$581m in Bitcoin left CEXs in 7 days, whales restart accumulation

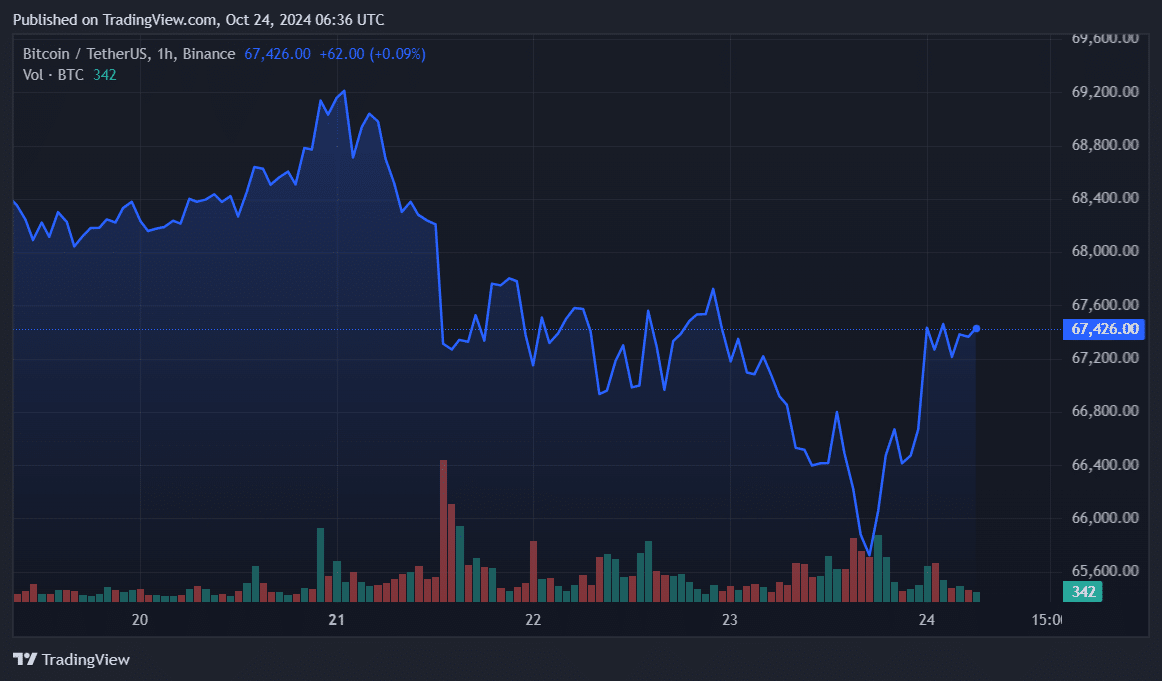

The Bitcoin outflows from centralized exchanges and the rising whale accumulation helped it surpass the $67,000 mark again.

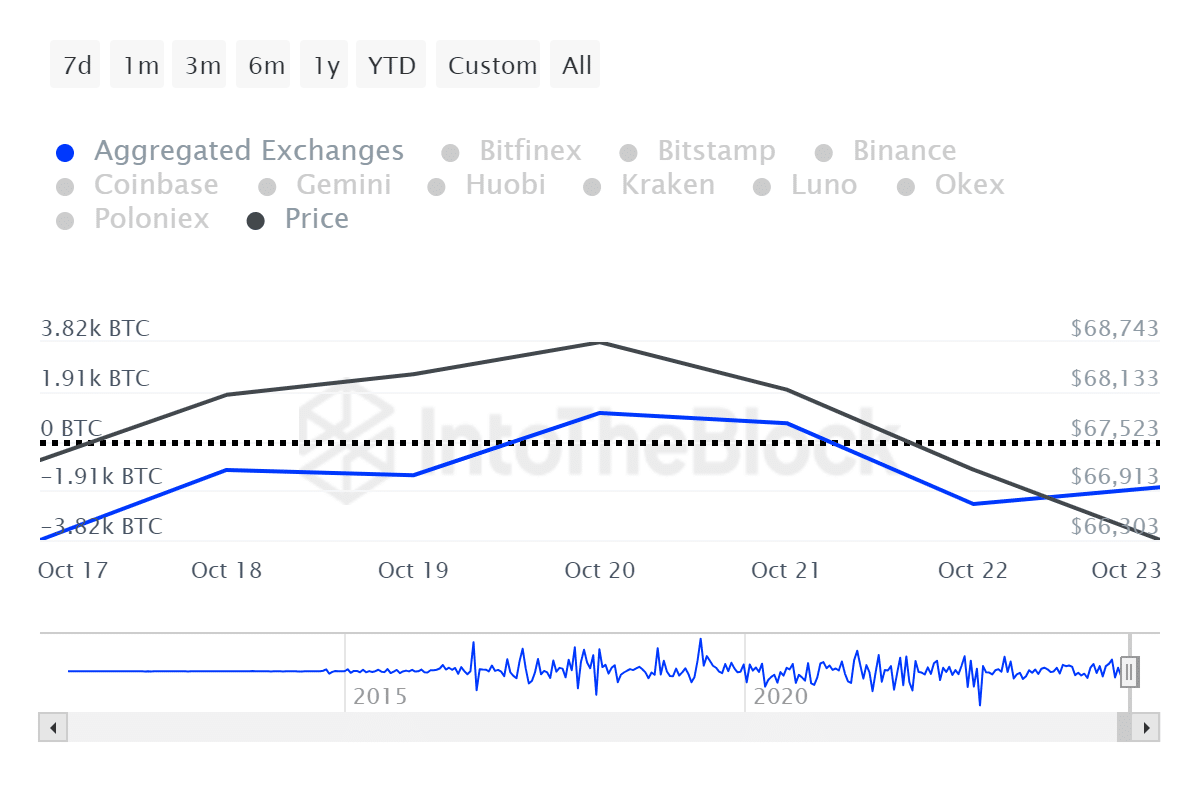

According to data provided by IntoTheBlock, the Bitcoin btc-3.42% Bitcoin exchange net flows witnessed two days of inflows on Oct. 20 and 21, bringing the price down from the local high of $69,400.

On Oct. 22 and 23, this movement shifted back to outflows. Per ITB data, BTC recorded a net outflow of $581 million over the past week. The increased outflows show the accumulation phase.

Whales join the accumulation

Whales also started selling Bitcoin on Oct. 21 as 94% of the holders were in profit. Data shows that the selloff among large holders is also fading away.

Bitcoin whale addresses recorded a net inflow of 165.5 BTC, worth $11.15 million, yesterday.

Notably, the total amount of Bitcoin whale transactions, consisting of at least $100,000 worth of BTC, surpassed the $100 billion mark over the past week.

High whale activity and accumulation could trigger a market-wide FOMO.

Bitcoin is up 0.3% in the past 24 hours and is trading at $67,350 at the time of writing. The asset’s market cap is sitting at $1.33 trillion with an 18% rise in its daily trading volume, reaching $35 billion.

Another bullish catalyst on Wednesday was the increased spot BTC exchange-traded funds’ inflows in the U.S. According to a crypto.news report, these investment products saw a net inflow of $192.4 million on Oct. 23, led by BlackRock’s iShares Bitcoin Trust ETF.