- The Swiss National Bank (SNB) dismisses the idea of holding Bitcoin as a reserve asset.

- SNB Chief Martin Schlegel cites concerns over volatility, security risks, and regulatory uncertainty.

- The decision is in contrast to growing global corporate and sovereign interest in Bitcoin reserves, particularly in the U.S.

Swiss National Bank has rejected a proposal to adopt Bitcoin as a reserve asset, citing concerns over volatility, security, and liquidity.

Swiss National Bank reject Bitcoin adoption on “volatility and “economic” concerns

Despite increasing global corporate and sovereign interest in Bitcoin adoption, the Swiss National Bank (SNB) has firmly rejected the idea of holding Bitcoin as part of its reserves.

In a recent statement, SNB Vice Chairman Martin Schlegel reiterated the central bank’s position, emphasizing that cryptocurrencies do not meet the necessary criteria to be included in Switzerland’s foreign-exchange reserves.

“We do not have plans to buy crypto assets.”

- Swiss National Bank (SNB) Vice Chairman Martin Schlegel pointed to Bitcoin’s high price volatility and security risks.

He also highlighted concerns over liquidity and the digital nature of cryptocurrencies, which could make them susceptible to technological failures.

The SNB’s position stands in contrast to growing institutional interest in Bitcoin globally. Notably, U.S. President Donald Trump has expressed support for greater Bitcoin adoption, fueling discussions on integrating Bitcoin into national reserves.

Global Trends: Bitcoin adoption on the rise amid Trump's influence

Switzerland’s reluctance to embrace Bitcoin as a reserve asset pales in contrast to other nations like El-Salvador, and Bhutan who now carry BTC on national balance sheets. More so, more countries are currently exploring regulatory frameworks for cryptocurrency adoption, in attempts to align with the United States regulatory leaning under Trump

In Pakistan, for example, authorities are working on a comprehensive legal framework to support the growth of the digital asset industry, as revealed by Pakistan Crypto Council CEO Bilal Bin Saqib.

Switzerland has built a reputation for strategic political neutrality, and stable national currency. In recent years the country has become a major hub for cryptocurrency and blockchain innovation with major projects like Etherum founded in Crypto Valley in Zug, Switzerland.

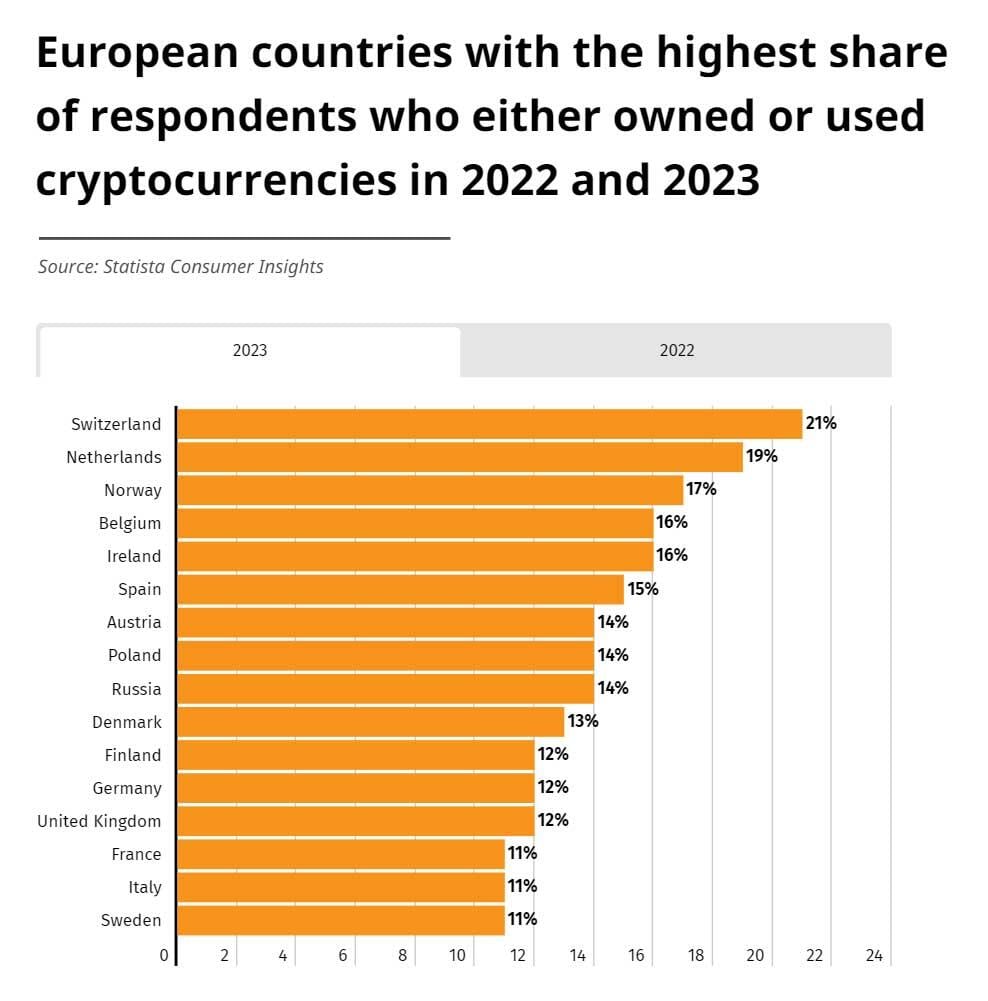

Crypto adoption trends in Europe, 2023 | Source; Financial Mirror, 2023

Notably, Switzerland emerged the country with the fastest crypto adoption rate in Europe according to a 2023 research by the FinancialMirror.

The SNB’s decision suggests that traditional financial institutions remain hesitant to integrate Bitcoin into their monetary policies.

However, with increasing global adoption, overt support from US President Donald Trump amid ongoing regulatory discussions, as well as one of the largest crypto-holding populations in Europe, many analysts believe Switzerland may eventually revisit its stance in the coming years.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Solana, Sui Price Forecast: Bulls aim for steady recovery ahead of large token unlocks

Solana (SOL) and Sui (SUI) altcoins are edging higher on Monday, building on the weekend gains that followed the sell-off on Friday, which was triggered by geopolitical tensions in the Middle East.

Crypto Today: Bitcoin, Ethereum, XRP rebound along with surge in open interest, trading volumes

Cryptocurrencies are broadly recovering on Monday, extending gains from the weekend, which followed instability and heightened volatility on Friday as geopolitical tensions exploded in the Middle East.

Meme Coins Price Prediction: DOGE, SHIB, and PEPE rise as broader crypto market recovers

Dogecoin holds at critical support, ticking up after five consecutive days of losses. Shiba Inu begins the week regaining strength and targeting a key resistance trendline. Pepe’s trend reversal gains momentum in the 4-hour chart.

Bitcoin recovers above $107,000, yet Israel-Iran conflict clouds bullish outlook

Bitcoin increases to around $107,000 on Monday after a slight decline in the previous week. Investors remain on edge as the Israel-Iran conflict enters its fourth day after fresh strikes over the weekend.

Bitcoin: BTC could slump to $100K amid Trump-Musk tussle

Bitcoin (BTC) tumbled to a low of $101,095 on Friday amid volatility in the market. The effect of the tussle between United States (US) President Donald Trump and Tesla Chief Elon Musk negatively influenced the NASDAQ and Tesla's stock price on Thursday, although both are recovering on Friday.