- The crypto market cap jumped above $3.5 trillion on Tuesday, following a weak headline CPI of 2.3% in April.

- Bitcoin's 10-week lag of the Global M2 money supply indicates its price could soar higher.

- BTC's spot Taker Buy Sell Ratio rose toward 1.02, signaling a strong capital inflow into the spot market.

- Ethereum saw a 9% gain as the altcoin market showed renewed strength alongside Bitcoin.

Bitcoin (BTC) saw a 1.4% uptick on Tuesday — reclaiming $104,000 — and Ethereum (ETH) gained 9% after the US Consumer Price Index (CPI) for April came in at 2.3%, below market expectations of 2.4%. The move was supported by a surge in Bitcoin's spot Taker Buy/Sell Ratio and its ongoing correlation with the Global M2 money supply, indicating strong upward momentum.

Bitcoin shapes up for further gains, altcoins show strong momentum

The total crypto market capitalization hit $3.5 trillion for the first time since February 2, following a lower-than-expected CPI report for April.

The headline CPI came in at 2.3% annually, underperforming market forecasts of 2.4% — its lowest level since February 2021 — and a modest monthly increase of 0.2%. April's unadjusted core CPI annual rate was 2.8%, which aligns with market expectations.

Investors quickly capitalized on the weak inflation data, increasing buying pressure across top cryptocurrencies. Bitcoin reclaimed the $104,000 psychological level, posting a mild 1.4% gain after a brief decline to $101,700.

BTC's rise is also attributed to President Donald Trump's call for the Federal Reserve (Fed) Chair Jerome Powell to cut rates. Trump said he should "just let it all happen, it will be a beautiful thing."

The recent price rise has also seen the number one crypto asset continuing its correlation with the Global M2 money supply, which it has been tracking with a 10-week lag. BTC could rip to a new all-time high if the historical pattern holds.

Likewise, Bitcoin's spot Taker Buy/Sell Ratio across centralized exchanges has surged near the 1.02 level, according to data from CryptoQuant. The indicator, which tracks the ratio of aggressive buy-to-sell orders at market price, last hit such levels at the 2022 bottom near $15,000 and the breakout past $30,000 in late 2023, which were crucial turning points in the market.

Spot BTC Taker Buy Sell Ratio. Source: CryptoQuant

"The pattern is repeating itself now, with the BTC price approaching its all-time high and the indicator coming out of a long phase of selling pressure," noted CryptoQuant analyst Gaah.

Altcoins are also witnessing a rally, led by Ethereum, which is up 9% on the day, stretching its weekly gains toward the 50% mark. The meme coin sector also posted a 4% gain amid broader market strength. Dogecoin (DOGE), PEPE, Shiba Inu (SHIB), and TRUMP led the charge, with gains of 5%, 8%, 4% and 6%, respectively.

The Artificial Intelligence (AI) tokens sector also witnessed a 3% uptick, led by Artificial Superintelligence (FET), Internet Computer (ICP), and RENDER with an 8%, 4.4% and 4% increase, respectively.

