- The US Congress began reviewing a Crypto Stablecoin bill on Wednesday.

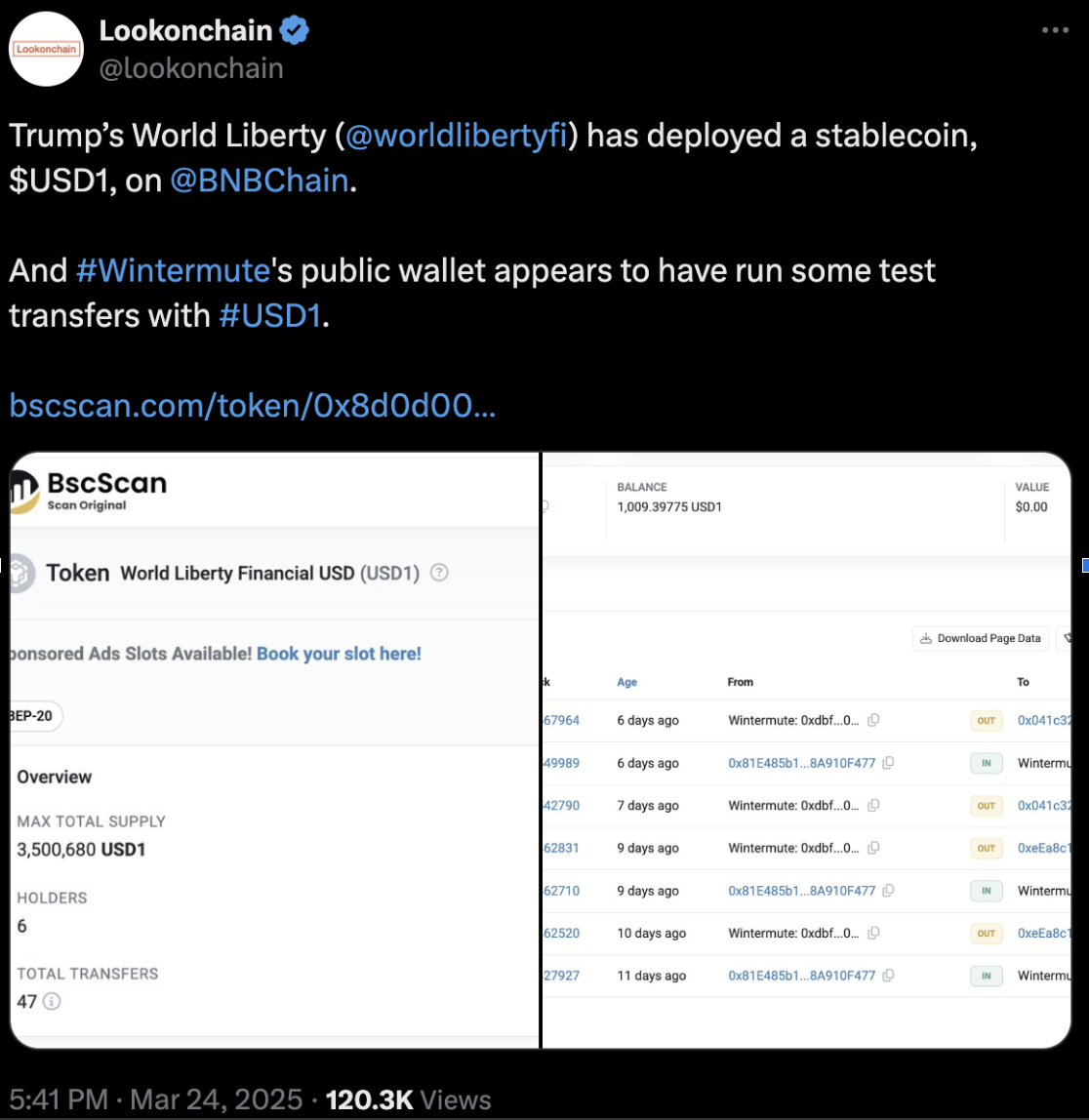

- This comes a week after Trump-backed WLFI announced the launch of its USD1 Stablecoin pegged 1:1 to the US dollar.

- Despite concerns, the House Financial Services Committee voted to recommend the crypto stablecoin bill for full legislative process.

The U.S. Congress took a major step toward crypto regulation on Wednesday, reviewing a stablecoin bill amid growing private sector.

Crypto stablecoin legislation advances, Trump’s USD1 poses major risks

The U.S. Congress has taken a significant step toward stablecoin regulation, as lawmakers on Wednesday reviewed a proposed crypto stablecoin bill.

The legislative process comes just weeks after Trump-backed Web3 Liberty Financial Initiative (WLFI) announced the launch of its USD1 stablecoin, pegged 1:1 to the U.S. dollar on March 25.

Democrat lawmakers voiced skepticism over Trump’s affiliation with USD1, citing potential risks to financial stability and regulatory oversight particularly due to the President’s immunity powers.

Trump-backed WLFI Mints USD1 Stablecoin on Binance and Ethereum, March 4, 2025 | Source: Lookonchain

Trump-backed WLFI Mints USD1 Stablecoin on Binance and Ethereum, March 4, 2025 | Source: Lookonchain

According to Reuters’ reports, some committee members also raised questions about the implications of a politically affiliated stablecoin gaining mainstream adoption.

Critics argue that without stringent federal oversight, stablecoins like USD1 could pose systemic risks or be exploited for political and financial leverage.

With the bill now progressing through Congress, the debate over stablecoin regulations is set to intensify.

Industry stakeholders will closely monitor how lawmakers address concerns surrounding transparency, compliance, and the intersection of digital assets with political influence.

