In the last 24 hours, there have been many significant developments in cryptocurrencies, and the leading cryptocurrency is still below the $58,000 threshold. Although it has moved away from the bottom, the bulls, who have not been able to surpass the $60,000 barrier, are now trying to keep the price above $57,500. Weekends are generally known for low volume and weak price movements. So, what events have occurred in the last 24 hours?

What Happened in Cryptocurrencies?

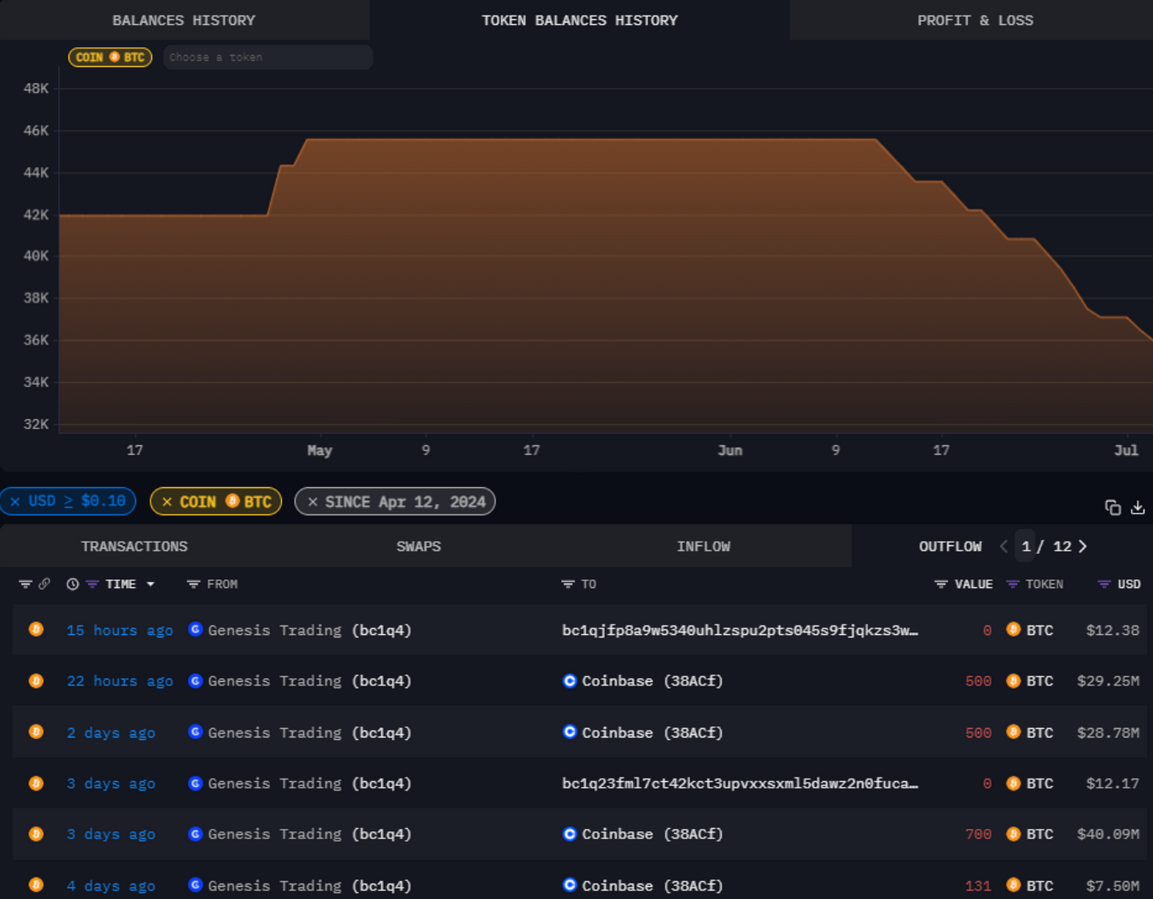

The first major development was the $720 million BTC transfer from the Genesis Trading wallet. Everyone thought the Germany sales were over or about to end, while the uncertainty of the MTGOX refund speed continued, Genesis again fueled negativity. In the last 30 days, the wallet has made massive transfers in parts. After the agreement with the Attorney General, it was requested to pay $2 billion to the victims of the Earn program.

Two months after the acquisition, the funds are being moved to the Coinbase exchange for sale. With $50,000 from Germany, $46,000 from Genesis, and $8.5 billion from MTGOX, a significant surplus has formed in the second half of 2024.

Extreme Fear Dominates

Extreme fear dominates as BTC failed to surpass $60,000 on its second attempt. Justin Bennett, a popular crypto commentator, warned investors that we might see further declines due to the rising wedge in the coming period. In 12 hours, BTC fell to $57,000, and the fear and greed index dropped back to the extreme fear zone. This level might signal a bottom for BTC, which has been seen before major losses.

Bitcoin (BTC) is now lingering 23% below its all-time high.

Ether ETF Predictions

Ahead of the upcoming launch, experts are publishing predictions about the inflows we will see following the ETH ETF listing. Tom Dunleavy, managing partner of crypto investment firm MV Global, predicted in his latest estimate that we could see inflows between $5 billion and $10 billion. He wrote that the real market impact would be felt in the last quarter;

“We saw a $15 billion flow for Bitcoin. For Ethereum, I think we will probably see between $5 billion and $10 billion. I expect a very positive price impact to take us to all-time highs at the beginning of the 4th quarter.”

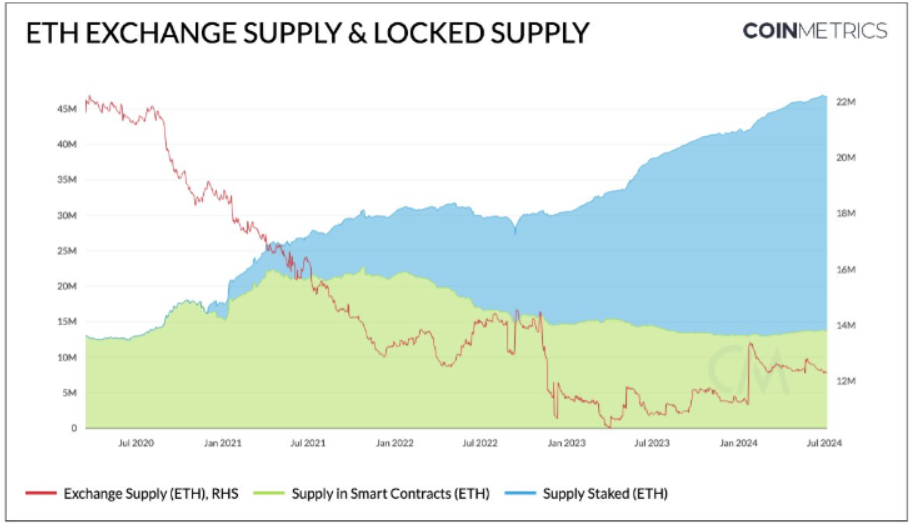

During this process, the supply of ETH on exchanges continues to decrease due to staking. Time will tell how much more it has weakened thanks to the growing issuer reserves with net inflows. Whether the impact of the exits on the ETHE side will be similar to GBTC is something we will live and see.

Türkçe

Türkçe Español

Español