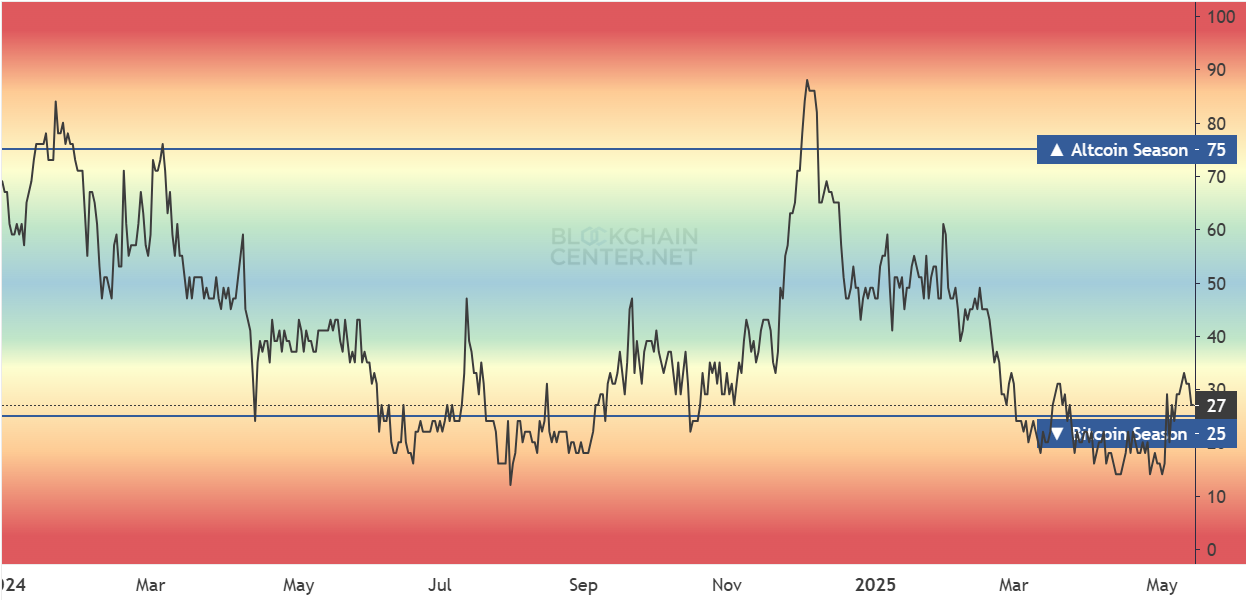

Ethereum's outperformance of Bitcoin in the past week has triggered calls of a potential altcoin season. However, the altcoin season index shows that Bitcoin still maintains a high dominance.

Altcoin Season Index. Source: Blockchain Centre

Meanwhile, short traders saw another day of increased liquidations after the recent rise wiped out $239.02 million in short liquidations. Ethereum short traders were the major casualties, with liquidated positions worth $109.24 million — nearly triple the $37 million wiped from Bitcoin shorts, according to Coinglass data. The largest single liquidation occurred on Binance, where a trader lost $12 million on an ETH/USDT position.

The crypto market's rebound comes in correlation with a rise in the US stock market, where the S&P 500 has erased all of its post-reciprocal tariff losses and is now up 0.31% year-to-date (YTD), per Google Finance data.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

BNB down 5% from peak as Windtree Therapeutics plans $520 million treasury

BNB price is down slightly to trade at $771 on Friday, after correcting from its new record high of $809, reached on Wednesday. The Binance exchange native token is up nearly 20% in July, amid relatively overheated market conditions and institutional adoption.

Crypto Today: Bitcoin declines amid de-risking sentiment, Ethereum and XRP hold key support

Bitcoin sweeps through liquidity around $115,000 level, amid profit-taking and risk-off sentiment. Ethereum rebounds from range low support above $3,500 amid steady ETF inflow.

Ethena eyes 20% gains amid Arthur Hayes 2 million ENA grab, Anchorage Digital deal, new apps

Ethena edges higher by over 20% on Friday as it bounces off a crucial support floor to extend the prevailing bullish run. Arthur Hayes acquires 2.16 million ENA tokens amid Ethena’s partnership with Anchorage Digital to achieve GENIUS Act compliance.

Bitcoin Weekly Forecast: BTC extends correction amid weakening momentum, ETFs outflow

Bitcoin price is slipping below the lower consolidation band at $116,000, a decisive close below to indicate further decline ahead. US-listed spot Bitcoin ETFs show early signs of investor pullback, recording a mild weekly outflow of $58.64 million by Thursday.

Bitcoin: BTC extends correction amid weakening momentum, ETFs outflow

Bitcoin (BTC) is slipping below the lower consolidation band at $116,000, after consolidating for more than ten days. A decisive close below this level would indicate further decline ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.