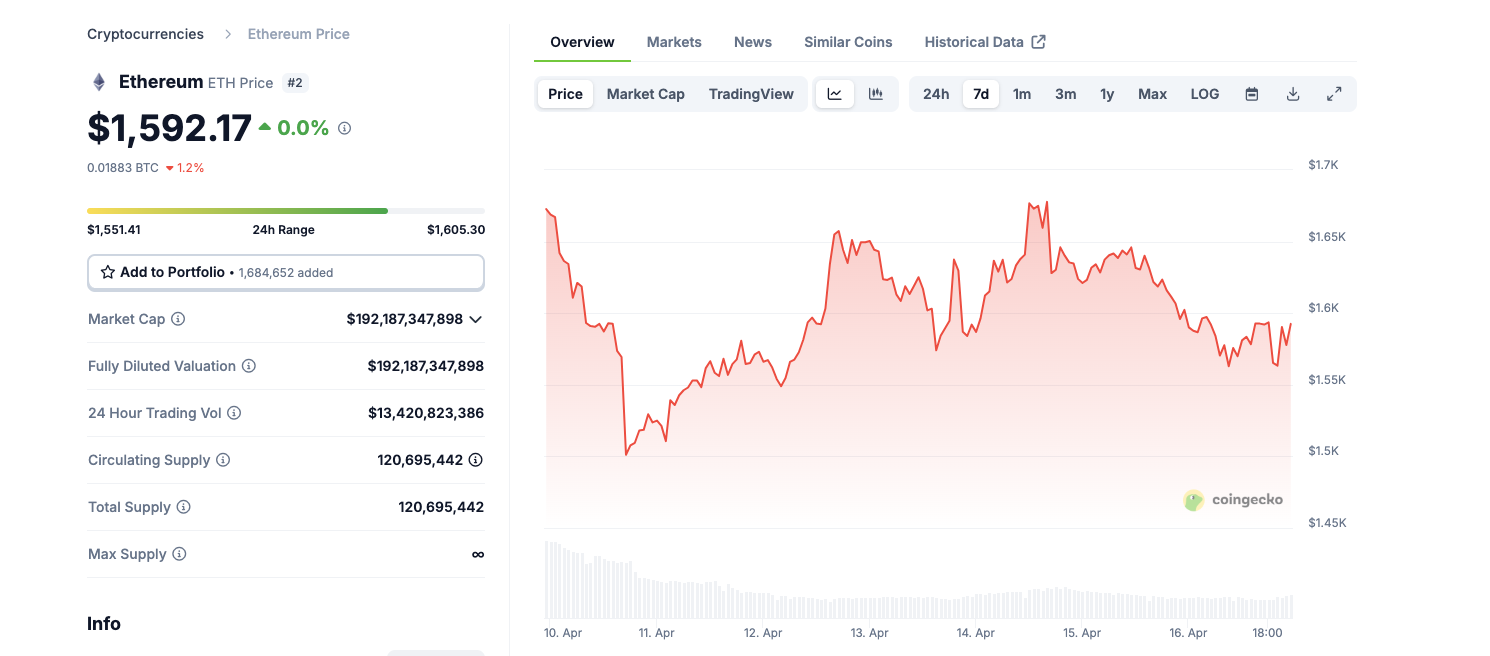

- Ethereum price dips below $1,600, lagging behind BTC and posting the second lowest gains on Wednesday.

