Gold is trading like bitcoin now, but a comprehensive flows-based approach doesn't corroborate the last leg of this rally, TDS’ Senior Commodity Strategist Daniel Ghali notes.

Downside momentum likely to accelerate below $2580

“The momentum break experienced on election day typically marks the end of such moves. But if that is the case, what can we expect from here? The melt-up has created a notable margin of safety for macro fund positions, which now hold significant paper profits on their extremely bloated length. Large scale selling activity from CTAs will only kick off below $2580/oz.”

“Given downside momentum is only likely to accelerate below this threshold, other cohorts will have to do the heavy lifting. Overall, this suggests the most vulnerable cohorts are ETF holders, given their recent inflows and Shanghai traders, who are still holding onto their near-record length.”

“Don't forget how significant TINA has been for this cohort — the last weeks have seen significant selling activity in Shanghai concurrently with improving Chinese sentiment. Silver, on the other hand, is more vulnerable to CTA selling activity in a continued downtape, but even a flat tape will likely lead trend following algos to reaccumulate their recently shed length.”

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends losses below 1.1700 as EU-US trade deal euphoria fades

EUR/USD extends the latest leg down below 1.1700 in the European session on Monday. The euphoria surrounding the EU-US trade deal appears to fade as the US Dollar regains traction on trade optimism and ahead of the US-China trade talks due later in the day.

GBP/USD edges lower toward 1.3400 on renewed US Dollar upside

GBP/USD has come under renewed selling pressure, heading toward 1.3400 in European trading on Monday. The Pound Sterling shrugs off the US-EU trade deal optimism amid a broad US Dollar resurgence. Traders turn cautious ahead of US-China trade talks and the US data deluge this week.

Gold price bulls seem reluctant amid sustained USD buying, trade optimism

Gold price stalls its intraday recovery from an over one-week low and trades around the $3,335 region during the early European session on Monday, down for the third straight day. The US Dollar gains some follow-through positive traction and turns out to be a key factor undermining the commodity.

Bitcoin Cash Price Prediction: BCH hits $600, the highest level in 2025

Bitcoin Cash (BCH) consolidates near $590 at the time of writing on Monday, after reaching its highest yearly level of above $600 the previous day. A bullish thesis in BCH is further supported by the rising Open Interest (OI) in the derivatives market which has reached levels not seen since April 2024.

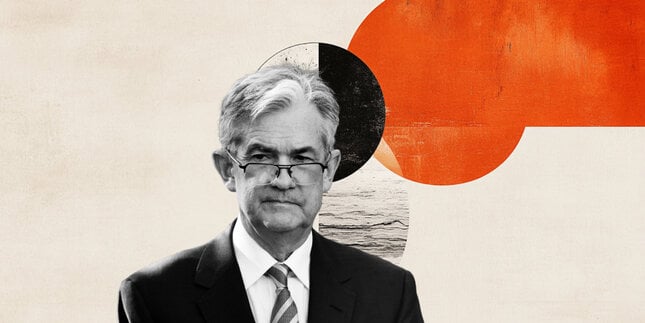

Is the Fed behind the curve?

Fed is under increasing scrutiny about its decision to delay rate cuts. Ongoing tariff uncertainty and resilient economy support Fed’s case for pause. But Fed may have left it too late amid some cracks in labour market.

Best Brokers for EUR/USD Trading

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.