Abstract

Bitcoin adoption as a legal tender threatens a financial crisis because of the lack of regulatory frameworks and systems for exchanging Bitcoin into local currencies. This study analyzes monthly data from 2010 to 2022 using a structural vector autoregressive model, estimating Bitcoin’s pass-through into remittance, money multiplier, the US Dollar index, and gold price. The results show that Bitcoin prices decrease the money multiplier and gold prices in both the short and long run, while remittances moderately increase in the long run. The implication of these results suggests the potential for international business opportunities to stimulate the credit, savings, and investment monetary policy channel. The results are robust to alternative SVAR identification strategies.

Similar content being viewed by others

Introduction

The legal tender adoption of Bitcoin in El Salvador in June 2021 has stimulated mixed reactions from academicians and policy experts. In particular, El Salvador’s government has more than 35% deficit, ~40 million United States dollars, on the 2301 Bitcoin coins bought using public funds since making it legal tender Collins (2022). The study on adopting Bitcoin as a legal tender in El Salvador addresses the problem of determining the policy-level significance.

Existing studies on Bitcoin adoption as legal tender have examined the incentives and network effects of Bitcoin adoption. However, one major challenge is the need for a comprehensive regulatory and legal framework to define Bitcoin’s status, ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) laws, and address tax implications. Additionally, Bitcoin’s fixed supply limits a government’s ability to manage monetary policy, complicating responses to economic crises, inflation, or deflation. Moreover, Bitcoin’s price volatility poses significant risks to financial stability, potentially affecting the economy if businesses and individuals hold substantial Bitcoin assets. Addressing these challenges requires a balanced approach that considers both the benefits and the potential risks of Bitcoin adoption. As a result, this study takes a unique approach by exploring the policy-level implications of adopting Bitcoin as a legal tender in El Salvador. Recently, Alnasaa et al. (2022) concluded that the rapid increase in the macroeconomic relevance of crypto assets adds to the importance of the case for regulating crypto usage. In this way of thinking, the monetary policy reason for creating digital currencies should include the possibility of making it easier for the policy rate to affect money markets and deposit rates. Doing so would help ease the effects of the zero lower bound (or effective lower bound).

Kiyotaki and Wright (1992) note that money’s essential characteristic is its use as a medium of exchange. Additionally, Umlauft (2018) observes that people generally do not use cryptocurrencies to transact. The concept of a medium of exchange is related but broader. A medium of exchange is an object exchanged for something without the “prerequisite” of existing debt, similar to Kiyotaki and Wright (1989).

Bitcoin price shocks are a subject of continuous debate among investors and academicians. To measure the effects of Bitcoin price shocks in this paper, \({Y}_{j}\) (pass-through estimate), which captures \({{\mathrm{Bt}}\_{\mathrm{rem}}}\) (Bitcoin price pass-through into remittance), \({{\mathrm{Bt}}\_{\mathrm{momu}}}\) (Bitcoin price pass-through into monetary supply), \({{\mathrm{Bt}}\_{\mathrm{usd}}}\) (Bitcoin price pass-through into USD index) and \({{\mathrm{Bt}}\_{\mathrm{gold}}}\) (Bitcoin price pass-through into gold prices). Bitcoin price pass-through significantly affects remittances, stimulating monetary policy transmission’s credit, savings, and investment channels. In this context, the paper explores the following research questions?

-

1.

Is there credibility in adopting Bitcoin as a legal tender in El Salvador toward economic stability?

-

2.

What is the impact of adopting Bitcoin as a legal tender on international transfers?

-

3.

What is the relationship between the characteristics of Bitcoin and gold in stimulating monetary policy?

The estimation uses a structural vector autoregressive (SVAR) model. \({Y}_{j}\) is measured as the cumulative impulse response of i (explanatory variables) divided by the cumulative impulse response of bitcoin prices, each after a shock to the bitcoin price. This paper implements Blanchard and Quah (1988) long-run restrictions identification strategy.

The empirical results show that the remittance decrease in response to bitcoin price shocks is about 11% after 1 month, 9% after 3 months, 5.9% after 6 months, and 6.1% in the long term. This suggests that the Bitcoin pass-through seriously impacts border transactions in the short and long run. Similarly, the money multiplier decreases by 8.8% after 1 month, 8% after 3 months, 7.5% after 6 months, and 7.6% in the long run. The US dollar index sees an immediate decrease of about 25% after 1 month, 5.8% after 3 months, 6% after 6 months, and in the long run. On the contrary, the response of gold prices to Bitcoin price shocks is minimal, decreasing by 4% after 1 month, 5.9% after 3 months, 6% after 6 months, and in the long run. We observe a similar decrease between gold prices and the US dollar index of about 6% in the medium and long term; however, only remittances show a positive response in the long run, as shown in Table 2.

The rest of the paper is structured as follows: The following section presents the literature review. Section “Hypothesis development” presents the data and the methodology used. Section “Data and estimation methodology” presents the implications of the estimation methodology for bitcoin price transmission measures. Section “Implications for bitcoin pass-through” presents the empirical results, while Section “Estimation results” reveals the bitcoin price pass-through estimates. Section “Bitcoin price pass-through estimates” concludes. The appendix contains a graphical representation of the fit and residual diagnostics plot.

Literature review

Jevans (1876) writes that legal tender “only means that the state provides a particular medium of exchange and defines what it is.” Our research shows that the designation of Bitcoin as legal tender does not mean that it becomes a common medium of exchange as defined by Wicksell (1962), an object “usually and without hesitation taken by someone in exchange for a common good.” Kiyotaki and Wright (1992) argue that “acceptability” increases the likelihood that an object will become a medium of exchange. According to Kiyotaki and Wright (1989), acceptability is a social convention. It is an equilibrium property where the use of a medium of exchange and its economy are endogenously determined. Aiyagari and Wallace (1997) extend Kiyotaki and Wright (1989) and show that government policy can influence the policies used as a medium of exchange. The Salvadoran experience has shown that simply accepting Bitcoin for tax payments may not be sufficient to achieve a balance when using Bitcoin as a medium of exchange.

