set to start trading today.

Grayscale Ethereum Trust (ETHE) and BlackRock ETF (ETHA) are witness massive trading activity in pre-market hours, as per Yahoo Finance.

ETH price jumped 0.50% in the past 24 hours, with the price currently trading at $3,505. The 24-hour low and high are $3,425.80 and $3,539.53, respectively. Furthermore, the trading volume has increased by 40% in the last 24 hours, indicating a rise in interest among traders.

Futures trading also records buying, with a 4% increase in ETH futures open interest in the lat 24 hours. The total Ethereum OI rises to $15.33 billion, as per CoinGlass.

Also Read: Terra Sets Preliminary Date For LUNA, LUNC, USTC Recovery

- Can Sweden Include Bitcoin Into Foreign Exchange Reserve?

- Pepe Coin Whales Offload Over 1 Trillion PEPE

- Binance To Delist These 7 Crypto Pairs Amid Market Turmoil, Are Prices At Risk?

- Shiba Inu Burn Rate Shoots Up 1500%, Can SHIB Price Recover After Bloodbath?

- Why Bitcoin Price Crashed Under $75,000 Today?

- Dogecoin Price Unlikely to Rebound as Transaction Count Plummets 94%

- Is it Realistic to Expect Shiba Inu Price to Revisit ATH?

- XRP Price on the Verge of Big Crash as Ray Dalio Warns of an Economic Collapse

- Pi Network Price Analysis: Growing Utility Drives 1.2M Pi Coin Buys on Banxa

- Solana Price Tumbles as SOL Founder Compares Looming US Bond Market Crisis to MicroStrategy