- US spot Ether ETFs gained $52.3 million in new inflows on Wednesday, a six-week high, with Fidelity and Grayscale leading.

- The value of all cryptocurrencies rose to $2.52 trillion as Ether price rose 12%.

- Spot Bitcoin ETFs also saw significant inflows, totalling $621.9 million, with Fidelity and others gaining and BlackRock seeing outflows.

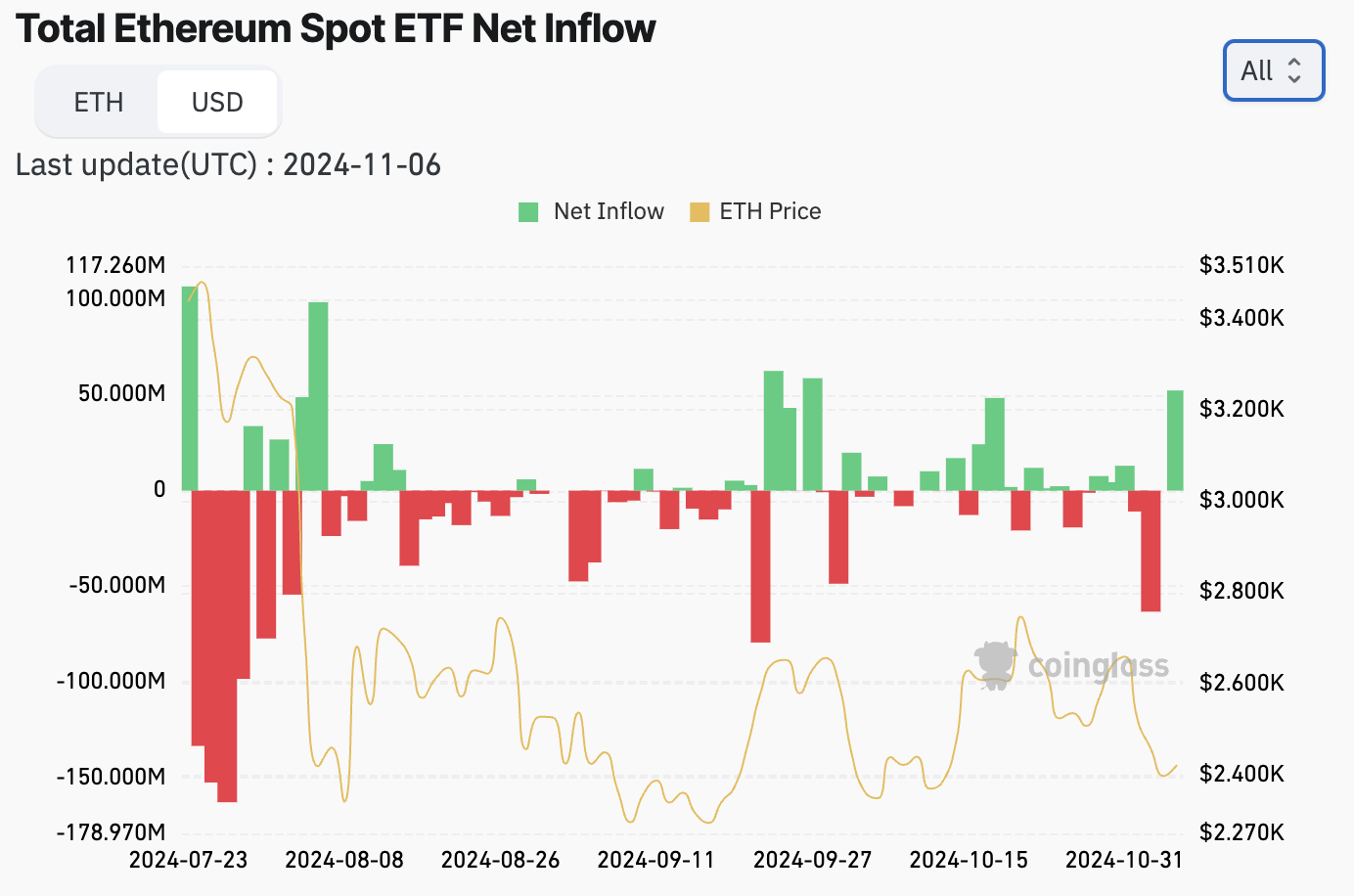

After a positive momentum in crypto markets following the outcome of the US presidential election, spot Ether exchange-traded funds (ETFs) in the United States saw their highest inflows in six weeks. Together, the nine newly-launched spot Ether ETFs saw a net inflow of $52.3 million on Wednesday.

While the inflow to Ether funds had remained modest, this was the highest since September 27, according to data from CoinGlass.