Chartalism, the precursor to modern monetary theory, identifies taxation as the crucial factor in the formation of money. For example, Coase (1977) describes that “a prince who should decree that a certain proportion of his taxes should be paid in paper money of a certain kind might thus give that paper money a certain value.” According to Jevans (1876), taxes play a crucial role in determining the value of paper money. Consistent with this notion, Wicksteed (1910) describes how, through taxation, the government can induce people to demand money at face value. More recently, Starr (1989) writes: “How can we exclude the possibility that the price of money is zero in equilibrium? Taxes can create demand for money independent of its usefulness as a medium of exchange, thus ensuring that its price will not fall to zero”. The concept described in this work is called “tax money.” This implies that when the state designates a currency as a legal tender, it can assign value to it as a form of currency and promote its acceptance as a medium of exchange by allowing the public to use it for tax payments.

The literature has focused on various aspects of cryptocurrencies, such as risks, arbitrage opportunities, network effects, asset pricing, and the impact of Bitcoin adoption on local prices. However, this study contributes to the long-standing literature by examining whether accepting a digital currency for tax payment is a sufficient condition for its acceptance as a currency.

In line with the research gap, this study proposes two solutions to address the issue at the policy level: determining the significance of adopting Bitcoin as a legal tender in El Salvador and contributing to cryptocurrency research. The first issue deals with assessing the impact on monetary policy, specifically focusing on the money multiplier. Bitcoin operates outside the traditional banking framework and has a limited supply, which could affect the behavior of the conventional banking system and the ability to generate new funds through lending. Policymakers should consider payment-related, social, security, and monetary policy motivations before adopting Bitcoin as legal tender.

The second solution evaluates the welfare effects. The study emphasizes the importance of assessing the welfare effects for Salvadorans after a Bitcoin price shock. Policymakers determine the stability of a currency if Bitcoin were to become legal tender by estimating how the price of Bitcoin impacts factors such as money transfers, the money supply, the USD index, and gold prices.

In several ways, the contributions of this research align with and expand upon existing literature. Empirically, previous research has focused on individual risks, arbitrage opportunities, price manipulation, and what factors affect the prices of cryptocurrency assets (Borri, 2019; Griffin and Shams, 2020; Liu and Tsyvinski, 2021; Makarov and Schoar, 2020, 2021). This study takes a distinctive approach by delving into the policy-level implications of adopting Bitcoin as a legal currency in El Salvador. In terms of theoretical contributions, existing literature often concentrates on the incentives and network effects of Bitcoin adoption (Biais et al. 2019; Cong et al. 2021; Pagnotta and Buraschi, 2018); the cost of production (Cong et al. 2021; Sockin and Xiong, 2023), and the determinants of cryptocurrency prices (Athey et al. 2016; Jermann, 2021; Liu et al. 2020; Schilling and Uhlig, 2019). Complementary to the studies mentioned above, Alvarez et al. (2023) measure the network effects that exist in a place where Bitcoin could become very popular and the effect that this form of payment has on local prices. This study builds on this foundation by including the impact on monetary policy, international transfers, and the relationship between Bitcoin and gold in stimulating monetary policy. The methodology, utilizing a structural vector autoregressive (SVAR) model and assessing pass-through measurements, adds empirical depth to the research landscape.

Hypothesis development

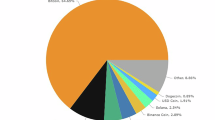

Although they emerged after the Global Financial Crisis, crypto assets were not considered significant risks until recently (Donnelly, 2019). Their volatile rise in market capitalization, growing correlation with other financial assets, and adoption in many emerging markets (Bains et al. 2021) have changed perceptions about the risks of crypto assets and the need for appropriate policies to address them. Policymakers around the world have been developing a variety of national approaches to crypto assets. On the opposite end of the spectrum, some countries have opted to grant unbacked tokens legal tender status.

H1a Bitcoin legal tender adoption has a negative impact on monetary policy in credit agencies and multilateral financial institutions.

In 2001, El Salvador adopted the US dollar as a legal tender to ensure monetary stability, which the country’s national currency, the colón, had historically failed to deliver. Frankel (2021) observed that the reform worked: the country’s annual inflation rate, which had substantially exceeded 10% between 1977 and 1995, has declined markedly since the adoption of the dollar. It has been below 2% since 2012 and nearly zero since 2015. Therefore, El Salvador’s decision to adopt Bitcoin alongside the US dollar as legal tender has raised concerns about monetary policy autonomy. This concern is particularly valid given the volatility of Bitcoin and the fact that the interest rate spread between El Salvador and the US has increased sharply since its adoption.

H1b Bitcoin adoption as legal tender detracts from the country’s monetary stability.

The Bank (2021) report on “Central Bank Digital Currencies for Cross-border Payments: A Review of Current Experiments and Ideas.” It suggests that most Central Bank Digital Currencies (CBDC) projects primarily focus on domestic needs. However, improving cross-border payment efficiency is also an important motivation. International remittances play a crucial role in economic development. However, they come with challenges such as high fees, lack of guarantee for total funds transfer, and absence of interoperability between payment systems. CBDC solutions potentially simplify intermediation chains, increase speed, and lower costs for cross-border payments. According to a survey among central banks in late 2020, cross-border payment efficiency is an essential motivation for CBDC issuance.

