Justin Sun's massive ETH sales (around $400 million) and unstaking activity are significantly impacting Ethereum's price.

Ethereum's price is under pressure, with a recent 17% drop and bearish sentiment.

The market is closely watching Justin Sun's moves, and his continued selling could further depress Ethereum's price.

Ethereum is having a rough week, and the crypto market is feeling the strain. Adding to the drama is Tron founder Justin Sun, who has been making waves with some massive Ethereum transactions. Over the past week, Sun sold $143 million worth of ETH—about half of his holdings—triggering a sharp price drop.

The community is buzzing with questions: Why is he offloading so much ETH? Is there a hidden agenda behind these moves?

Let’s unravel the factors driving Ethereum’s slide and see what lies ahead.

Justin Sun’s Massive ETH Transactions

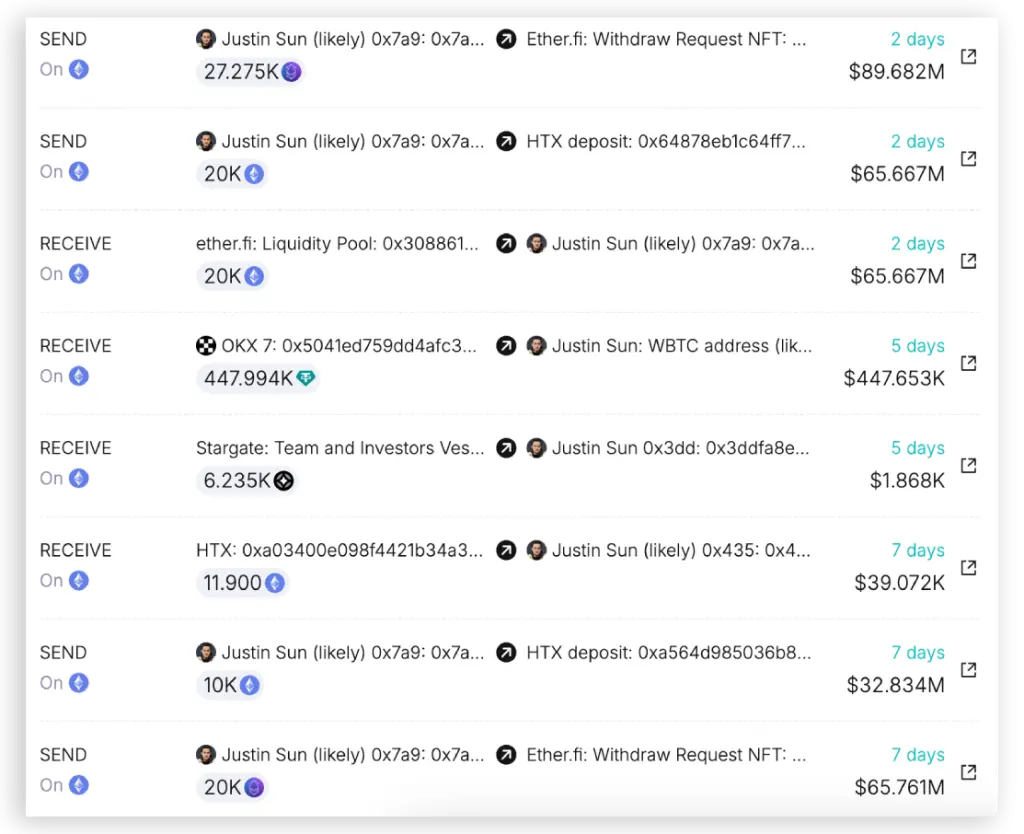

Since November 10, Justin Sun has deposited 108,919 ETH—worth around $400 million—into HTX (formerly Huobi), according to blockchain data from Spot On Chain. Most of these deposits happened when Ethereum’s price was near its recent highs, averaging $3,674 per ETH.

In addition, Sun recently unstaked 42,904 ETH from Lido Finance, valued at $139 million. There’s speculation he may move these funds to HTX as well. Such large transactions are putting pressure on Ethereum’s price, and the market is feeling the heat.

Ethereum’s Price Takes a Hit

Ethereum is now trading at $3,304, down 17% from its recent rejection at $4,000. In the last 24 hours, it has dropped another 2.19%, and trading volume is down 8.57%.

The market sentiment isn’t great either. Data shows that 54% of futures trades are short positions, with the long-short ratio at 0.8495. However, there’s a small silver lining: 78% of Ethereum holders are still in profit at the current price.

Key Technical Levels to Watch

Ethereum is approaching a crucial support level at $3,260. If it breaks below this level, the price could drop further to $3,000, where the 200-day moving average might provide some support.

The Relative Strength Index (RSI) is at 39.28, near oversold territory, while the Average Directional Index (ADX) indicates strong bearish momentum. These signals suggest Ethereum’s price could remain under pressure in the short term.

What’s Next for Ethereum?

The big question is whether Ethereum can hold above $3,260. If not, analysts warn the price could fall as low as $2,800, especially if large holders like Justin Sun continue selling. While some experts think Ethereum is still in a “safe zone,” others caution that low weekend trading volumes and uncertainty in the stock market could lead to more volatility.

Justin Sun’s large Ethereum transactions have added pressure to an already weak market, leading to speculation about his motives. For now, investors should stay cautious and keep an eye on key support levels and whale movements as the market remains volatile.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

At press time, the Ethereum price trades at $3,334.10.

As per our Ethereum price prediction 2025, the ETH price could reach a maximum of $6,925.

As the altcoin season begins, the short-term gains make Ethereum a lucrative buying option. However, the long-term promises of this programmable blockchain make it a viable long-term crypto investment.