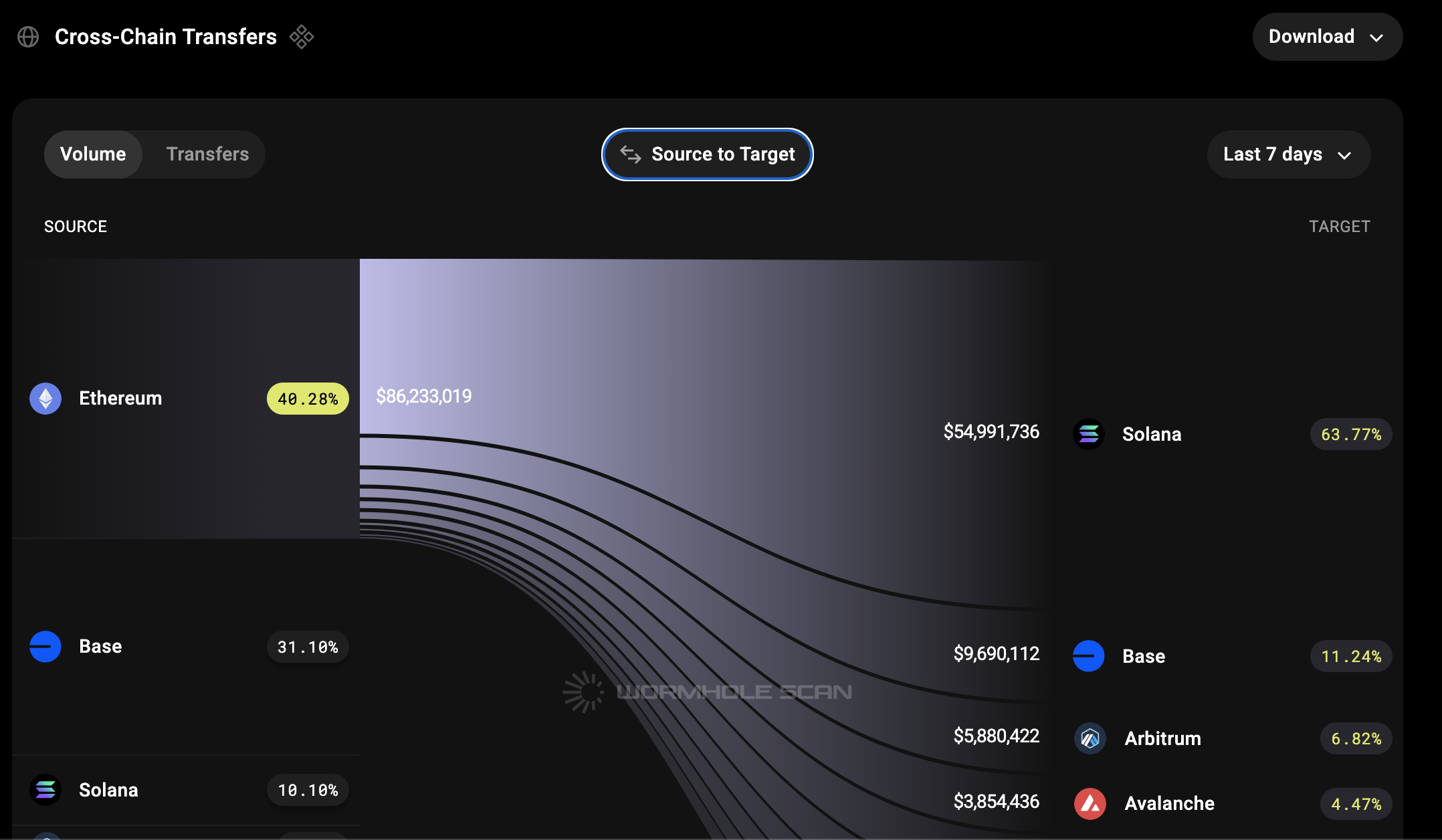

- Investors withdrew over $86 million in assets from Ethereum to Solana, Base, Arbitrum, and Avalanche in the week following Trump’s DeFi law repeal.

- On April 10, Trump’s executive order reversed a Biden-era policy mandating KYC compliance for DeFi protocols.

- Solana captured over 60% of Ethereum outflows in the past week, raising questions over Ethereum's long-term market share.

Ethereum price tumbles below $1,600, a week after Trump repealed the DeFi KYC mandate, as investors react by redirecting capital towards Solana and other rival DeFi networks.

Ethereum performance lags as markets reacts to Trump’s DeFi law repeal

Ethereum’s dominance in decentralized finance (DeFi) is under intense pressure this week, triggering bearish tensions in the ETH spot markets. On Wednesday, Ethereum price languished below the $1,600 level, while BTC flipped to $85,000.

As a sudden NVIDIA sell-off prompted investors to rotate funds from US stock markets towards crypto assets, top altcoins like Bitcoin Cash and Litecoin also saw mild gains.

Ethereum price performance

However, on-chain data shows that Ethereum’s persistent underperformance could be linked to swings in capital flows with the global DeFi sector.