H2 Bitcoin’s relative advantage on international transfers positively impacts remittances.

The US dollar (USD) and cryptocurrencies are linked through some channels. First, cryptocurrencies are designed to complement and sometimes act as substitutes for conventional currencies (Corelli, 2018). The advantage of cryptocurrencies over traditional currencies lies in their algorithm-based backing rather than government backing. Also, they have immense flexibility and speed of international transfer compared to other currencies guaranteed by their protocol. Urquhart and Zhang (2019) indicated that cryptocurrencies’ attractive growth could challenge policymakers and investors in that cryptocurrencies resemble the role of money and create an alternative environment for businesses.

In addition, cryptocurrencies have attractive attributes that enable them to replace conventional currencies. This is due to the security in transactions that come with cryptocurrencies and the potential reduction in transaction costs and exchange rate risks that allow them to supplement conventional currencies (Kristjanpoller and Bouri, 2019; Van Alstyne, 2014). Second, this linkage can be related to the hedging strategy offered by cryptocurrencies. In this context, some studies, including Urquhart and Zhang (2019) and Kristjanpoller and Bouri (2019), highlight the potential role of leading cryptocurrencies in hedging conventional currencies. Third, inflation could link cryptocurrencies to the US dollar and other currencies. In fact, during periods of turmoil, the government’s excessive money emission leads to inflation, and investors are stashing their investment capital into long-term, stable investments. In such a situation, investors may look for hedging assets like gold and cryptocurrencies to protect against inflation.

H3 The characteristics of Bitcoin and gold positively impact monetary policy.

Data and estimation methodology

This paper uses the implications of the SVAR model based on monthly data to measure the impact of Bitcoin price shocks on remittances, money multipliers, the USD index, and gold prices; Table 1 provides the descriptive statistics.

Data set

This paper uses monthly datasets. For Bitcoin prices, a series of “Monthly Bitcoin Prices to the US Dollar” is obtained from investing.com, the cryptocurrency section database.

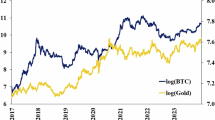

The adoption of Bitcoin is a shift from traditional financial systems, and the marginal spread of this sentiment could lead to a higher demand for gold as a haven, driving up prices. Historical events, such as financial crises in small countries, have occasionally triggered global shifts in gold prices due to perceived risks. As a result, the study adopts “Monthly LBMA Gold Fixing Prices” obtained from investing.com. Further, drawing parallels with other instances where countries adopted unconventional economic policies (e.g., countries with pegged currencies like Taiwan or adopting a currency board), these have often led to reactions in the global commodities and forex markets. For Money Multiplier, a “Monetary and Financial Statistics” series is obtained from the International Monetary Fund database. This study acknowledges that external forces rather than local authorities may influence changes in the monetary multiplier in El Salvador. The country’s reliance on the USD as a legal currency does limit the direct control over monetary policy tools typically available to sovereign nations with their currency. Therefore, this study also uses the “Monthly US Dollar Index (DXY)” obtained from investing.com. The financial market is highly interconnected; even small economies can have outsized effects on global markets through contagion effects. Changes in economic policies, such as adopting Bitcoin, can still influence the perception of the USD in international markets. This can potentially impact investor confidence in the USD, leading to fluctuations in the USD index. Finally, remittance data was collected monthly from the central bank of El Salvador’s macroeconomic data section. Remittances are measured in millions of dollars, focusing on the flow of funds from individuals abroad to recipients in El Salvador. The data explicitly captures the monetary value of remittances in traditional currencies, such as USD.

The monthly sample period between September 10, 2010, and February 30, 2022, has been considered due to consistency in data availability; variables are made stationary for estimation.

VAR model

This paper considers a multivariate VAR, as adopted by Momoli (2017), where \({y}_{1{\rm{t}}}\) and depends on different combinations of the previous values of the variables and the error terms

where \({it}\) is a white noise disturbance term with E (\({{\rm{u}}}_{{\rm{it}}}\)) = 0, (i = 1…, n), E (\({{\rm{u}}}_{1{\rm{t}}}{{\rm{u}}}_{{\rm{nt}}}\)) = 0.

We rewrite in matrix form the generic order VAR p as:

the stationarity condition is verified if and only if |A(L) − λ| = 0, meaning that λ values are less than 1 in absolute terms. We introduce two dummies (\({b{\mathrm{dummy}}}\) and \({{\mathrm{btdummy}}}\)) to measure the significance of the impact on June 9, 2021, when the government of El Salvador published in the official gazette that made the digital currency Bitcoin legal tender in the country. \({{\mathrm{Btdummy}}}\) measures the impact of the legislation that went into effect on September 7th, 2021. \({Bdummy}\) and \({{\mathrm{btdummy}}}\) are significant at 1%.

Analysis of causality according to Granger

In general, interpretative problems arise because (1.1) is a representation in a reduced form that, by its nature, lends little to supporting structural considerations. Granger’s causality analysis aims to evaluate the predictive power of a variable concerning other system variables. According to Granger, if a variable, \({y}_{1}\), assists in improving forecasts of another variable, \({y}_{2}\), then \({y}_{1}\) causes \({y}_{2}\).

Granger causality only means a correlation between the present value of one variable and the past values of others; it does not mean that movements of one variable cause movements of another. There should be caution when interpreting the results of non-causality tests. First, the results are usually sensitive to the set of information used in the application, that is, to the set of strings included in the VAR; there is always the risk of finding “false” causal relationships derived from omitted variables. Causality: By inferring the chronological sequence of movements in the series, one could argue that changes in one variable seem to influence a delay-related variable. This paper rejects the null hypothesis that remittance, the money multiplier, the US Dollar index, and gold prices do not Granger-cause bitcoin price, given that our p value is 0.001.