Meanwhile Binance, the world’s largest exchange has delisted Tether (USDT) stablecoin for customers residing within the European Union in compliance with new MiCA laws.

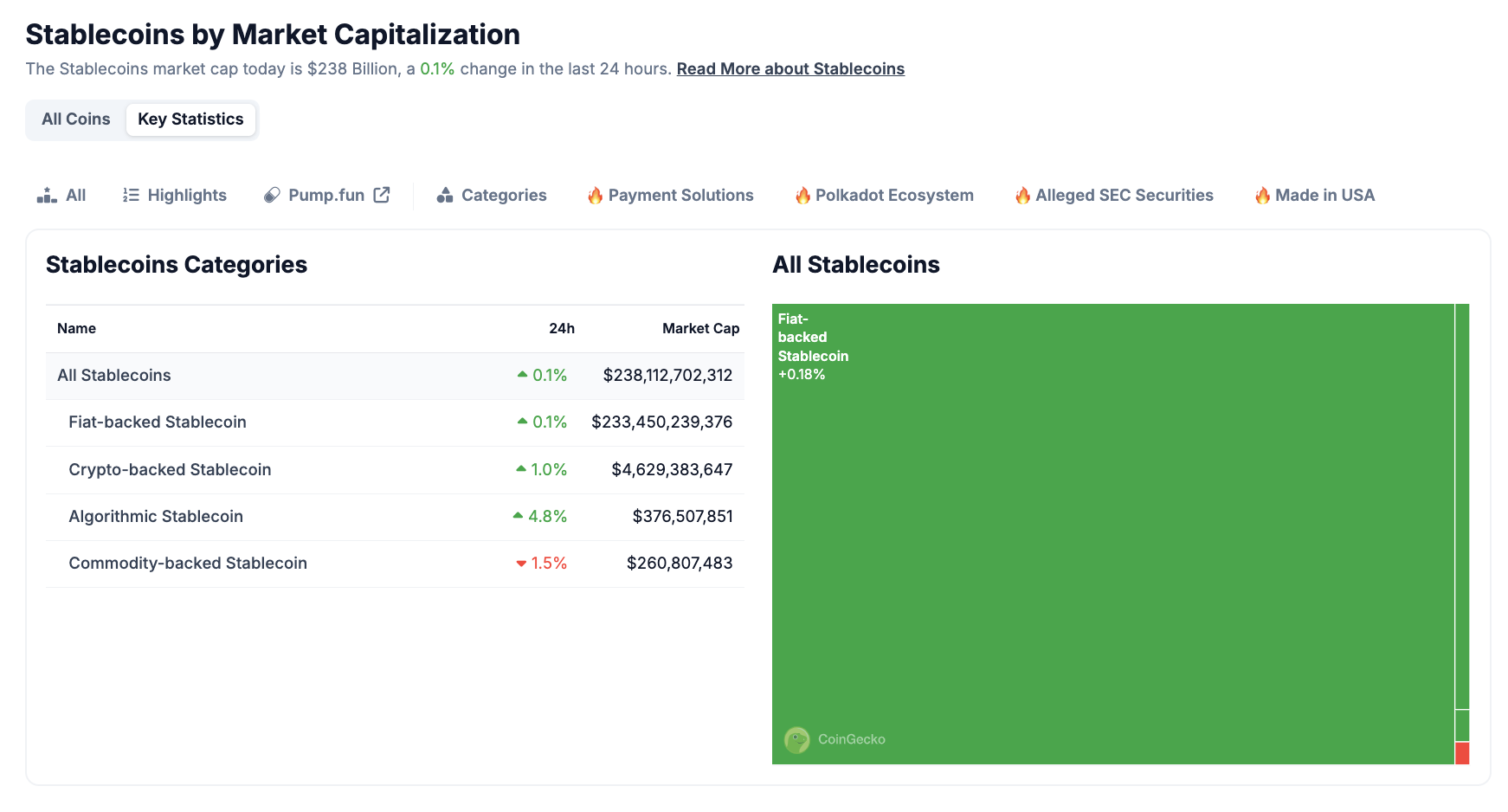

Total Stablecoin Market Cap | Source: Coingecko

Total Stablecoin Market Cap | Source: Coingecko

While Stablecoins continue to make headlines, markets have not shown any outlier movements on Thursday.

According to Coingecko data, the total stablecoin market cap stands at $238 billion with a mild 0.1% uptick in the last 24 hours.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP show signs of recovery

Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) are showing signs of recovery after a period of consolidation and bearish pressure. BTC, ETH and XRP prices rebound slightly, approaching their key resistance levels; a daily close above could open the door for further upside.

SKY, QNT, and FET soar, overlooking risk-off sentiment in crypto market

The cryptocurrency market consolidates halfway through the week as Bitcoin (BTC) loses steam above $106,000, resulting in a broader pullback. Select real-world asset (RWA) and Artificial Intelligence (AI) tokens surge, ignoring the top altcoins' struggle to bounce back.

Pump.fun plans to raise $1 billion from token launch: Blockworks

Solana-based Pump.fun is reportedly planning a token sale to raise $1 billion at a fully diluted valuation (FDV) of $4 billion, available to public and private investors, according to a Blockworks report on Tuesday. The token sale is expected to commence in about two weeks and will be open to both private and public investors, the report added.

Ethereum Price Forecast: ETH faces resistance at $2,750 following Protocol launch

Ethereum (ETH) traded around $2,600 on Tuesday after announcing the launch of Protocol, a project aimed at scaling its Layer 1, expanding Blobspace, and improving the user experience (UX). The Ethereum Foundation announced it would be restructuring and rebranding its Protocol Research & Development team to "Protocol."

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.