On April 10, Trump signed an executive order nullifying a Biden-era policy that required DeFi protocols to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

The reversal has been hailed as a win for crypto-native platforms and open financial infrastructure—but for Ethereum, the aftermath has been decisively negative.

Just one week after the former U.S. President Donald Trump repealed the law, investors have persistently shifted assets out from Ethereum into other rival networks.

Solana captures 60% of outflows as investors withdraw $86M from Ethereum

According to data from Wormhole, Ethereum’s largest cross-chain bridge, Solana absorbed the lion’s share of the outflows, drawing over $54 million—roughly 62% of the total. Base, Arbitrum, and Avalanche followed with $9.6 million, $5.8 million, and $3.9 million in inflows respectively.

Ethereum Cross Chain transaction flows | Source: Wormhole Bridge

Most Solana-bound assets were funneled into high-velocity DeFi protocols like Jupiter, Kamino, and MarginFi, which have seen surging volumes amid Solana’s improved scalability and lower fees.

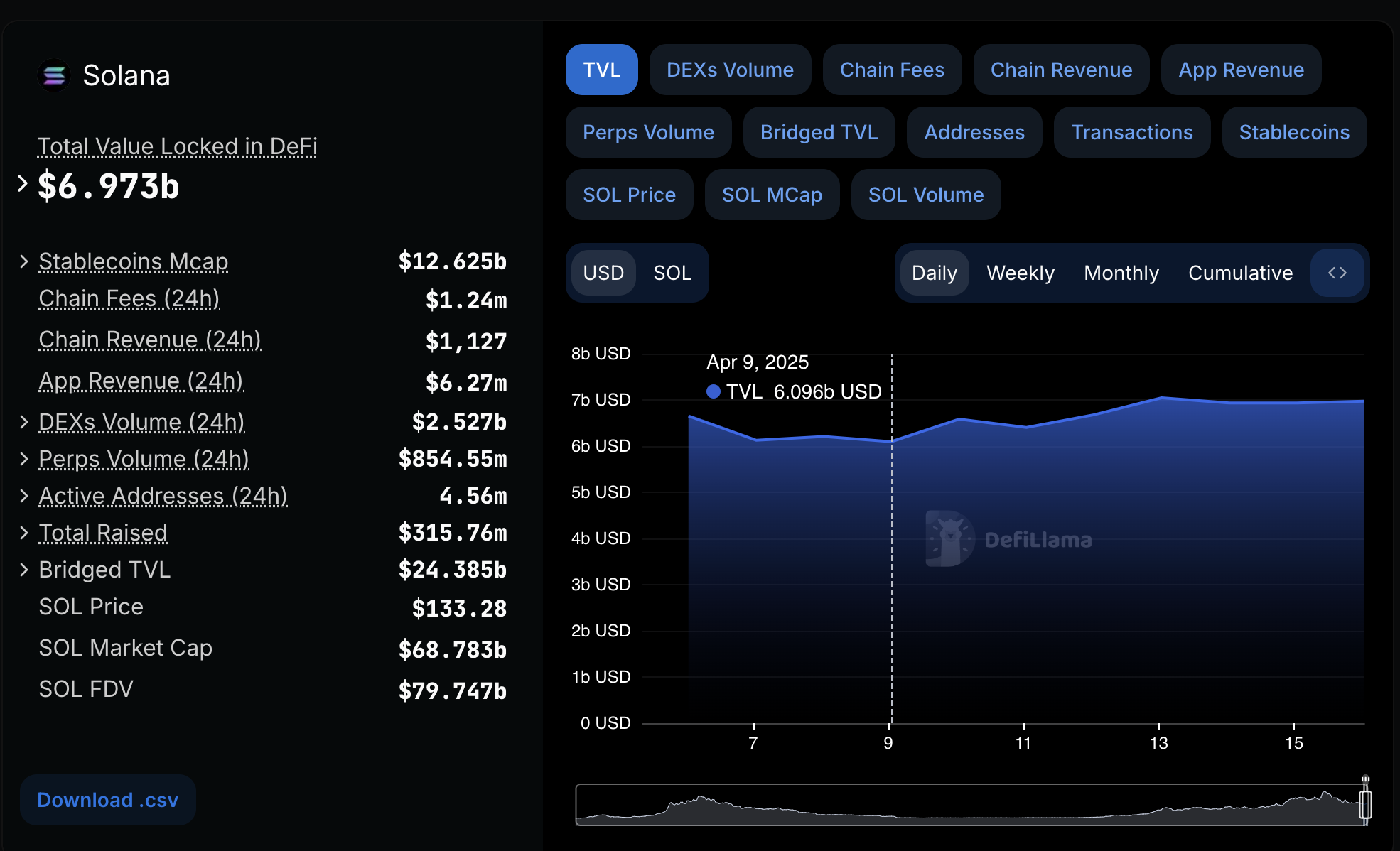

Solana DeFi Total Value Locked, April 16 2025 | Source: DeFillama

The move sparked a strong market response. Solana’s total value locked (TVL) surged 12% over the past week, climbing from $6.1 billion on April 9 to $6.9 billion as of April 16, according to DeFiLlama.

More than $800 million in fresh capital was deployed across Solana-based protocols during that period.

Solana’s native token SOL also rallied, gaining 21% in the past week to trade at $135. In comparison, Ethereum’s price rose just 8%, underperforming nine of the top 10 cryptocurrencies by market capitalization.

Ethereum's long-term market share at risk

The sharp capital rotation suggests that Ethereum’s long-standing lead in DeFi could be eroding as developers and users seek faster, lower-cost environments.

While Ethereum still leads in total value locked—with over $80 billion—it is increasingly being challenged on performance metrics and user experience.

The DeFi migration trend appears to be part of a broader shift. Institutional investors pursuing real-world asset tokenization and onchain securities issuance are increasingly exploring alternatives like Avalanche and Hedera, which offer native compliance tooling and low fees.

Meanwhile, Solana and Cardano continue to dominate the retail trading and memecoin space due to their scalability and community traction.

Solana Price Forecast: Bulls eye $139 as RSI momentum builds above midline