Impulse response function

We rewrite 1.2 in a compact form as follows, where L is the lag operator:

Assuming I-A(L) is invertible, with B(L) = (I-A(L))-l, we can get the moving average representation of the VAR (VMA)

We can then interpret as follows matrix \({\beta }_{{\rm{s}}}\):

In other words, the ij element of \({B}_{{\rm{s}}}\) identifies the consequences of an increase of one unit in the innovations on the jth variable VAR on the value of the ith variable VAR to time t + s, maintaining zero all other innovations in all possible dates between t and t + s. This partial derivation is only meaningful if the impact on the different variables can be assumed to be uncorrelated. Otherwise, if the variables are correlated, there will be an off-diagonal error variance-covariance matrix, resulting in a biased result. The impulse response function describes the effect of a transitory shock (duration is a period) on the VAR variable j on the variable i. However, whether the error terms are correlated is not a valid assumption, as it allows for a current correlation between them.

Structural VAR

The structural VAR with p lags of the n x 1 vector \({y}_{{\rm{t}}}\) of the Eq. (1a) in reduced form is given by:

Here, the shocks are perpendicular to each other, interpreted as “raw” shocks with no common cause and unrelated to each other. However, it does not limit the fact that individual shots end up in the same equation. The matrix B cannot be diagonal. This analysis proposes a structural model with traditional functions in the components of different equations that can be related to each other. This correlation happens when multiple equations have at least one impact in common. Since \({it}\) is a response to these innovations, it is worth looking at the impulse response function.

Identification strategy

This paper, similar to Blanchard and Quah (1988), identifies temporary shocks in Bitcoin by imposing long-term constraints to account for the effects of supply and demand shocks. The limit does not affect the long-run impact of the aggregate demand shock on output. The idea behind these constraints is the existence of a vertical supply curve. The identification restriction is given by \({{\rm{\varphi }}}_{12}\left(1\right)=0\) in Eq. 1a. The VAR can be implemented as follows:

Where E (\({{\rm{u}}}_{{\rm{t}}}{{\rm{u}}{\prime} }_{{\rm{t}}}\)) = \(\Omega\). Let S = chol (\({\rm{A}}(1)\Omega {\rm{A}}(1){\prime} )\) and K = \({\rm{A}}(1)\)-1S. The identified shocks are \({w}_{{\rm{t}}}=K\)-1\({{\rm{u}}}_{{\rm{t}}}\), and the resulting impulse response to structural shocks is \(\varphi ({\rm{L}})\) = \(A\)(L)K. Notice that the restrictions are satisfied in the equation below:

which is lower and triangular, implying that \({{\rm{\varphi }}}_{12}\)(1) = 0 in Eq. 1a.

Implications for bitcoin pass-through

Measurement of pass-through

This study measures the transmission of Bitcoin price shocks to remittance, money multiplier, US Dollar index, and gold price by dividing the cumulative impulse of these variables by the cumulative response of Bitcoin prices following Bitcoin’s first jump, which occurred from July 2010 to October 2010. The price rose from a fraction of a cent in the spring to $0.09 by July, and by October 2010, it was about $0.10.

where \(Yj=\)(\({{\mathrm{Bt}}\_{\mathrm{rem}}},{{\mathrm{Bt}}\_{\mathrm{momu}}},{{\mathrm{Bt}}\_{\mathrm{usd}}}\), \({{\mathrm{and}}\; {\mathrm{Bt}}\_{\mathrm{gold}}}\)), which all represent pass-through, and i = (remittance, money multiplier, US Dollar index, and gold price), which can be calculated for any period after the shock; hence, pass-through measures are estimated continuously. Similarly, the pass-through of Bitcoin prices to monetary policy is measured by \({Yj}\), which is deemed as the ratio of the cumulative impulse of the explanatory variables divided by the cumulative response of Bitcoin.

Estimation results

Priors and estimation algorithm

We follow Lanne et al. (2017) and estimate the structural VAR using the SVAR package in R, which implements a data-driven fitting method for a structural vector autoregressive (SVAR) model. Structural effects matrices based on existing VAR model objects (e.g., VAR () provided by the “vars” package) are obtained using data-driven identification methods (i.e., Rigobon and Sack (2003) variability variance). Regardless of whether GARCH (Normandin and Phaneuf, 2004), independent component analysis (Matteson and Tsay, 2013), least dependent innovation (Herwartz and Plödt, 2016), variance smooth transition (Lütkepohl and Netšunajev, 2017). Probability Gaussian maximum Lanne et al. (2017). This study uses a lag of p = 1 to estimate the monthly data, thereby allowing for the dependence of the variable. The results jointly satisfy the identifying restrictions.

Structural impulse response

Estimating the model yields the structural impulse responses shown in Figs. 1,2. As can be seen, a positive Bitcoin shock has fewer effects on remittance. Given that the remittance variable is captured in USD, any impact that Bitcoin price changes have on remittances is likely indirect. For example, when the price of Bitcoin rises, people may prefer to retain it as an investment rather than convert it into traditional currencies for remittance purposes. This behavior could indirectly reduce the flow of currency remittances. Additionally, changes in Bitcoin’s value could influence broader economic conditions in countries dependent on remittances, further impacting the flow of remittances in traditional currencies.

Further, a positive Bitcoin shock has reduced effects on the money multiplier, US Dollar index, and gold prices for about three months. Remittances only positively affect the adoption of Bitcoin as legal tender in this study. The negative impact of the Bitcoin legal tender shock is much larger for the US Dollar index compared to the money multiplier and gold prices. Finally, a positive gold price shock decreases Bitcoin, remittance, money multiplier, and US Dollar index for the duration under study.

