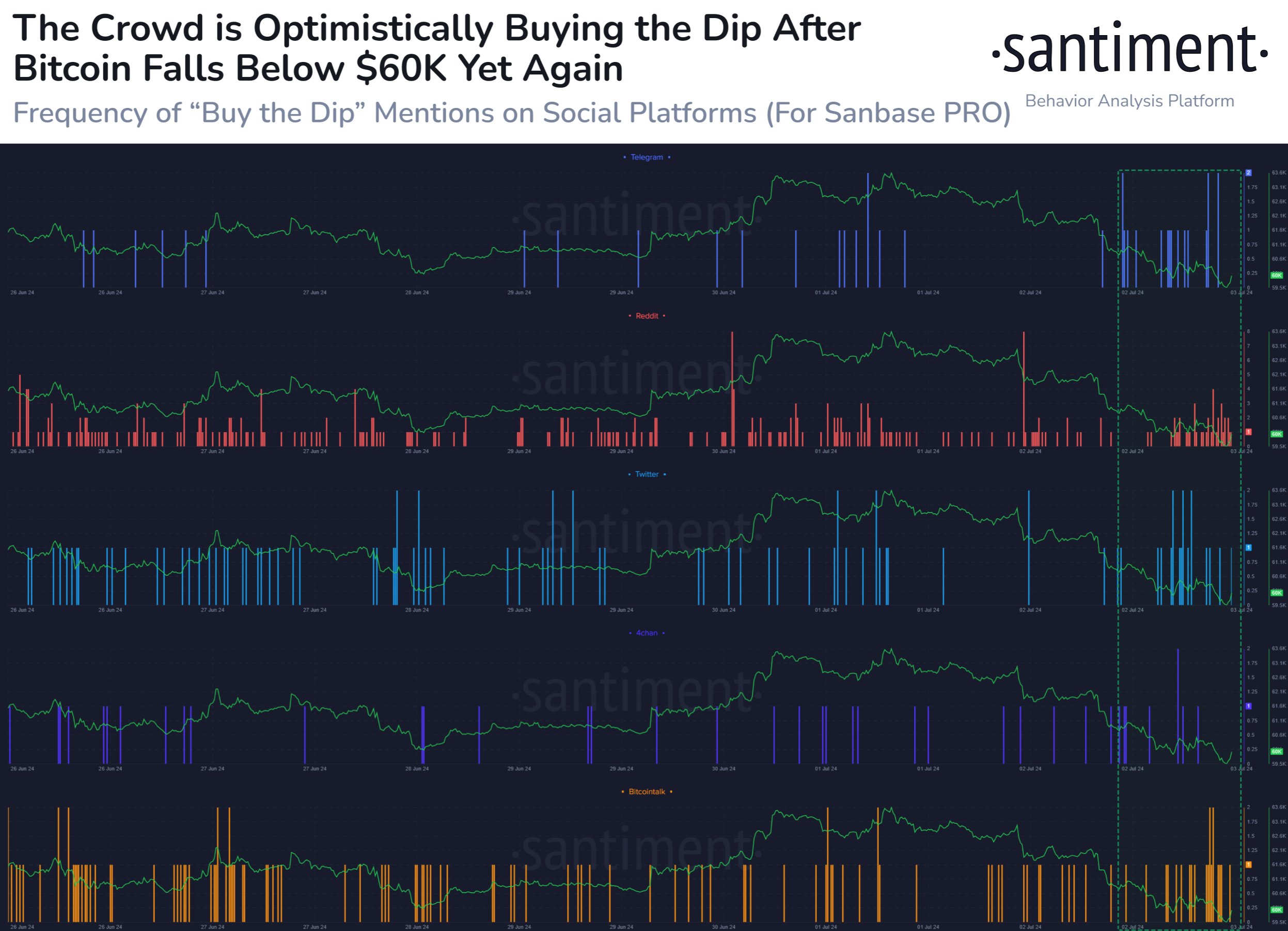

Reddit, X, 4chan, and Bitcoin Talk have seen a doubling of “buy the dip” statements in the past two days as Bitcoin fell below $60,000 for the second time in four months. Blockchain data analysis platform Santiment tracked the total number of times this phrase appeared on the four platforms while discussing which stage of the bull market Bitcoin is currently in for crypto investors.

