- Top 10 cryptocurrencies post nearly double-digit gain in the last seven days as trade-related uncertainty clears.

- Bitcoin holds steady above $103,500 and Ethereum hovers above $2,500 early on Wednesday.

- Meme coins, utility tokens, and altcoin prices rally on optimism in the global market as the Trump administration closes trade deals.

The cryptocurrency market capitalization holds above $3.45 trillion while the top three cryptos (Bitcoin (BTC), Ethereum (ETH) and XRP are in the green on Wednesday. Sentiment among market participants has improved as the uncertainty surrounding the trade war crisis settles following the Trump's administration trade deal with the UK and its temporary agreement to lower reciprocal tariffs with China.

The Crypto Fear & Greed Index shows the sentiment has improved steadily over the past week. The indicator reads 73 at the time of writing, up from 67 last week.

Crypto Fear & Greed Index | Source: Alternative.me

Crypto token categories like meme coins, utility tokens and altcoins also extend gains, riding on market optimism.

Crypto traders rejoice, gear for further gains

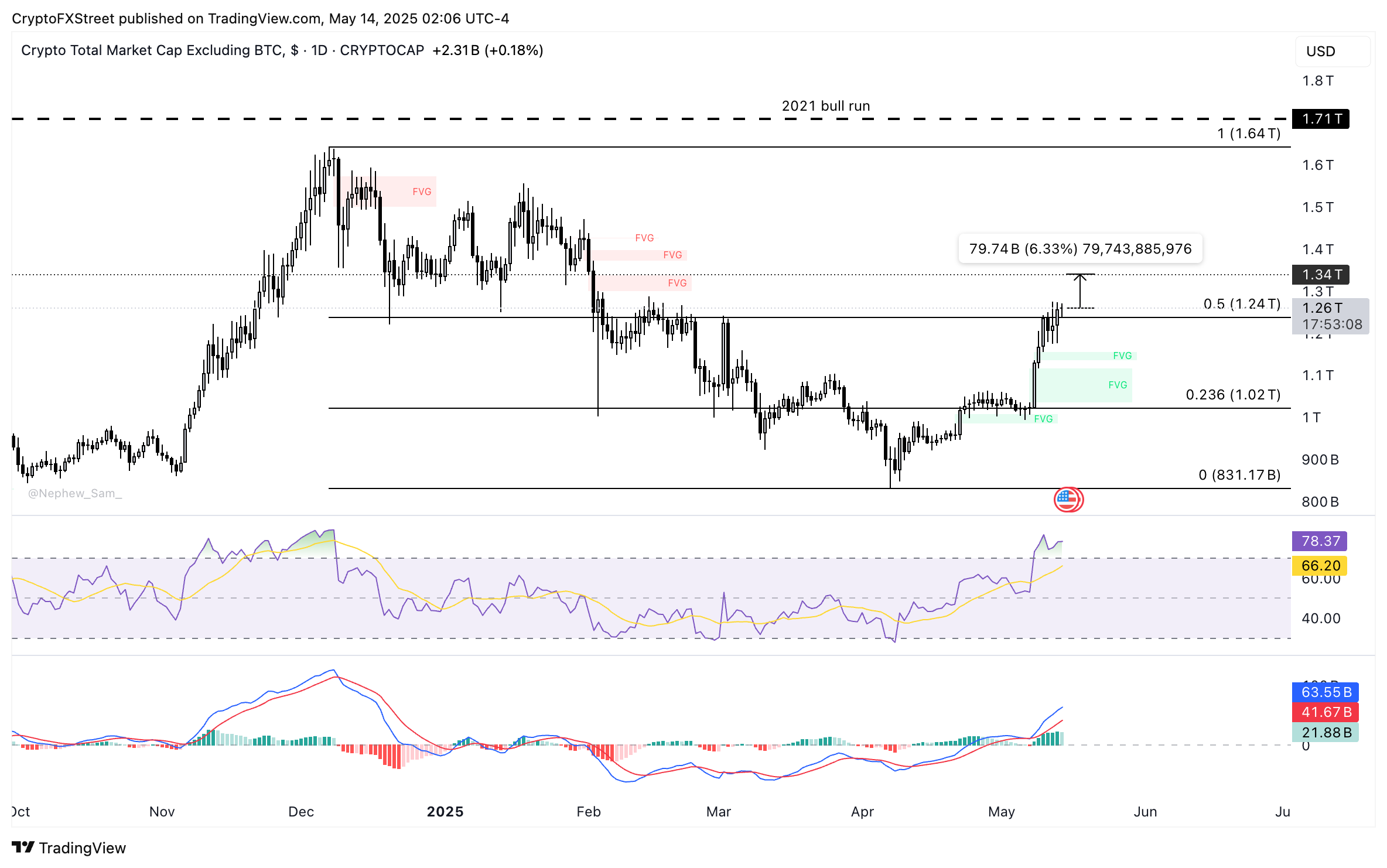

Data from CoinGecko shows that top 10 cryptocurrencies by market capitalization registered nearly double-digit gains in the last seven days. The total market capitalization of cryptocurrencies barring Bitcoin is back to a level previously recorded in February, just 6.33% away from $1.34 trillion, a key level marked by the upper boundary of a Fair Value Gap (FVG) on the daily price chart.

Crypto total market cap excluding BTC

Expert commentary

Ruslan Lienkha, Chief of Markets at YouHodler, told FXStreet that the agreement between the US and China to reduce tariffs is viewed as a positive development for the crypto market. Lienkha believes this could ease inflationary pressures and support global trade flows.

Lienkha said:

“Reduced tariffs can improve liquidity conditions and boost investor confidence, factors that are typically supportive of risk assets, including cryptocurrencies. Reduced trade tensions and improved macro stability should create a more constructive environment for risk assets. While both equities and crypto may benefit, crypto could experience relatively higher upside given its sensitivity to shifts in liquidity and investor sentiment.”