Historical and forecast-error variance decompositions

The historical decomposition (HD) and forecast-error variance decomposition (FEVD) results, as shown in Fig. 5, indicate that gold prices significantly influence the adoption of Bitcoin as legal tender. According to Kyriazis (2020), Bitcoin has a low or negative correlation with gold, and there is evidence of asymmetric and non-linear relationships. The main difference between Bitcoin and gold is their risk-return profile when included in a portfolio and their volatility and correlation. These differences are apparent in extreme cases, such as the bull or bear market observed in this 2021–2022 white paper. Kyriazis (2020) adds that while Bitcoin is a good hedge against oil and stock indices, it is not as great as gold.

However, it effectively trades in an existing portfolio of assets that must have low risk without compromising returns. Gold is more stable and an effective hedge in abnormal economic conditions.

Overall, by observing the contribution of the variables in the HD and FEVD of Bitcoin, as in Fig. 5, we can conclude that Bitcoin is an asset between gold and the dollar. As Kyriazis (2020) observed, the Bitcoin market needs to be much more mature to be comparable to gold because Bitcoin is a global haven. On the contrary, the money multiplier contributes negatively to Bitcoin prices; however, its impact is minimal, consistent with the results from the HD and FEVD of Bitcoin, where both effects are entirely salient. This raises serious questions about the policy implementation of accepting Bitcoin as a legal tender for the Salvadoran economy.

Dynamic effects of demand and supply disturbances

Figures 3,4 report the dynamic effects of demand and supply disturbances. A demand disturbance has a hump-shaped effect on Bitcoin and remittances. The effect is excellent during the first, second, and fourth months; the demand effects disappear after the 7th month.

These dynamic effects, just as observed in Blanchard and Quah (1988), are consistent with a traditional view of the dynamic effects of aggregate demand on Bitcoin prices and remittance, in which movements in aggregate demand build up until the adjustment of prices and remittance leads the economy back to equilibrium. These quantitative results follow the same explanation for the other variables in Fig. 3.

Figure 4 reflects Fig. 3’s observations about Bitcoin price and remittance, with supply disturbances having a mirror effect on Bitcoin prices. The dynamic response in remittance is the opposite of what is observed in Fig. 3. Essentially, a supply disturbance that initially decreases the remittances in the first and second months has a positive long-term effect. Following this decrease, the effect is reversed after the third month and decreases in the fourth month before reversing back in the fifth month. Eventually, the remittance stabilizes and becomes a steady-state situation. We observe that the dynamic effects of a demand disturbance and the dynamic impact of a supply disturbance on remittances are essentially over by about five months.

Bitcoin price pass-through estimates

Based on the impulse response functions shown in Figs. 1, 2 and Table 2 gives Bitcoin pass-through estimates as point estimates and Fig. 5 gives continuous estimates (Figs. 6, 7).

Bitcoin price pass-through into remittances

The pass-through analysis reveals compelling insights into the relationship between Bitcoin price shocks and remittances. After a Bitcoin price shock, the impact on remittance volumes, represented by Bt_rem, demonstrates a clear pattern over time. Initially, Bt_rem had a significant decline of ~11% within one month, indicating an immediate response to Bitcoin price movements. This reduction gradually moderates, with the magnitude increasing to 9% after three months and then declining to 5.9% after six months. Notably, the long-term estimate for Bt_rem stabilizes at around 6.1%, a trend observed consistently beyond the twelfth month, suggesting a sustained influence of Bitcoin prices on remittance volumes. There could be several reasons for the decrease in remittances. Firstly, the heightened volatility of cryptocurrencies may cause individuals sending remittances to perceive increased risk and uncertainty in the value of their transferred funds during periods of pronounced Bitcoin price volatility. Secondly, concerns about potential losses or unfavorable exchange rates during the conversion process may deter remittance senders from using Bitcoin as a medium for cross-border transfers. Lastly, sharp fluctuations in Bitcoin prices bring a sense of uncertainty and apprehension among individuals sending remittances, leading to a temporary reduction in remittance volumes as senders adopt a wait-and-see approach in response to price volatility. The robustness of these findings is underscored by the strong support provided by the 95% confidence intervals, reaffirming the statistical significance and reliability of the estimated effects.

Bitcoin price pass-through into money multiplier

The examination of Bitcoin price pass-through into the money multiplier, as represented by Bt_momu, suggests that in the aftermath of a Bitcoin price shock, the estimates for Bt_momu exhibit a relatively modest impact, registering at ~−8.8% just one month after the shock. This implies an initial reduction in the money multiplier by around 8.8%, indicative of the immediate influence of Bitcoin prices on monetary dynamics. Over subsequent periods, the impact persists but gradually moderates, with Bt_momu declining to 8% after three months and 7.5% after 6 months. Importantly, this negative effect remains consistent in the long run, stabilizing at 7.6% beyond the 12th month and continuing until the 19th month. The persistently negative estimates highlight the enduring influence of Bitcoin prices on the money multiplier in El Salvador, portraying a sustained negative reflection on the short- and long-term monetary effects. This underscores the potential challenges and adjustments within the financial system induced by Bitcoin price movements. The 95% confidence intervals affirm the statistical reliability and significance of the estimated effects.