What’s Happening with Bitcoin?

The Santiment team shared the following statements with their followers on the social media platform X:

“The crowd is showing signs of seeing this as a buy the dip opportunity. Ideally, we would wait for their enthusiasm to subside. It is time to buy when they are impatient and skeptical.”

CoinGecko data shows that Bitcoin was trading at $58,900 with a 4.2% drop in the last 24 hours at the time of writing. This price level is the lowest since May 3. Tom Lee, the founder of the financial research company Fundstrat, stated in an interview with CNBC on July 1 that most of the recent negative sentiment is largely due to Mt. Gox preparing to transfer $9 billion worth of Bitcoin to its creditors at the end of July.

Some are worried that if a significant portion of Mt. Gox’s 127,000 creditors sell their recovered Bitcoins, Bitcoin could drop. Lee is unsure when the bottom will occur but remains committed to his prediction that Bitcoin could reach $150,000 before the end of 2024:

“Mt. Gox has been a major source of concern for many years, but knowing that this will be resolved in July, I think there is a reason to expect a sharp recovery in the second half.”

Notable Details

Farside Investors data indicates that another source of negative sentiment may have come from spot Bitcoin exchange-traded funds, which saw inflows on only six of the last 18 trading days. GCM Investment research director Kudret Ayyldr suggested that alarm bells might be ringing because Bitcoin has not been able to hold above $67,500 since April. In a post to his 19,300 followers on July 3, Ayyldr shared the following statements on the subject:

“This negativity could lead to a correction in the $48,000 – $50,000 dip zone.”

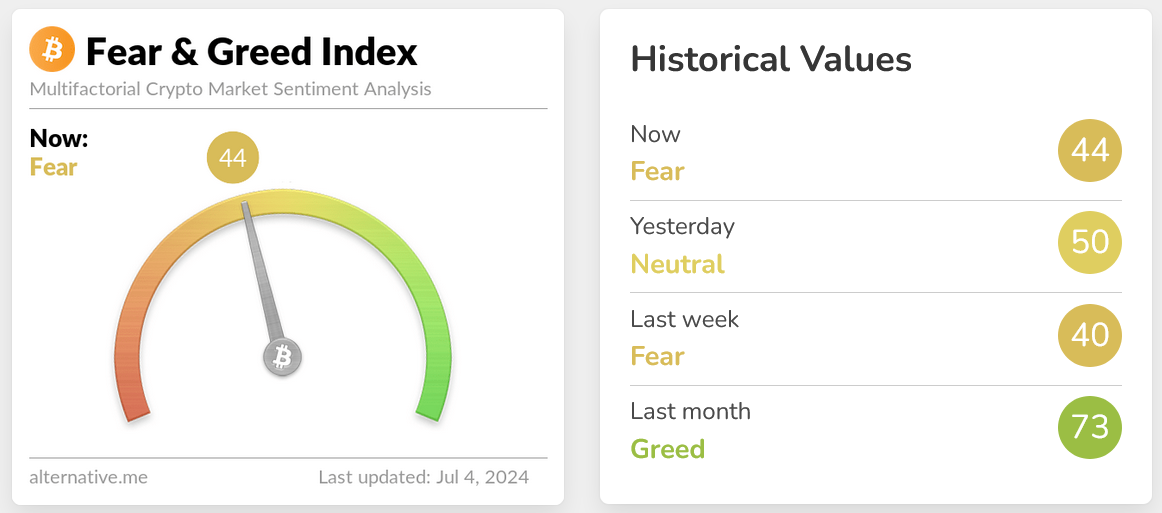

The Crypto Fear and Greed Index, which measures market sentiment towards Bitcoin and the broader cryptocurrency industry, is currently in the fear zone with a score of 44 out of 100. It fell to 31, the lowest level in 18 months, on June 25 and has since fluctuated between 30 and 53.

Türkçe

Türkçe Español

Español