Total Ethereum Spot ETF net inflow. Source: CoinGlass

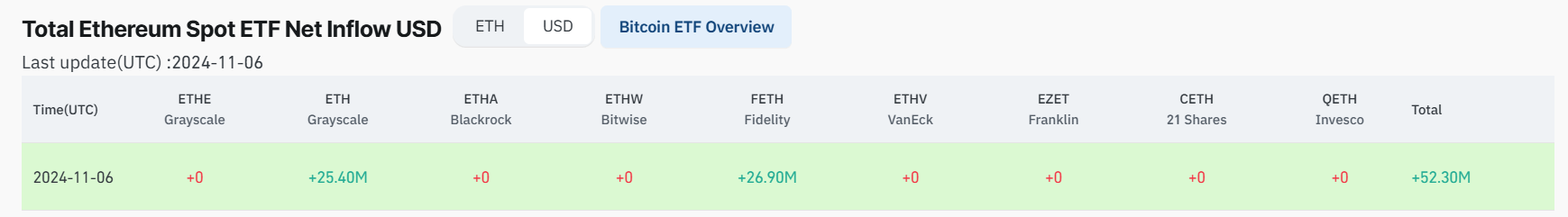

When dissecting the big figure, however, the data shows that just two ETFs recorded inflows: $26.9 million to the Fidelity Ethereum Fund and $25.4 million to Grayscale Ethereum Mini Trust. All the rest, including BlackRock’s iShares Ethereum Trust, didn’t register any inflows or outflows on Wednesday despite the price surge.

Ethereum Spot ETF net inflow by asset manager. Source: CoinGlass

Fidelity leads Bitcoin ETF inflows with record $308.8 million

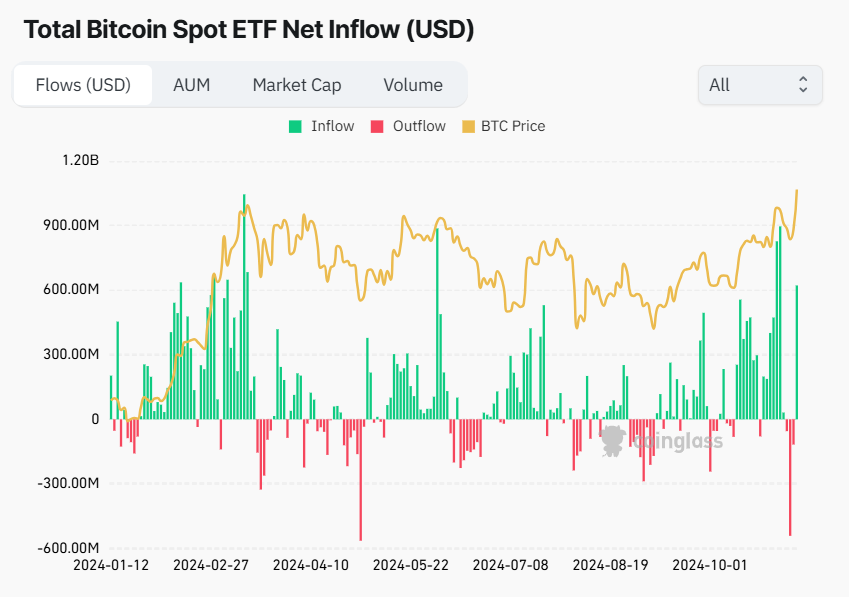

US-listed Bitcoin spot ETFs also registered inflows on Wednesday following BTC’s price surge. Net inflows of $621.9 million turned a page on three days of straight red, according to CoinGlass data.

Total Bitcoin Spot ETF net inflow. Source: CoinGlass

BlackRock's iShares Bitcoin Trust saw outflows for a second consecutive trading day, shedding $69.1 million. The fund also reported its highest trading volume, with $4.1 billion.

Bitcoin Spot ETF net inflow by asset manager. Source: CoinGlass

The most significant influx was $308.8 million into Fidelity’s Wise Origin Bitcoin Fund, which represented the fund’s most considerable inflow since June 4. Furthermore, Bitwise, Ark 21Shares, and Grayscale experienced more than $100 million in product inflows.

The crypto total market capitalization has reached $2.464 trillion, a 4% increase over the past 24 hours.

Total crypto market capitalization. Source: TradingView

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cardano stabilizes near $0.62 after Trump’s 90-day tariff pause-led surge

Cardano stabilizes around $0.62 on Thursday after a sharp recovery the previous day, triggered by US Donald Trump’s decision to pause tariffs for 90 days except for China and other countries that had retaliated against the reciprocal tariffs announced on April 2.

Solana signals bullish breakout as Huma Finance 2.0 launches on the network

Solana retests falling wedge pattern resistance as a 30% breakout looms. Huma Finance 2.0 joins the Solana DeFi ecosystem, allowing access to stable, real yield. A neutral RSI and macroeconomic uncertainty due to US President Donald Trump’s tariff policy could limit SOL’s rebound.

Bitcoin stabilizes around $82,000, Dead-Cat bounce or trendline breakout

Bitcoin (BTC) price stabilizes at around $82,000 on Thursday after recovering 8.25% the previous day. US President Donald Trump's announcement of a 90-day tariff pause on Wednesday triggered a sharp recovery in the crypto market.

Top 3 gainers Flare, Ondo and Bittensor: Will altcoins outperform Bitcoin after Trump's tariff pause?

Altcoins led by Flare, Ondo and Bittensor surge on Thursday as markets welcome President Trump's tariff pause. Bitcoin rally falters as traders quickly book profits amid Trump's constantly changing tariff policy.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.