Bitcoin price pass-through into the USD index

The analysis of Bitcoin price pass-through into the US Dollar index (Bt_usd) reveals a pronounced impact, with a substantial decrease of ~25% observed just one month after a Bitcoin price shock. This immediate response highlights the significance of Bitcoin prices, resulting in a USD index reduction. While the magnitude of the effect diminishes over time, the negative impact persists, with Bt_usd decreasing to 5.8% after three months and further declining to 6% after 6 months. Remarkably, this negative reflection remains constant in the long run, stabilizing at 6% from the 12th month onward and persisting until the 19th month. These findings highlight the enduring adverse effects of Bitcoin prices on the US Dollar index in El Salvador, portraying a sustained influence on currency valuation’s short and long-term dynamics. The 95% confidence intervals affirm the statistical significance and reliability of the estimated effects.

Bitcoin price pass-through into gold prices

The Bitcoin price pass-through to gold prices (Bt_gold) further highlights the dynamics between cryptocurrency fluctuations and the precious metal market. Remarkably, the estimates for Bt_gold indicate a subtle impact, with a marginal decrease of ~4% observed just 1 month after a Bitcoin price shock. This suggests that Bitcoin prices contribute to a modest short-term decline in gold prices. As time progresses, the negative effect becomes more pronounced, with Bt_gold decreasing to 5.9% after three months and further declining to 6% after 6 months. This pattern persists in the long run, as the estimate stabilizes at 6% from the 12th month onward and remains consistent until the 19th month. These results reveal a sustained impact on short and long-term dynamics within the precious metal market. These findings are robust, as evidenced by the strong support of the 95% confidence intervals.

Robustness analysis

Identification strategy

This paper follows four approaches to modeling structural relationships between the endogenous variables of a VAR model: the A-model, the B-model, the AB-model, and the long-run restrictions found in Blanchard and Quah (1988) that have been followed in this paper. For the robustness check, this study will use the A-model identification strategy.

The A-model assumes that the covariance matrix is diagonal, meaning it only shows the error term variances. It also says that an extra matrix A shows the current relationships between the variables that can be seen, which means that:

where \({{\rm{A}}}_{{\rm{j}}}^{* }\) = \({{\rm{AA}}}_{{\rm{j}}}\) and \({{\rm{\epsilon }}}_{{\rm{t}}}\) = A\({{\rm{u}}}_{{\rm{t}}}\) ∼(0, Σϵ =AΣuA′). Matrix A has a special form:

Apart from the normalization achieved by setting the diagonal elements of A to one, the matrix contains (K(K − 1)/2 further restrictions needed to obtain unique estimates of the structural coefficients. Reducing restrictions would lead to mathematical problems. In the example above, the upper triangular elements of the matrix are set to zero, and the elements below the diagonal are freely estimated. However, it is also possible to calculate the coefficient in the upper triangular area if a value in the lower triangular area is set to zero. Furthermore, when more than (K(K − 1)/2 elements of A are equal to zero, the model is said to be overidentified.

Robustness of bitcoin price pass-through estimates

Based on the impulse response functions shown in Figs. 8, 9, 10, Table 3 gives Bitcoin pass-through estimates as point estimates and Fig. 11 as continuous estimates.

Bitcoin price pass-through into remittances

The robustness analysis introduces intriguing nuances to the Bitcoin price pass-through into remittances (bt_rem), offering a distinct perspective on the dynamics between cryptocurrency fluctuations and international financial flows. Remarkably, the results indicate a notable increase of ~46% in remittance volume just 1 month after a Bitcoin price shock. This suggests a swift and substantial positive impact of Bitcoin prices on remittances, starkly contrasting the negative trend observed in the earlier results. Over time, the positive effect diminishes, with bt_rem dropping to 2.56% after three months and further declining to 1.9% after 6 months. Despite the attenuation, the positive impact remains consistent in the long run, stabilizing at around 1.95% from the 12th month onward and persisting until the 19th month. The 95% intervals strongly support these estimates. These results underscore the enduring positive influence of Bitcoin prices on remittances in El Salvador, revealing a sustained impact on both short- and long-term dynamics within international financial flows (Figs. 12–15).

This contrasts with the earlier results, where Bt_rem exhibited an immediate negative impact on remittance volumes, reflecting the potential sensitivity of this estimate. This robustness analysis provides a nuanced perspective, suggesting that more is needed to understand the complex relationship between cryptocurrency fluctuations and international remittance behaviors.

Bitcoin price pass-through into money multiplier

The robustness analysis introduces nuanced insights into the impact of Bitcoin price shocks on the money multiplier (bt_momu), offering a refined understanding of the dynamics within the monetary system. Notably, the estimates reveal a relatively modest negative impact, with a decrease of ~−6.5% observed just one month after a Bitcoin price shock. This immediate decrease suggests that Bitcoin prices contribute to a moderate short-term decline in the money multiplier. As time progresses, the negative effect persists, with bt_momu decreasing to −6.47% after three months and further declining to −6.05% after six months. This negative trend remains constant in the long run, stabilizing at around −6.09% from the twelfth month onward and persisting until the nineteenth month. The 95% intervals strongly support these estimates.

Compared with the earlier results, this robustness analysis reaffirms the consistent negative impact of Bitcoin prices on the money multiplier, aligning with our previous findings. Despite variations in the magnitude, the overarching trend remains consistent, emphasizing the resilience and stability of this relationship within the monetary system.

Bitcoin price pass-through into the USD index

The robustness analysis provides nuanced insights into the dynamics between Bitcoin price shocks and the US Dollar index (bt_usd), revealing distinctive patterns in currency valuation. Notably, the estimates indicate a substantial negative impact, with a significant decline of ~27.54% observed just one month after a Bitcoin price shock. This immediate and pronounced decrease implies that Bitcoin prices contribute to a substantial short-term decline in the US Dollar index. Over time, the negative effect persists, with bt_usd decreasing to 10.6% after three months and further declining to 11.23% after 6 months. This negative trend remains constant in the long run, stabilizing at around 11.15% from the 12th month onwards and persisting until the 19th month. The 95% intervals strongly support these estimates.