Still, the recent tariff adjustments still leave duties higher than the values noted prior to the initial trade policy shift, the analyst said, so the long-term deflationary impact may therefore be limited and gradual.

Commenting on Bitcoin’s price performance, Lienkha told FXStreet:

“A stable or rising equity market creates favorable conditions for Bitcoin to challenge new all-time highs. Conversely, if equity markets come under pressure, that negative sentiment is typically mirrored in Bitcoin’s price performance.”

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

BNB down 5% from peak as Windtree Therapeutics plans $520 million treasury

BNB price is down slightly to trade at $771 on Friday, after correcting from its new record high of $809, reached on Wednesday. The Binance exchange native token is up nearly 20% in July, amid relatively overheated market conditions and institutional adoption.

Crypto Today: Bitcoin declines amid de-risking sentiment, Ethereum and XRP hold key support

Bitcoin sweeps through liquidity around $115,000 level, amid profit-taking and risk-off sentiment. Ethereum rebounds from range low support above $3,500 amid steady ETF inflow.

Ethena eyes 20% gains amid Arthur Hayes 2 million ENA grab, Anchorage Digital deal, new apps

Ethena edges higher by over 20% on Friday as it bounces off a crucial support floor to extend the prevailing bullish run. Arthur Hayes acquires 2.16 million ENA tokens amid Ethena’s partnership with Anchorage Digital to achieve GENIUS Act compliance.

Bitcoin Weekly Forecast: BTC extends correction amid weakening momentum, ETFs outflow

Bitcoin price is slipping below the lower consolidation band at $116,000, a decisive close below to indicate further decline ahead. US-listed spot Bitcoin ETFs show early signs of investor pullback, recording a mild weekly outflow of $58.64 million by Thursday.

Bitcoin: BTC extends correction amid weakening momentum, ETFs outflow

Bitcoin (BTC) is slipping below the lower consolidation band at $116,000, after consolidating for more than ten days. A decisive close below this level would indicate further decline ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.