Ethereum (ETH)  $2,752, the largest altcoin by market capitalization, is experiencing an unexpected downturn following a series of historical events. For the first time since April 2021, its value has dropped to 0.04 against Bitcoin (BTC)

$2,752, the largest altcoin by market capitalization, is experiencing an unexpected downturn following a series of historical events. For the first time since April 2021, its value has dropped to 0.04 against Bitcoin (BTC)  $96,106. Experts had warned of this risk months ago, and despite the approval of ETFs, this weakness is alarming.

$96,106. Experts had warned of this risk months ago, and despite the approval of ETFs, this weakness is alarming.

Ethereum (ETH) Hits a Low

Although Ethereum tested this low in August and quickly recovered, it has now fallen below 0.04 BTC for the first time since April 2021. At the time of writing, the pairing continues to linger at historic lows. This event reflects extreme sell-offs among altcoins, as clearly seen in the total market value of TOTAL3.

If ETH continues to lose value against BTC, it could decline to around 0.033 BTC. In early 2021, the 0.04 BTC level acted as a significant resistance before the all-time high. To signal a recovery, ETH needs to close above 0.045, or else a further drop could lead prices to around $1,800 in USD pairs.

Altcoins and ETH

Bitcoin has been fluctuating within a limited range for two quarters. Its inability to break resistance has negatively affected risk appetite in altcoins, especially after massive long liquidations in futures trading. Investors are turning towards BTC, perceived as safer and more profitable amid high volatility.

Moreover, before experiencing a true bull market in altcoins, Bitcoin is anticipated to break its all-time high. This situation leads investors to be less hasty, causing prices to decline further in an environment with fewer buyers during BTC dips.

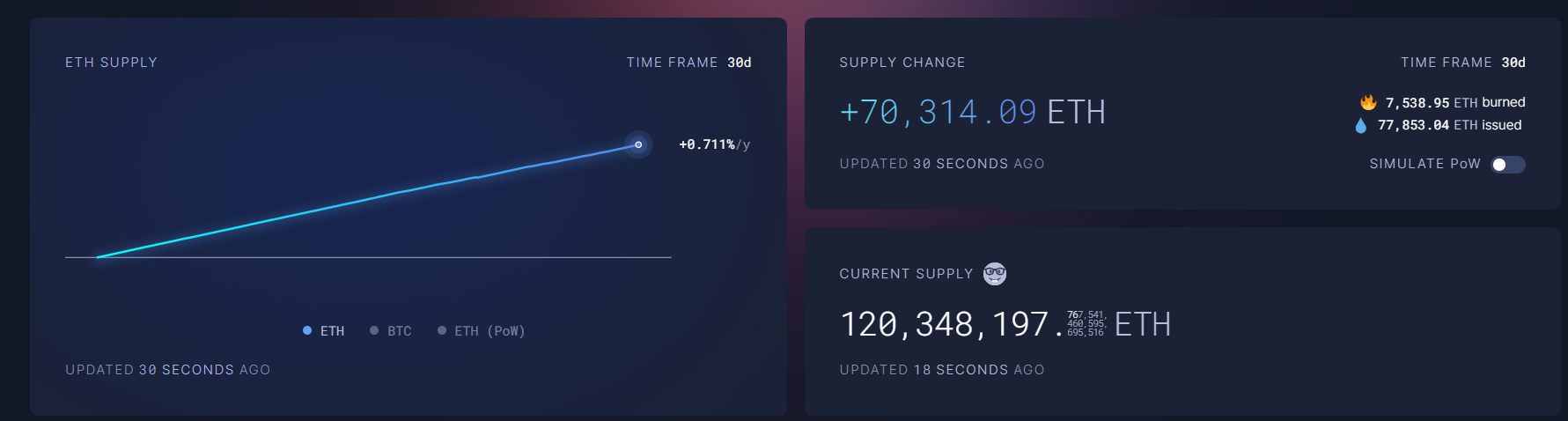

Another issue specific to Ethereum (ETH) is the returning inflation, as seen in the charts below. The drastic drop in transaction fees, coupled with a decrease in network activity, has resulted in a very low burned supply.

Due to these factors, investors in the ETF channel are increasingly favoring BTC over ETH, contributing to the ongoing weakness.

Türkçe

Türkçe Español

Español