After initial fears from FTX payouts at the start of the month, Solana price action has regained bullish momentum, reclaiming $132 with a 5.01% gain on Wednesday.

A closer look at vital technical indicators suggests further upside toward the $139 resistance marked by the Keltner Channel upper band.

The 12-hour chart shows a clear rejection from the midline support at $124.62, with bullish volume expanding, the 3.64M SOL traded indicates renewed buyer interest.

Solana Price Forecast

Solana price forecast signals further bullishness as the Relative Strength Index (RSI) currently prints 57.86, comfortably above its signal line at 54.84.

This crossover confirms positive momentum building while remaining below overbought levels, suggesting room for continuation.

While downside risk to $124.62 remains possible in a pullback scenario, as long as Solana holds above the midline, the path of least resistance is upward. A breakout above $139.57 would open the door to a potential rally toward $145.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: BTC price reaches 70-day peak, propelled by Michael Saylor and 21Shares

The cryptocurrency aggregate market cap dips by 1.4% in the early hours of Friday despite BTC price rallying above $97,000 for the first time in 70 days. Lagging altcoin performance signals a cooling risk appetite.

Dogecoin spot ETF hype sparks breakout hopes as supply in profit rises

Dogecoin price is consolidating, hovering around the 50-day EMA, as optimism for spot ETF approvals surges. Dogecoin on-chain metrics signal bullish potential as derivatives open interest rises 2.17% to $1.85 billion amid rising shorts liquidation.

Bitcoin Weekly Forecast: BTC looks set to head back to $100K after logging fourth straight week of gains

Bitcoin price is hovering around $97,000 at the time of writing on Friday, following a decisive breakout above its key resistance level the previous day, and looks set to post a fourth consecutive week of gains.

Bitcoin holds gains close to $97,000 as Strategy doubles bet on BTC

Bitcoin steadies close to the $97,000 level even as traders continue to digest tariff-related economic uncertainty on Friday. Most of the top 10 cryptocurrencies gain on Friday and crypto trader’s sentiment improves.

Bitcoin Weekly Forecast: BTC looks set to head back to $100K after logging fourth straight week of gains

Bitcoin (BTC) price is hovering around $97,000 at the time of writing on Friday, following a decisive breakout above its key resistance level the previous day, and looks set to post a fourth consecutive week of gains.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.