Compared with the earlier results, this robustness analysis reaffirms the consistent negative impact of Bitcoin prices on the US Dollar index, aligning with the previous findings. Despite variations in the magnitude, the overarching trend remains consistent, emphasizing the resilience and stability of this relationship within the currency valuation framework. As a result, this analysis contributes to the robustness of the observed phenomenon, reinforcing our understanding of the enduring impact of cryptocurrency dynamics on the US Dollar index in El Salvador.

Bitcoin price pass-through into gold prices

The robustness analysis enriches our understanding of the intricate relationship between Bitcoin price shocks and gold prices (bt_gold), revealing nuanced dynamics within the precious metal market. Notably, the estimates suggest a subdued impact, with a modest decrease of ~8.72% observed just one month after a Bitcoin price shock. This indicates that Bitcoin prices contribute to a limited short-term decline in gold prices. As time unfolds, the negative effect intensifies, with bt_gold decreasing by 22.95% after three months and further declining to 23.8% after 6 months. This negative trend remains constant in the long run, stabilizing at around 23.71% from the 12th month onwards and persisting until the 19th month. The 95% intervals strongly support these estimates.

Compared to earlier results, this robustness analysis reaffirms the consistent negative impact of Bitcoin prices on gold prices, aligning with the previous findings. Despite variations in the magnitude, the overarching trend remains consistent, emphasizing the resilience and stability of this relationship within the precious metal valuation framework. This analysis reinforces our understanding of the enduring impact of cryptocurrency dynamics on gold prices in El Salvador.

Discussions

Key findings

The adoption of Bitcoin as a legal tender varies by country, with motivations extending beyond payment-related reasons. A study focused on El Salvador’s decision discusses the government’s perspective from a monetary policy angle and emphasizes the need to consider broader market trends when analyzing and predicting the behavior of cryptocurrencies. The study highlights the interdependence of digital and traditional assets, challenging the perception of Bitcoin as an independent and standalone asset and underscoring the correlation between past gold prices and Bitcoin movements. Recognizing these correlations can lead to a more comprehensive understanding of the dynamics in the financial world.

In the study, Table 4 shows that the money multiplier is insignificant for Bitcoin in the VAR estimation. The research suggests that privately issued currencies, like cryptocurrencies, could be used when official currencies do not guarantee price stability. However, if the central bank credibly guarantees the actual value of monetary assets, cryptocurrencies may lose value as a medium of exchange. This implies that the coexistence of state money and cryptocurrencies is not impossible; central banks can prevent cryptocurrencies from being valued as a medium of exchange by pursuing other monetary policies. Policymakers should consider the trade-offs between innovation and maintaining control over economic conditions. From a practical perspective, however, the emergence of cryptocurrencies as viable means of exchange with stable purchasing power may pose some risks for central banks. Moreover, the extent to which economic agents substitute cryptocurrencies for cash and bank deposits will determine the effectiveness of monetary policy. If the economy’s broad money supply shrinks, then bank deposit substitution would result in less control over economic conditions.

The final and serious threat arises not from the potential use of cryptocurrencies as money but rather from their attractiveness as an investment asset. Cryptocurrencies are prone to bubbles because they are speculative assets. The bursting of a cryptocurrency bubble could exacerbate financial instability, as households, companies, and financial institutions are all indebted. Central banks would be at risk in two ways: first, the stability of the financial institutions they watch over could be at risk because cryptocurrency markets might not be regulated. Second, price stability could be at risk due to the impact of people paying off debt and defaulting on loans.

Conclusion and policy implications

Adopting Bitcoin as a legal tender in El Salvador may not be the best choice for economic liberation, as it is not widely used because of its volatility. This could negatively impact remittances, which contributes about 20% of the country’s (El Salvador’s) GDP and are crucial for citizens lacking access to traditional banks. While the government may have seen it as an investment incentive to avoid high fees for cash transfers, the impact must be assessed in the short and long term. The adoption of Bitcoin as legal tender has implications for monetary policy. Bitcoin’s value and volatility can impact exchange and inflation rates, so the government must consider it in its policies.

In contrast, Bitcoin operates outside the traditional banking system and does not increase the money supply through lending. However, adopting Bitcoin as a legal currency in El Salvador could change conventional banking behavior and affect the money multiplier. If the population and businesses invest more in Bitcoin, it could reduce deposits in the banking system and limit banks’ ability to generate new funds through lending activities.

The study has revealed that Bitcoin’s emergence as an attractive asset could have more pronounced monetary policy implications if certain design features are met, such as rules regulating access, availability beyond intraday use, and interest-bearing rates.However, while El Salvador’s experience with Bitcoin offers valuable insights, further research is needed to determine whether similar outcomes would be observed in other countries with different economic or political conditions. Further, it would be interesting to explore the behavioral aspects influencing individuals’ decisions regarding remittances in the context of Bitcoin price volatility.

This could shed light on remittance senders’ psychological factors and risk preferences in response to cryptocurrency fluctuations.

