But why will it be effective? In this assessment article, we will discuss the current state of labor markets. On September 4, half an hour after the US market opened, the JOLTS data caused BTC to rise rapidly and recover from below $57,000. We shared in the breaking news that the incoming data would be one of the things forcing the Fed to cut rates. More data will come on Friday.

Job Opportunities Weakening

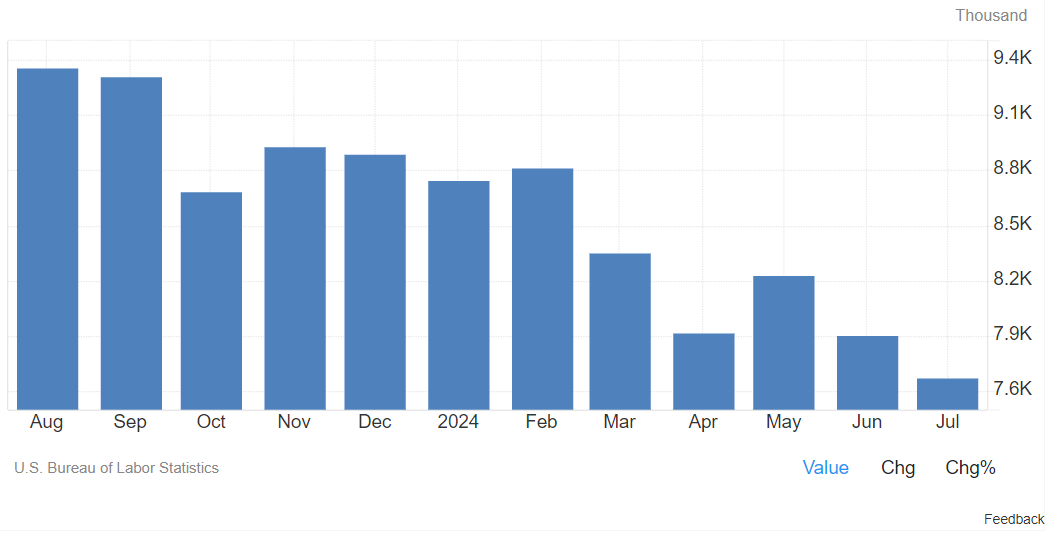

For July, the US reported 7.673 million job openings, which was well below analysts’ estimate of 8.1 million. We can see the state of the decline in labor demand through JOLTS. Powell should consider the possibility of a 50bp cut at the September meeting.

On the other hand, this low data brings questions before the Non-Farm Payrolls (to be announced on Friday) data. Just last month, we saw significant downward revisions in the employment report, with Fed members making statements like “stay calm” as consecutive cuts were expected.

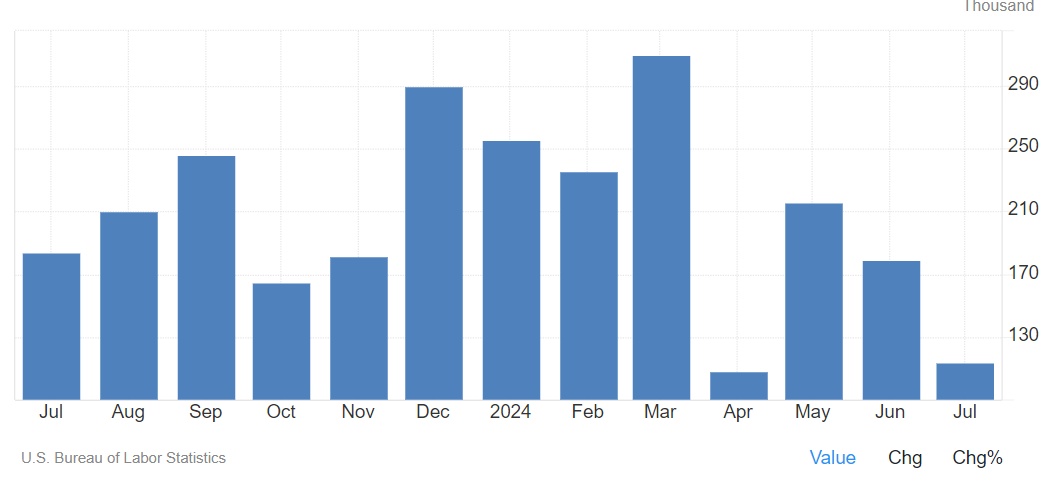

There is a possibility that the Non-Farm Payrolls data will be announced below expectations, favoring risk markets. This has increased the likelihood of a 50bp rate cut according to FedWatch.

What Awaits the Markets?

The Fed’s first rate cut decision will send a strong message. On the other hand, September is known as a bearish month for both stocks and cryptocurrencies. For example, the S&P 500 has lost an average of 1.2% during this period over the past century. For BTC, we have seen negative returns since 2013.

The employment data coming on Friday for September will push the Fed to decide on a 50bp or 25bp cut. If the Fed wants to convey that the current situation is tolerable (as some members have stated), it will decide on a 25bp cut and announce a more gradual rate reduction.

Atlanta Fed President Bostic said a few hours ago that waiting to reach the 2% inflation target would cause “unnecessary pain.” He highlighted the decline in the labor market and encouraged those expecting a 50bp cut. If the unemployment rate exceeds expectations and the non-farm payrolls fall below expectations, we could see positive hours in crypto when the US markets open on Friday.

Türkçe

Türkçe Español

Español