References

Aiyagari SR, Wallace N (1997) Government transaction policy, the medium of exchange, and welfare. J Econ Theory 74(1):1–18

Alnasaa M, Gueorguiev N, Honda J, Imamoglu E, Mauro P, Primus K, Rozhkov D (2022) Crypto-assets, corruption, and capital controls: cross-country correlations. Econ Lett 215:110492

Alvarez F, Argente D, Van Patten D (2023) Are cryptocurrencies currencies? Bitcoin as legal tender in El Salvador. Science 382(6677):eadd2844

Athey S, Parashkevov I, Sarukkai V, Xia J (2016). Bitcoin pricing, adoption, and usage: theory and evidence

Bains P, Diaby M, Drakopoulos D, Faltermeier J, Grinberg F, Papageorgiou E, Petrov D, Schneider P, Sugimoto N (2021). The Crypto Ecosystem and Financial Stability Challenge. Glob. Financ. Stab. Rep. Covid-19, Crypto, Clim. Navig. Challenging Transitions, 41–58

Bank W (2021). Central bank digital currencies for cross-border payments: a review of current experiments and ideas

Biais B, Bisiere C, Bouvard M, Casamatta C (2019) The blockchain folk theorem. Rev Financ Stud 32(5):1662–1715

Blanchard OJ, Quah D (1988) The dynamic effects of aggregate demand and supply disturbances. National Bureau of Economic Research Cambridge, USA

Borri N (2019) Conditional tail-risk in cryptocurrency markets. J Empir Financ 50:1–19

Coase RH (1977) The wealth of nations. Econ Inq 15(3):309–325

Collins J (2022). Crypto, crime and control. Cryptocurrencies as an enabler of organized crime, Global Initiative Against Transnational Organized Crime

Cong LW, He Z, Li J (2021) Decentralized mining in centralized pools. Rev Financ Stud 34(3):1191–1235

Cong LW, Li Y, Wang N (2021) Tokenomics: dynamic adoption and valuation. Rev Financ Stud 34(3):1105–1155

Corelli A (2018) Cryptocurrencies and exchange rates: a relationship and causality analysis. Risks 6(4):111

Donnelly, S (2019). Financial stability board (FSB), Bank for International Settlements (BIS) and Financial Market Regulation Bodies. In Research Handbook on the European Union and International Organizations. Edward Elgar Publishing, p 360–385

Frankel, J (2021). El Salvador’s adoption of bitcoin as legal tender is pure folly. The Guardian

Griffin JM, Shams A (2020) Is Bitcoin really untethered? J Financ 75(4):1913–1964

Herwartz H, Plödt M (2016) Simulation evidence on theory‐based and statistical identification under volatility breaks. Oxf Bull Econ Stat 78(1):94–112

Jermann UJ (2021) Cryptocurrencies and Cagan’s model of hyperinflation. J Macroecon 69:103340

Jevans WS (1876). Money and the mechanism of exchange. D. Appleton

Kiyotaki N, Wright R (1989) On money as a medium of exchange. J Polit Econ 97(4):927–954

Kiyotaki N, Wright R (1992) Acceptability, means of payment, and media of exchange. Fed Reserve Bank Minneap Q Rev 16(3):18–20

Kristjanpoller W, Bouri E (2019) Asymmetric multifractal cross-correlations between the main world currencies and the main cryptocurrencies. Phys A Stat Mech Appl 523:1057–1071

Kyriazis NA (2020) Is Bitcoin similar to gold? An integrated overview of empirical findings. J Risk Financ Manag 13(5):88

Lanne M, Meitz M, Saikkonen P (2017) Identification and estimation of non-Gaussian structural vector autoregressions. J Econ 196(2):288–304

Liu W, Liang X, Cui G (2020) Common risk factors in the returns on cryptocurrencies. Econ Model 86:299–305

Liu Y, Tsyvinski A (2021) Risks and returns of cryptocurrency. Rev Financ Stud 34(6):2689–2727

Lütkepohl H, Netšunajev A (2017) Structural vector autoregressions with smooth transition in variances. J Econ Dyn Control 84:43–57

Makarov I, Schoar A (2020) Trading and arbitrage in cryptocurrency markets. J Financ Econ 135(2):293–319

Makarov I & Schoar A (2021). Blockchain analysis of the bitcoin market. Available at SSRN 3942181

Matteson DS, Tsay RS (2013) Independent component analysis via U-statistics. Cornel University Press, United States of America

Momoli T (2017). Financialization of the commodity future markets: a SVAR model approach. Available at http://hdl.handle.net/10362/26207

Normandin M, Phaneuf L (2004) Monetary policy shocks: testing identification conditions under time-varying conditional volatility. J Monetary Econ 51(6):1217–1243

Pagnotta E, Buraschi A (2018). An equilibrium valuation of bitcoin and decentralized network assets. Available at SSRN 3142022

Rigobon R, Sack B (2003) Measuring the reaction of monetary policy to the stock market. Q J Econ 118(2):639–669

Schilling LM, Uhlig H (2019). Currency substitution under transaction costs. AEA Papers and Proceedings

Sockin M, Xiong W (2023) A model of cryptocurrencies. Manag Sci 69(11):6684–6707

Starr, RM (1989). The price of money in a pure exchange monetary economy with taxation. In General equilibrium models of monetary economies. Elsevier, p 325–335

Umlauft, TS (2018). Is bitcoin money? An economic-historical analysis of money, Its functions and its prerequisites

Urquhart A, Zhang H (2019) Is Bitcoin a hedge or safe haven for currencies? An intraday analysis. Int Rev Financ Anal 63:49–57

Van Alstyne M (2014) Why Bitcoin has value. Commun ACM 57(5):30–32

Wicksell K (1962) Lectures on political economy. Volume II: money and credit. Routledge & Kegan, London

Wicksteed, PH (1910). The common sense of political economy, including a study of the human basis of economic law. Macmillan and Company, Limited

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not include studies with human participants performed by any authors.

Informed consent

This article does not include studies with human participants performed by any authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Msefula, G., Hou, T.CT. & Lemesi, T. Financial and market risks of bitcoin adoption as legal tender: evidence from El Salvador. Humanit Soc Sci Commun 11, 1396 (2024). https://doi.org/10.1057/s41599-024-03908-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-03908-3